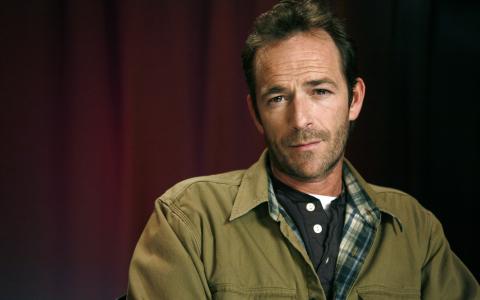

(Forbes) Luke Perry’s passing on March 4, 2019 was a sad moment for many as his iconic role on Beverly Hills 90210 is forever etched in pop culture. However, in the eight months since his passing, it has become clear that unlike most celebrity estates, Luke Perry was financially savvy. From news reports, the public learned that his estate planning was well-thought out and included being buried in a biodegradable mushroom suit to using a revocable trust to pass assets to his heirs in an efficient and private manner.

Recently, media outlets such as The Blast reported that Perry’s $2 million home in the San Fernando Valley had been transferred from his revocable trust to his two children in equal shares. While this seems like a normal part of the estate administration process, for those in the know, it also illustrates additional good planning on the Perry family’s part. Based on the reports, it is likely that Perry’s children likely took advantage of a unique tax loophole in California: the parent-child property tax exemption. As a result, they would have inherited their father’s property tax base – an important financial benefit in California as the home has significantly increased in value since its purchase.

Caitlin Carey, an estate planning attorney in the Personal Planning Group at Perkins Coie LLP in San Francisco explains. “The parent-child exclusion provides great benefits to California property owners that, with proper planning, can be passed on to the next generation,” she says. “The rules are complex, however, and must be followed carefully to avoid inadvertently triggering reassessment.”

California’s Nuanced Property Tax Rules

Usually the words ‘tax shelter’ and ‘California’ don’t appear in the same sentence. For better or worse, the Golden State is considered the land of high costs and taxes. But navigating California’s statutes requires an understanding of the history of two key propositions that the state has on record in creating this tax loophole.

In 1978, California voters approved Proposition 13. This proposition rolled back property tax values for existing homeowners to their 1976 value. For new purchases, the property tax rate would be set at 1% of purchase price. Further, increases to the property tax base were limited to 2% per year.

Then on November 6, 1986, California passed Proposition 58, which was a constitutional amendment that excluded from reassessment transfers of real property between parents and children. To put it succinctly, when a child inherits their parent’s home, they can also inherit the parent’s property tax base.

While both propositions independently create property tax relief, when you combine the two, it can have extraordinary benefits. For instance, imagine a home purchased for $100,000 in 1979. The property tax base would have been established at 1% of the purchase price or $1,000. This property tax base forty years later in 2019 would be $2,208. But let’s say the $100,000 home has increased in fair market value $1,000,000. If the owner passes and the property is transferred to their child, their child would inherit the parent’s property tax base of $2,208, that would continue to grow at the 2% rate.

It’s a pretty unbelievable tax loophole – and one that even surprises Californians. But an estimated 50,000 to 60,000 property transfers occur annually in the state this way – likely including the Perry estate.

However, one area that makes this complicated is understanding the terms involved. For instance, the exclusion permits the transfer up to $1 million of assessed value (and each spouse of a married couple has $1 million to allocate). But assessed value is merely the property tax base, not fair market value. So provided the assessed value stays within the $1 million of assessed value, parents can transfer property that has increased by millions of dollars.

In California, these rules can have a big impact on beneficiaries. The ability to inherit a parent’s property tax on a home that has increased in value might make the difference between selling and keeping the family home.

Carey sums up the impact, “This is why many children in California are holding on to residences and rental property. This is not just a one-time saving but a savings each and every year. [It] can really add up over time.”

The Perry Transfer

While we don’t know the specifics about the Luke Perry estate, we do know that his home was owned by a revocable trust. The revocable trust set up is quite common in California as a way to avoid probate. But it doesn’t preclude the ability to inherit a parent’s property tax base.

“A California property owner can still take advantage of the parent-child exclusion even if his or her home or other property is held in a revocable living trust,” explains Carey. “The county assessor will look through a revocable trust to identify the persons with beneficial ownership of the property and apply the parent-child exclusion accordingly.”

But as beneficial as this loophole is, it is not a technique that one should do on their own.

“In addition, there are reporting requirements with deadlines that must be met in order to claim the parent-child exclusion”, says Carey. “Working with an attorney experienced with California property tax planning is the best way to ensure that this benefit is preserved, first and foremost, and also that it is used to maximum effect.”

It’s About Legacy

Ultimately Luke Perry’s estate will be seen as an example of a celebrity estate with excellent planning. He created tax benefits and administration efficiency for a process that can often be difficult. This includes his family’s utilization of the parent-child exclusion. While the passing of a parent is always sad, how he handled his assets is a legacy he can be proud of.