U.S. stocks look set to dip slightly on Tuesday after Monday’s rally, as U.S.-China tensions rise over TikTok.

President Donald Trump said TikTok will “close down” in the U.S. on Sept. 15 unless Microsoft or another company buys the Chinese-owned video-sharing app. Trump also suggested the U.S. government should get part of the proceeds of a sale. Chinese state media describe the potential sales as “theft” and Beijing could retaliate if Washington’s “smash and grab” of TikTok went ahead.

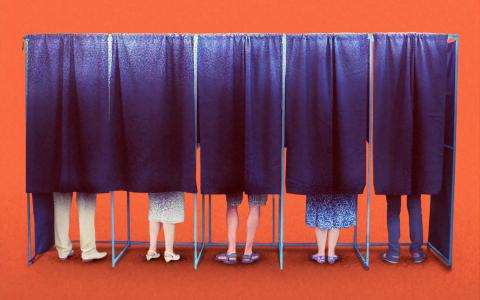

Along with the heightened tensions, investors have plenty more to keep an eye on, including signs of the economic recovery, earnings season and the coming U.S. election.

In our call of the day, Deutsche Bank global chief strategist Binky Chadha said in a close election U.S. stocks typically rally after the result, regardless of the winner.

In the 10 postwar “close elections,” which include all of the last five — defined as elections where the polls were consistently tight or fluctuating widely, making the result unpredictable — the result has been followed by an average 5% rally to year-end, the bank’s strategists said.

“While predictable elections were nonevents, close elections historically have seen equities begin to go sideways starting in July; then rally strongly after on a clear win, independent of who won,” Bandha said in a note.

The pattern reflects the “classic buildup of an uncertainty risk premium” as opposed to a reflection on which candidate is better for equity market prospects, he added.

The team said a widening in the polls in the run up to November’s election will cause a market rally, but if it gets closer we could see a selloff.

Former vice president Joe Biden, the presumptive Democratic nominee, has widened his lead over Trump in the polls in recent months. In many polls, Biden holds double-digit leads nationally in head-to-head contests against Trump, along with leads in swing states.

Despite Biden’s lead, Deutsche Bank said the election could still be considered close and far from predictable. The polls are only slightly wider than at certain points in the run up to the 2016 election, the team said, and the sharp widening in favor of Biden happened over a short period, raises the question over whether it would be reversed or sustained.

The team said the COVID-19 pandemic and increased volume of mail-in ballots created risks to getting a “quick and clear” result in November, and that volatility may persist after election day.

“But the equity volume curve is pricing in a traditional election playbook, with a sharp kink around the election and we would be buyers of November and December volume,” they added.

Corporate tax hikes, one of Biden’s policies, haven't been a key negative catalyst for equities historically, they noted.

Unsurprisingly in years with a predictable outcome — one candidate consistently far ahead in the polls — including 1984, 1988, 1992 and 1996, the stock market trended up through the year with little change around Election Day, the strategists said.

This article originally appeared on MarketWatch.