(ETF.com) It's been a rough summer for cannabis.

Stock prices for several marijuana companies have plummeted due to worse-than-expected revenues from sales of legal cannabis in Canada and various corporate scandals.

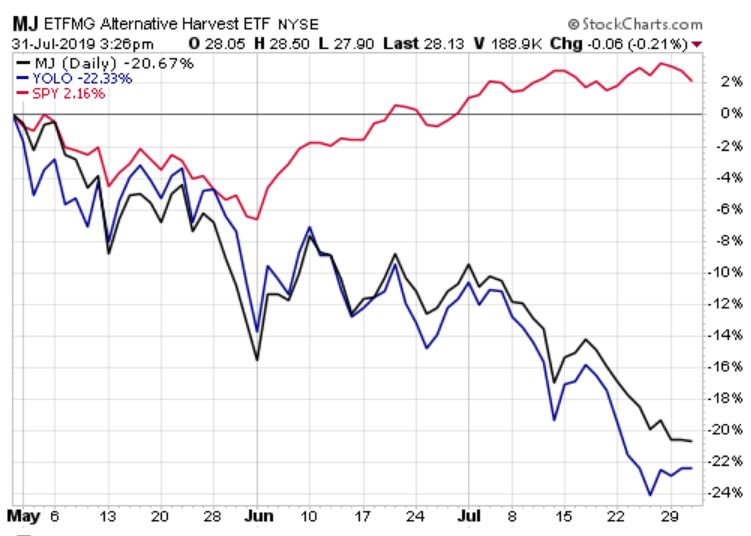

Over the past three months, the ETFMG Alternative Harvest ETF (MJ) has fallen 21%, while the AdvisorShares Pure Cannabis ETF (YOLO) has fallen 23%. Meanwhile, the SPDR S&P 500 ETF Trust (SPY) rose 3% over the same period:

Weaker-Than-Expected Earnings

One of the most significant factors driving the sector lower has been weaker-than-expected earnings reported from several cannabis companies in Canada, where recreational marijuana was fully legalized for adult use late last year.

In their latest earnings calls, Canopy Growth, Cronos Group, Aurora Cannabis, OrganiGram and other market leaders all reported losses for Q3 2018, the period in which legalization was implemented.

Over the month of July, Canopy Growth's stock price fell 21%, Cronos Group’s fell 13%, Aurora Cannabis’ fell 20% and OrganiGram’s fell 10%.

Top Holdings in Cannabis ETFs

| MJ | YOLO | ||||

| Stock | % In Portfolio | 1-Mo. Return | Stock | % In Portfolio | 1-Mo. Return |

| GW Pharmaceuticals (ADR) | 9.21% | -6% | Innovative Industrial Properties | 6.28% | -17% |

| Cronos Group | 8.12% | -13% | OrganiGram Holdings | 5.49% | -10% |

| Tilray | 7.94% | -18% | Village Farms International | 5.21% | -5% |

| Aurora Cannabis | 6.97% | -20% | Neptune Wellness Solutions | 4.81% | 32% |

| Canopy Growth | 6.60% | -21% | CuraLeaf Holdings (Swap) | 4.68% | 11% |

| Corbus Pharmaceuticals | 4.14% | -13% | Hexo Corp | 4.52% | -22% |

| OrganiGram Holdings | 4.08% | -10% | Charlottes Web Holdings | 4.36% | 19% |

| Aphria Inc | 3.70% | -24% | Canopy Growth | 4.22% | -21% |

| Green Organic Dutchman | 3.56% | -11% | Cara Therapeutics | 3.77% | 7% |

| Hexo Corp | 2.80% | -22% | Arena Pharmaceuticals | 3.61% | 6% |

Sources: ETF.com, issuer websites; data as of July 31, 2019

Corporate Scandals Abound

Exacerbating poor performance were several scandals that generated uncertainty about the viability of established cannabis players and shook investors' faith in the legal cannabis industry.

First, after its earnings call, Canopy Growth fired its CEO Bruce Linton, a high-profile advocate in favor of the legal cannabis industry. According to a report by MarketWatch, Linton's ouster was a result of pressure from Constellation Brands (STZ), who had inked a partnership deal with Canopy last year and was frustrated by the firm's continued lack of profitability.

Meanwhile, CannTrust Holdings was discovered to have illegally planted marijuana with the knowing consent of its top management. More than five tons of crop were seized by the Canadian government, but some of the illegal marijuana had already been illegally exported, a violation of Canadian law.

FDA Crackdown On CBD

In the U.S., the FDA issued a crackdown letter to multistate operator Curaleaf Holdings, whose consumer wellness cannabidiol (CBD) products are sold at CVS stores.

The firm has made far-reaching claims as to the health benefits of its products, including their efficacy in treating Alzheimer's disease and opioid withdrawal.

Swaps on Curaleaf represent 5% of YOLO's portfolio, while Canopy Growth and CannTrust represent 4% and 1%, respectively. MJ holds 2% in CannTrust and 7% in Canopy Growth, but holds no swaps.

Poor Timing Not Keeping THCX Down

As cannabis stocks enter free fall, it might appear to be rough timing for the three marijuana ETFs that launched last month: The Cannabis ETF (THCX), the Amplify Seymour Cannabis ETF (CNBS) and the Cambria Cannabis ETF (TOKE). (Read: "Challenge Of Launching Cannabis ETFs.")

The sector's troubles haven't blunted investor enthusiasm for cannabis ETFs, however. Trading especially in THCX has been brisk so far, with average trading volume in the ETF surpassing even that of longer-lived rival YOLO:

Average Volume & Spreads For Cannabis ETFs

| ETF | AUM (M) | ADV (M) | Spread |

| MJ | $1,030 | $13.0 | 0.24% |

| YOLO | $58 | $1.30 | 0.42% |

| THCX | $13 | $2.40 | 0.20% |

| CNBS | $4 | $0.40 | 0.30% |

| TOKE | $2 | $0.48 | 0.38% |

Source: ETF.com; data as of Aug. 1, 2019

Since it launched on July 9, THCX has brought in $13 million in new net investment assets. That may sound modest, but it's more than the segment's current leader, MJ, which has brought in $8 million; and YOLO, which has brought in $6 million.