An obsessive focus on stock market returns is lulling many investors and analysts into thinking that the worst of the current COVID-19 economic crisis is over. Before the pandemic struck, I expressed my concern about significantly leveraged non-financial companies in over forty pieces in Forbes. Eye opening research published by Bank for International Settlements economists, Benoît Mojon, Daniel Rees, and Christian Schmiederconfirms my view that corporate insolvencies, bankruptcies, and credit losses to financial institutions are just starting to be felt. And as they wrote in “How much stress could Covid put on corporate credit? Evidence using sectoral data” published today, “the looming increase in corporate bankruptcies will generate credit losses that will need to be absorbed, either by the financial system or by taxpayers.”

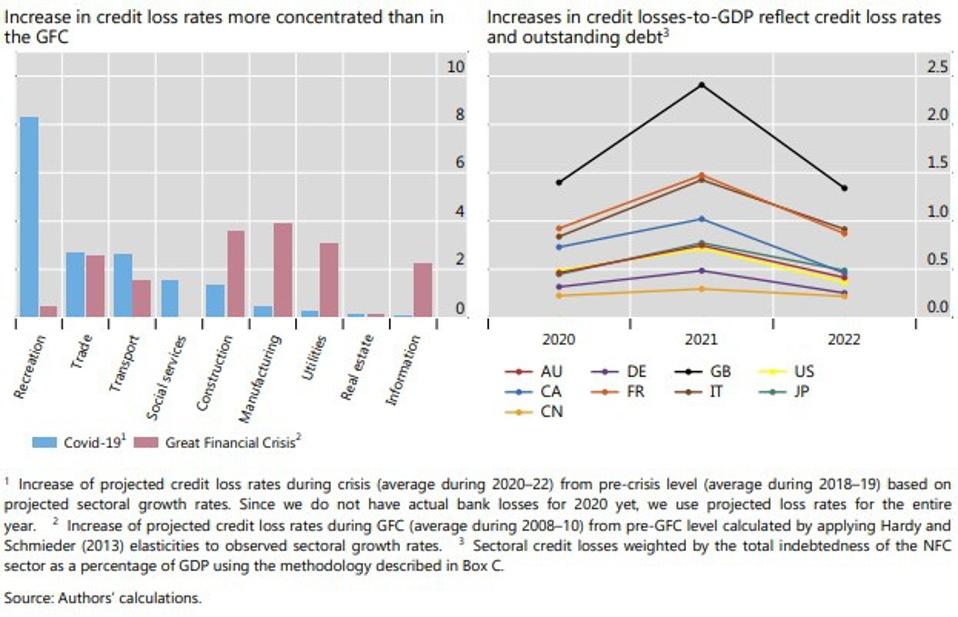

Mojon, Rees, and Schmieder created a framework to translate sectoral macroeconomic scenarios into sectoral corporate credit losses, and applied it to the Group of 7 (G7) economies, China and Australia. Based on their sectoral GDP projections, the BIS economists found that “corporate credit losses during 2020–22 could be equivalent to about three times the pre-crisis level on average across the G7, China and Australia.” These additional “credit losses emerging from the crisis during the three-year period would cumulate to slightly above 2% of annual GDP or $1 trillion.” Corporate credit losses would be borne not only by financial institutions that have lent to them, but also by investors who invested in leveraged loans and collateralized loan obligations (CLOs) backed by corporate loans. Unfortunately, even taxpayers might be impacted by corporate credit losses if governments have to step in to rescue distressed financial institutions.

The research by Mojon, Rees, and Schmieder shows that corporate credit accounts for slightly more than half of total private non-financial credit in the countries in their study (ranging from 31% of total credit in Australia to 73% in China); corporate credit typically incurs larger credit losses during recessions than does household credit. Therefore, we should all be attentive, because the outlook for corporate credit has a significant bearing on the health of these countries’ financial systems. They project credit losses, defined as recognized impairments on bank and non-bank debt, until the end of 2022; this assumes that the pandemic will be under control by then and that its impact on credit losses will have materialized. We have been lucky that thus far, non-financial corporate bankruptcy rates have been relatively low in most countries, despite partial or full lock downs due to the pandemic. Yet, I expect that as governments reduce fiscal support programs, this will impact companies’ liquidity and credit worthiness. Moreover, consumer changes in spending habits after over a year of the pandemic is likely to put pressure on certain sectors of the economy.

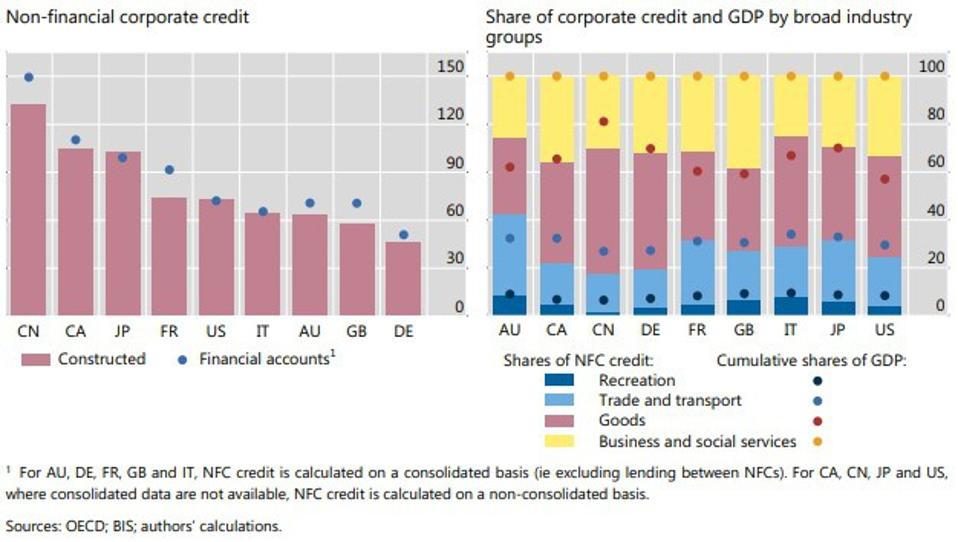

Corporate indebtedness varies across countries, but industry compositions are similar, As a % of ... [+]

