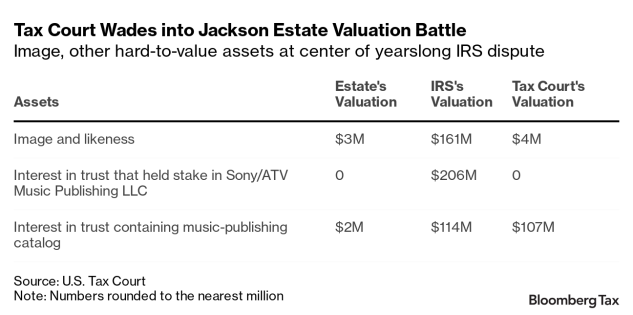

A ruling that Michael Jackson’s image and likeness at the time of his death were worth about $157 million less than the IRS estimated warns the agency not to look too far down the road when assessing the value of a celebrity’s estate.

Jackson’s fame and the potential implications for taxes on other high net-worth estates meant the case, which had been pending at the Tax Court since 2013, attracted wide attention. While much of the May 3 opinion focused on fact-based issues that may look different in other cases, estate tax specialists said the the case sends the message to the IRS not to be over-aggressive when it assesses the value of an estate’s assets.

“It’s plausible that the court reacted negatively to its perception that the IRS had overplayed its hand,” said Mitchell Gans, a professor at Hofstra University’s law school who focuses on estate and gift tax issues.

The years-long dispute exposed a divide in how the IRS and Jackson’s heirs prized the pop star’s image and likeness—one portion of his overall estate. While the estate only looked at current income and revenue, the IRS took a more opportunistic approach, looking at future ventures such as shows and merchandise, said William I. Sanderson, a partner at McGuireWoods who provides estate planning advice. In this instance, Jackson’s heirs won, successfully limiting how much they will owe the IRS.

The $157 million drop-off largely came down to the IRS’s inclusion of revenue streams that the Tax Court concluded weren’t foreseeable at the time of the entertainer’s death, including a Cirque du Soleil show, a film, and branded merchandise.

“Even if these potential revenue streams were traceable to Jackson’s image and likeness, they were not foreseeable when Jackson died, which means we should not include them in the Estate’s gross value,” wrote Judge Mark Holmes.

The IRS declined to comment Tuesday.

Image Tarnished

Jackson died June 25, 2009. The circumstances particular to his case could limit its impact, attorneys said.

That included severe damage to the entertainer’s image, including multiple allegations that Jackson sexually abused children. Holmes said in his opinion that Jackson was so unpopular in the last two years of his life that “he did not even have a Q score,” referring to a measurement of the likelihood that a celebrity can be a corporate spokesperson.

“The notoriety of Michael Jackson’s alleged misdeeds, although not proven, totally undercut the value of his name and likeness while he was alive,” said Michael R. Morris, a tax and wealth-planning attorney at Valensi Rose PLC who focuses on the entertainment industry.

Another strike against the IRS was the court’s conclusion that its sole expert witness lied multiple times and also refused to answer questions directly throughout his testimony—which the court said affected its factfinding throughout the opinion.

“A person reading the opinion, once they got to that point, like woah—you have to say, ‘Wow, this is a really hard issue for the Service to get over,’” said James F. Hogan, managing director at Andersen Tax LLC and a former branch chief in the IRS’s Office of the Chief Counsel.

A Waiting Game

The case may increase interest in changing estate tax laws given the difficulties with valuing speculative assets based on what was reasonably foreseeable at the time of someone’s death.

Gans suggested a “wait-and-see” approach where people look at how much money is actually produced rather than trying to guess about the issue as of the date of death.

That approach however, could put some estates in limbo for years, forcing an executor to retain assets during the wait-and-see period, said James F. Hogan, managing director at Andersen Tax LLC and a former branch chief in the IRS’s Office of the Chief Counsel.

“If you’ve ever dealt with beneficiaries, they usually want their money right away,” he said.

Jonathan Blattmachr, who is a senior adviser for Pioneer Wealth Partners, argued that a rational approach to that would be for estates to exclude likeness or the ability to exploit a name and image, and then to have distributed assets taxed after death at ordinary income rates.

“This is an area of developing law and no one is going to get it 100% right,” Blattmachr said.

One takeaway from the long-fought case for estate planners is to expect scrutiny from the IRS, Sanderson said.

“The IRS is going to challenge values, and if you have a high-profile asset, it’s going to attract the attention of the IRS,” he said.

This article originally appeared on Bloomberg Tax.