Round about a month ago, I took a closer look at Joe Biden’s retirement-related policy proposals, or, more specifically, those of the “Unity Task Force,” which had just released its final document.

One of the items in that document and on the Biden campaign website is a promise to “equalize the network of retirement saving tax breaks” — a proposal that generally translates to eliminating the tax advantages currently enjoyed by retirement savings accounts and replacing them with a “credit” or “match.” The idea is that the tax advantages, or “tax expenditures,” as they’re called, disproportionately accrue to relatively higher earners, and the hope of a change is to provide benefits in equal measure to all income groups.

But how this translates in practice is not clear. An article at Roll Call this morning picked up on the proposal, as did Courthouse News, but neither had more detail, referencing only a 2014 Urban Institute/Tax Policy Center proposal, which provided various hypothetical alternatives.

So what did that proposal suggest? It included a variety of options, including

- Reducing total available pre-tax savings (employer and employee) from (at the time) $51,000 to only the lesser of $20,000 or 20% of pay;

- Expanding the currently relatively-small “Saver’s Credit” (equal to 50% of the first $2,000 in retirement savings, only for relatively lower earners, up to $$19,500 for singles, $39,000 for couples; and phasing out quickly, to 20%, 10%, and ultimately nothing for singles with $32,500/couples with $65,000 in income) to stay at 50% for higher earners and phase out in a much more gradual manner instead; or

- Wholly removing any tax benefit for retirement savings and provide a credit of 25% instead (often this proposal includes a limit to the credit; this particular proposal doesn’t specify such; also, note that this was prior to the 2017 tax law which dropped tax rates).

Biden’s proposal sounds, well, fair enough. But what would happen, in practice?

Let’s start with a small point of clarification: strictly speaking, “401(k)” refers to the ability of a worker to defer a part of their pay for retirement savings purposes, and to avoid taxes until the money is ultimately withdrawn. The deferral of employer contributions is not a part of section 401(k) of the relevant IRS tax code. Does Biden want to remove the tax preference for both workers’ and employers’ contributions to retirement plans, or only the former?

The Urban Institute proposal assumed that higher-income workers would continue to save just as usual, even if they are on the losing end of tax changes. But would they continue to save through their employers’ 401(k)? And, likewise, if employers’ contributions no longer offered a tax advantage, would they continue to offer these plans, or to offer employer contributions to them?

As it is, “nondiscrimination” regulations require that employers design their plans to ensure that the amount of benefit received by lower-income workers is not too much less, proportionately, than highly-compensated employees, even though the latter are more likely to save and receive matches. The entire system is designed on the expectation that employers’ concerns lie largely with their higher earners and that they must be regulated into offering similar benefits to their lower earners. Would they be more likely, in these alternate circumstances (especially if benefits are capped and quite limited for higher earners), to simply boost pay instead so that these workers can seek out other forms of tax-advantaged investing?

To be sure, this isn’t generally an either-or situation. But employers evaluate their entire benefits cost and determine overall benefits & compensation budgets, shifting, at any one time, how much they allocate to retirement savings compared to pay raises. And this would surely be a consideration.

(Incidentally, in fairness, one further concern, that middle class savers who are currently urged by conventional wisdom to aim to save at least enough to receive their employer’s match, would aim for a lower target instead, that of the maximum “government-matched” contribution, might not be an issue: according to Vanguard’s 2020 survey, most savers do not target this “get the full match” level of savings at all. 34% of savers contribute less than needed to get the full match, a surprising 49% contribute more, and only 18% contribute exactly enough to get that full match, and nothing more.)

But there’s a final issue that’s even more concerning: this proposal doesn’t appear to recognize what really happens with retirement savings accounts tax advantages.

Here’s another example of such a proposal, a 2011 Brookings report:

“There is a formal economic equivalence between the incentives created by a deduction at a given rate and those created by a tax credit of a different rate. For example, a 30 percent matching credit is the equivalent of an income tax deduction for someone with a 23 percent tax rate. For every $100 contributed to a retirement account by an individual with a 23 percent tax rate, the individual would receive a tax deduction worth $23.”