BANK FOR INTERNATIONAL SETTLEMENTSAs part of their research, the BIS economists combine data on bonds and bank loans to derive corporate debt by sector for each of the G7 countries, China and Australia. They then constructed sectoral economic projections for each of the nine economies in the sample. Lastly, they drew on existing estimates from the literature on the GDP sensitivity of credit loss rates (i.e. losses in relation to the stock of corporate debt) for banks.

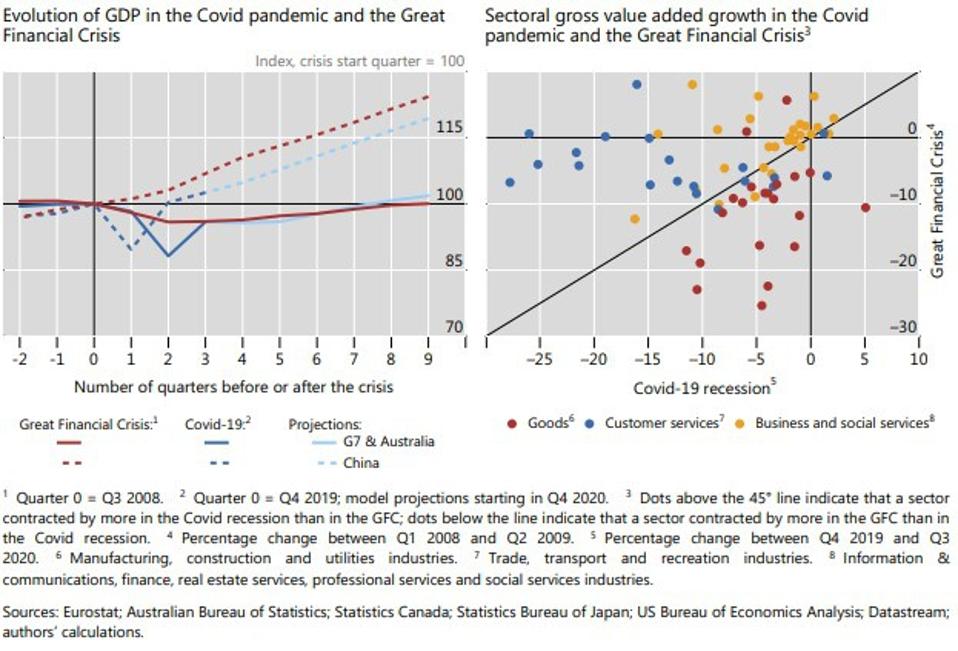

A large and uneven recession

BANK FOR INTERNATIONAL SETTLEMENTSCorporate credit loss rates could rise substantially in sectors most affected by the pandemic. Unlike other crises, such as the 2007-2009 crisis, where manufacturing and construction declined significantly, the Covid crisis has been felt most acutely in entertainment, transportation, energy, and wholesale and retail trade. “The sectoral dispersion in credit loss rates is likely to be wider than during the Great Financial Crisis (GFC) of 2007–09 because of unevenness in sectoral economic conditions as well as the tendency for credit losses to rise more than proportionally with output shortfalls.”

Fortunately, aggregate corporate credit loss rates are likely to fall short of those sustained during the 2007-2009 financial crisis; this is in significant part because the sectors most impacted by the pandemic account for a comparably small share of total credit. Additionally, the economists’ projected credit losses based on sectoral growth paths are larger than those based on aggregate GDP data alone. This shows the importance of taking account of sectoral differences in economic conditions and credit exposures when estimating the implications of an uneven recession for corporate credit losses.

Corporate indebtedness varies across countries, but industry compositions are similar, As a ... [+]

BANK FOR INTERNATIONAL SETTLEMENTSHow corporate debt will perform will vary from country to country. Last week, in its Monetary Policy Report to Congress, the Federal Reserve expressed concern that approximately 30% of complex corporate loans in 2020 are now in trouble; this is more than double the amount in 2019. Unsurprisingly, retail, entertainment, real estate, energy, and transportation are the most adversely affected sectors. Not only do banks hold these loans, but so do investors from insurance companies, specialty leveraged funds, and pensions funds.

The BIS research could be very useful for regulators and bankers to use as a complement to existing regulatory stress tests. It should be straightforward to implement and can be updated when new information arises. The BIS economists have their sectoral macroeconomic projections available in an online appendix, and they plan to revise them periodically to account for economic developments as well as incorporating the ongoing race between vaccines and mutations of the virus. Their framework, “ allows running sensitivity analyses that can account for both the dynamic nature of the crisis and for alternative policies that handle weaknesses in the corporate sector. Using better data, the approach could also be extended in a number of dimensions, along the lines mentioned above.”

This article originally appeared on Forbes.