The second round of the Paycheck Protection Program (PPP) launched April 27, with complaints about the Small Business Administration’s (SBA) system to submit loan applications coming almost immediately from bankers. Curt Queyrouze, President of TAB Bank in Utah, tweeted:

“Suspicious that big banks' xml files are getting processed first. Ninety minutes in and our team of 35 people haven't been able to submit one successful app (or even stay logged in).”

On April 29, the SBA dedicated an eight-hour window to banks with less than $1 billion in assets and by the end of the week, the furor subsided.

But the headaches for small businesses and banks have only just begun.

The Looming PPP Forgiveness Nightmare

The Treasury’s guidelines for PPP loan forgiveness specify that:

“Loan amounts will be forgiven as long as: 1) Loan proceeds are used to cover payroll costs, and most mortgage interest, rent, and utility costs over the 8 week period after the loan is made; and 2) Employee and compensation levels are maintained.”

Easy-peasy right? Maybe not.

Small business borrowers will face challenges regarding:

- Computing the forgiveness amount. The American Institute of CPAs published a five-step guide instructing PPP borrowers how to calculate their loan forgiveness. It’s not all or nothing, however. The amount of forgiveness can be reduced if a business doesn’t spend its loan exactly as specified by the guidelines. Don’t think there won’t be plenty of confusion—and lots of phone calls to the banks.

- Tracking allowable expenses. According to a recent survey of small business owners by Cornerstone Advisors and Autobooks, nearly half (47%) of small businesses with $100,000 to $50 million in revenue rely on spreadsheets for their accounting efforts. Among small businesses with less than $1 million in revenue, 10% have no technology support for their accounting operations.

- Filing taxes. Although the CARES Act states that forgiven PPP loans will not be considered as income, there are complications. IRS Code Section 265 denies deductions for “otherwise allowable expenses that are allocable to exempt income.” According to CPA Peter Reilly, “more than a few taxpayers will take the deduction anyway and the matter will end up in the courts unless Congress quickly clarifies this one way or the other.”

Banks are facing major headaches themselves regarding:

- Servicing the non-forgiven portion of loans. Many people don’t realize that not every bank was an SBA-approved lender prior to the PPP. More than 4,000 new SBA lenders have never had to deal with the servicing and reporting requirements on these loans.

- Debt categorization. To date, the Treasury has provided unclear and non-existent guidance on how the retained portion of PPP loans will be categorized as debt on banks’ balance sheets.

- Audits. Treasury Secretary Mnuchin announced that all loans over $2 million will be subjected to audits. A later announcement hinted that all loans under the program would be subject to an audit. Who’s going to do that? The SBA? Banks?

- Customer service. Add PPP loan forgiveness questions, issues, disputes, and problems to the mortgage and credit card deferment calls and fee waiver requests already pouring in to banks’ call center workloads. With so many PPP-lending banks new to SBA—and small business—lending, many may not have the skill sets in-house to handle the calls.

According to the CEO of a $1.7 billion bank:

“Banks that made required documentation a big part of their application process will have fewer issues. Those that didn’t—and that didn’t document payroll history, as well—will have a harder time.”

Fintech to the Rescue?

Fintech providers are stepping up to stave off the nightmare.

To date, many—if not most—banks have not established mechanisms for PPP loan borrowers to report the data required for forgiveness back to the bank. According to Charles Potts, Chief Innovation Officer, Independent Community Bankers of America, “There are at least 20 fintech companies working on addressing the PPP forgiveness process.”

One of them is Alpharank, a San Francisco-based company that does customer journey mapping and attribution solution for banks and credit unions.

