(MarketWatch) Get ready.

That’s the upshot of a strategy note by J.P. Morgan Cazenove analysts Mislav Matejka, Prabhav Bhadani and Nitya Saldanha , who argued it’s “nearing the time to add back risks.”

“The consolidation seen over the past few weeks has contributed to an improvement in a number of tactical indicators that were stretched entering the month,” they said.

The strategists said they still believe that the market will advance into year-end, starting with a September up move. “The positives then are likely to be better technicals, restart of ECB’s QE, possibly bigger 2nd Fed cut, signs of activity trough, as well as travel & arrive with respect to tariffs, with a chance of the latest ones not being implemented after all,” they wrote.

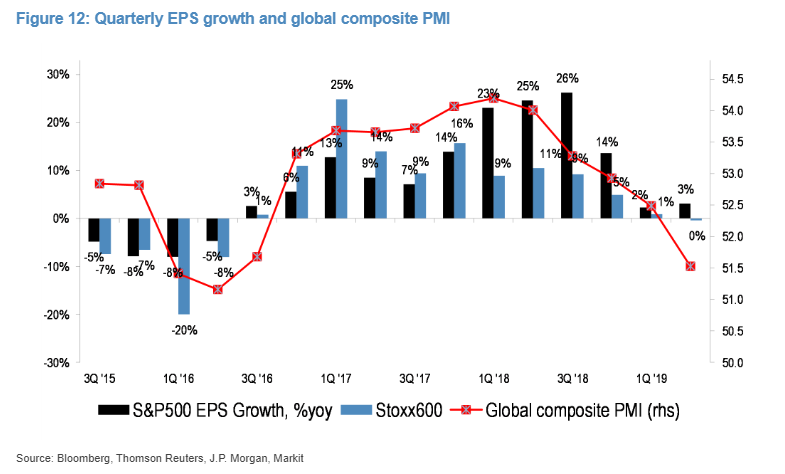

U.S. earnings growth, they say, still has been positive, rising 3% in the second quarter against expectations of a contraction. Second-half consensus earnings growth estimates of 1.6% is “rather conservative” in their view.

One other point they make is that U.S. earnings have only fallen “meaningfully” in the last 35 years when there’s a recession.

“In other words, unless one is a subscribed believer in a U.S. recession over the next 12 months, one should not expect earnings to be contracting,” they said.

The advice from J.P. Morgan diverges from rival Wall Street bank Morgan Stanley, which has been talking about the risk of a recession.

Over the last 12 months, the Dow Jones Industrial Average and the S&P 500 have each dropped 0.6%, and the Nasdaq Composite has declined 2%.