These proposals appear to forget that tax advantages in retirement savings accounts are not simply a matter of deductibility, as one deducts mortgage interest or charitable deduction.

Instead, recall that in a Roth account, whether a 401(k) or an IRA, one pays taxes right away, then takes one’s money at retirement without paying further taxes.

In a traditional 401(k), one doesn’t pay taxes when making the contribution, but nonetheless must pay taxes upon withdrawing the money at retirement. This is the entire reason for the RMDs, required minimum distributions, to give the government its share without excessive delay.

But regardless of which type of account one elects, the principle is the same.

Imagine that the tax rate was entirely flat, say 20% for everyone, no deductions, no marginal rates. Your effective tax rate, measured as the proportion of the final account balance at retirement paid out in taxes, is 20% either way.

What’s the benefit of the tax advantage, then? It prevents workers from being double-taxed, that is, taxed on their investment return.

Here’s the math:

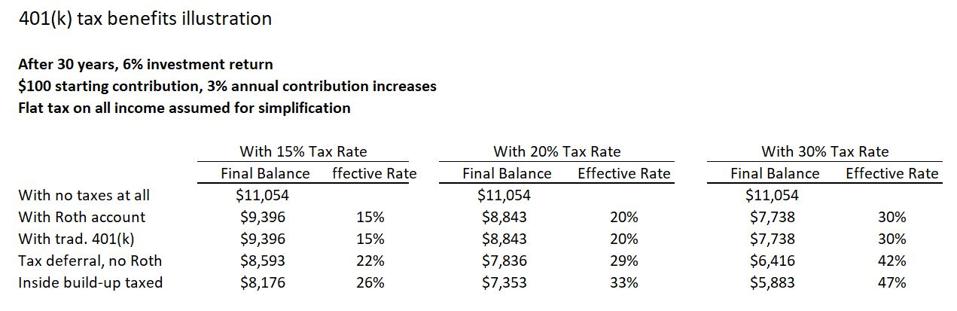

Imagine a 30 year career, where a worker has 3% pay increases each year and earns 6% in investment return each year.

With a 15% income tax rate, the tax-advantaged net tax rate at the end of the 30 years would be, of course 15%. But if there were no tax benefits, and if investment gains were taxed at the same rate, the effective tax rate would be 22%, considering the “cost” in taxation on the compounding of returns. If the income tax rate were 20%, the effective tax rate would be 29%. And a tax rate of 30% would result in an effective tax rate of 42%, in each case considering the proportion of the total investments paid as taxes over the years.

Hard to follow? Here’s a table to illustrate:

Here, “tax deferral, no Roth” is a scenario similar to capital gains, paying taxes only when you sell the stock. “Inside build-up taxed” is like an interest-bearing bank account, where you pay taxes on the interest every year. This is highly simplified just to provide an idea of what’s going on.

Now, reader, your own reaction might be: “what double taxation? It’s entirely fair to tax investment income!” But in either case, that means that the comparisons being offered are comparing apples to oranges.

Here’s another example: there have been proposals to switch from a “pure” tax deduction for charitable contributions to a tax credit instead. If the credit were set at 20% of the contribution, then anyone who pays income tax at a rate less than 20% would be a “winner” and anyone who pays taxes at a rate greater than 20% would be a loser.

But to remove the tax-deferral (or, in the case of the Roth, the removal of taxes on investment build-up), is wholly different conceptually. Yes, you can do the’ math of the long-term additional revenue the federal government would get by taxing investment gains (assuming they don’t find other tax advantaged savings, or stop saving altogether), and calculate, over the long term, how much the government could “spend” by giving tax credits for retirement savings instead, but it’s a much more complicated set of changes than it appears.

And, finally, here’s a comment by Biden adviser Ben Harris, made at a Democratic National Convention roundtable and cited by Roll Call:

“If I'm in the zero percent tax bracket, and I’m paying payroll taxes, not income taxes, I don't get any real benefit from putting a dollar in the 401(k).” Harris isn’t wrong here — and, indeed, however much Mitt Romney was excoriated for saying that 47% of Americans don’t pay taxes, he was right. But there’s a place for both types of tax treatment, to accomplish two different purposes.

This article originally appeared on Forbes.