AAII members’ exposure to fixed income rose to its highest level in seven years last month. The April AAII Asset Allocation Survey also shows an increase in equity exposure and a decrease in cash allocations.

Stock and stock fund allocations rebounded by 2.3 percentage points to 57.5%. The historical average is 61.0%.

Bond and bond fund allocations rose 0.8 percentage points to 19.5%. Fixed-income allocations were last higher in April 2013 (19.7%). Last month’s increase keeps exposure to bonds and bond funds above their historical average of 16.0% for the 14th consecutive month and the 15th time in 16 months.

Cash allocations pulled back by 3.1 percentage points to 23.0%. Cash exposure is equal to its historical average.

The increase in bond exposure occurred as yields fell and the stock market remained highly volatile. Though they are at a seven-year high, fixed-income allocations are only slightly above the level we saw last August (19.4%).

While many individual investors made changes to their portfolios amidst the coronavirus volatility, the majority are continuing to stick to their portfolio strategies. (The May AAII Journal’s Big Questionprovides more insights into how AAII members have reacted.)

Last month’s special question asked AAII members to describe their comfort level with their portfolio’s allocation strategy given this year’s coronavirus pandemic-related volatility. A majority of the nearly 250 responses we received said they were more or less comfortable with their allocation strategy in the current market. Specifically, 40% of respondents described their comfort level as average and 34% stated that they are very comfortable. This compares to 15% of respondents who stated that they are mildly uncomfortable with their allocation in light of this year’s volatility and 11% of respondents who stated they are very uncomfortable.

Here is a sampling of the responses:

- “As a long-term investor, this too will pass. I am very comfortable.”

- “Fairly comfortable. I had to dump some losers to free up cash with which I bought some blue-chip stocks at bargain-basement prices.”

- “I wish I had more cash prior to the volatility; however, I maintained the course through this volatility and don’t see any changes in the near future.”

- “Not at all comfortable, but this is no time to sell any assets, especially those in which I would be locking in a loss.”

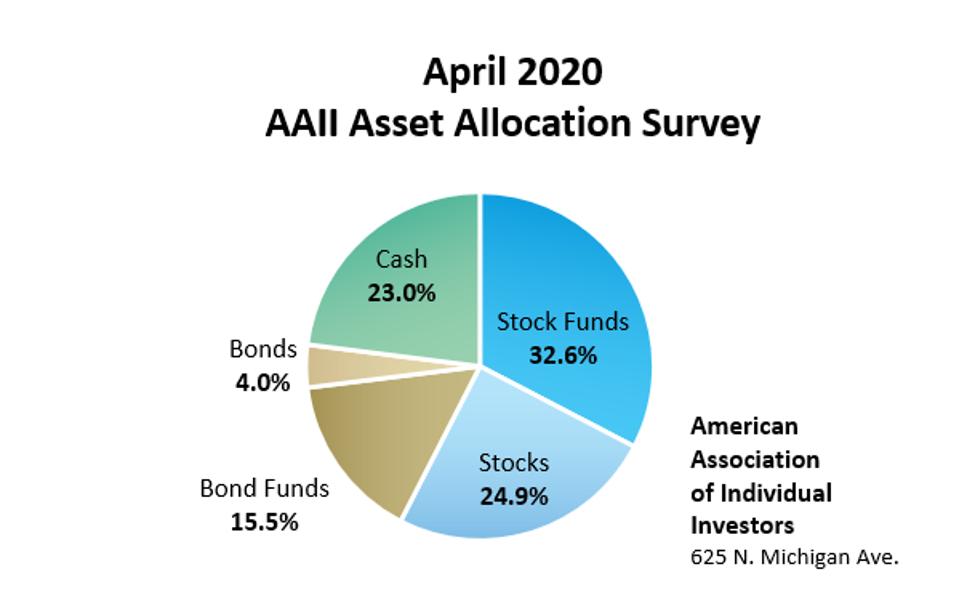

April AAII Asset Allocation Survey results:

- Stocks and stock funds: 57.5%, up 2.3 percentage points

- Bonds and bond funds: 19.5%, up 0.8 percentage points

- Cash: 23.0%, down 3.1 percentage points

April AAII Asset Allocation Survey details:

- Stocks: 24.9%, up 2.2 percentage points

- Stock Funds: 32.6%, up 0.2 percentage points

- Bonds: 4.0%, up 0.6 percentage points

- Bond Funds: 15.5%, up 0.2 percentage points

Historical Averages:

- Stocks/Stock Funds: 61.0%

- Bonds/Bond Funds: 16.0%

- Cash: 23.0%

The numbers are rounded and may not add up to 100%.

This article originally appeared on Forbes.