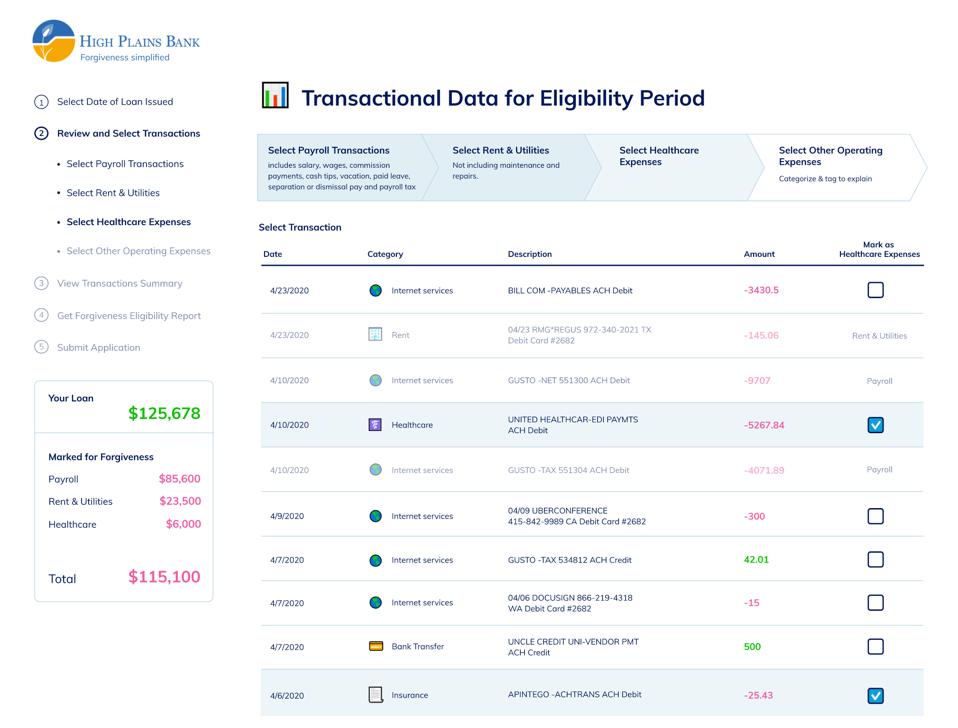

The fintech’s application, which runs on a bank’s website, pulls in spending data from from a small business’ transaction account, and can access data in accounts at other banks and from accounting software like Quickbooks.

The application walks borrowers through the forgiveness reporting process and collects their “attestations,” which will be a critical part of complying with the SBA’s requirements for forgiveness.

Other fintech firms offer tools for the forgiveness include:

- Boss Insights. Boss CARES covers the application, monitoring and forgiveness calculation of PPP loans. Borrower can connect their accounting, financial, and payroll systems to Boss Insights’ platform, while lenders can see that information at the company and portfolio level.

- FINSYNC. The company’s client-facing forgiveness application includes a calculator, guide, document submission portal and optional cash flow management tools to manage PPP loan forgiveness.

- Numerated. Numerated has expanded its SBA lending platform to help banks automate the forgiveness process. The solution supports self-service and banker-led forgiveness journeys, and offers document upload/routing, e-signing, and SBA validation.

PPP Loan Forgiveness is Banks’ Make or Break Moment

In The Paycheck Protection Program Will Disrupt Small Business Banking, I asserted that:

“With the earmarking of $60 billion of the second PPP round to community-based institutions, many community banks and credit unions are going to get a shot at lending to small businesses they don’t serve today. This will give community banks (and credit unions) a chance to shine and be heroes to many small businesses, and turn the tide of the small business lending decline.”

The forgiveness process on these loans will make or break the opportunities facing the smaller banks.

More than six in 10 small businesses that currently bank with a megabank (BofA, Chase, and Wells) or a large regional bank (>$100 billion in assets) said they were somewhat or very likely to look for a new banking relationship in the next year.

And that was before PPP loans.

Megabanks and large regional banks have roughly 85% market share of small businesses with revenues between $100,000 and $50 million. Many of these relationships are already in play—and could be pushed over to community banks with poor PPP loan forgiveness experiences.

Community banks are looking at a big opportunity with small businesses—if they can overcome the loan forgiveness nightmare.

This article originally appeared on Forbes.