(Financial News) On May 30, US President Donald Trump declared a new trade policy on Twitter. “On June 10th, the United States will impose a 5% Tariff on all goods coming into our Country from Mexico, until such time as illegal migrants coming through Mexico, and into our Country, STOP,” Trump tweeted.

Seconds after reading the tweet, a London hedge fund manager sprang into action. Sensing a new US trade dispute, and recognising that trade war threats often result in investors fleeing to safe-haven assets, he immediately increased his position on Treasury bonds, making a “six-figure sum” when the bond market rallied. “Thanks to that tweet, I entered June in a very good mood,” said the manager, who asked to remain anonymous.

President Trump’s novel way of issuing government decrees on a social networking platform has moved markets ever since his shock election victory in November 2016. Whether attacking the Federal Reserve for not adopting more accommodative monetary policy, escalating trade tension with China and Mexico — the New York Times recently estimated Trump has tweeted 521 times about tariffs — or going after the management of specific companies, Trump’s Twitter proclamations have altered market expectations of government, Fed policy and corporate America.

While a growing tide of opinion questions the long-term economic impact of the Trump tweet, leading bank analysts have lately been queuing up to recognise its power. Ronnie Walker, economist at Goldman Sachs, wrote to the bank’s clients last month: “Markets believe that the president primarily affects Fed policy indirectly by influencing the macroeconomic outlook.”

JPMorgan went further, creating the “Volfefe index” (named in homage to Trump’s cryptic “covfefe” tweet in May 2017) which tracks the effect of the president’s tweets on two-year and five-year US Treasury yields. Other banks that have studied the economic impact of Trump’s social media decrees include Citigroup and Bank of America Merrill Lynch.

More attention is paid to Trump’s tweets by discretionary managers, rather than systematic hedge funds that deploy machines to guide trading decisions.

“Aspect Capital has not built any trading strategies that look at the president’s Twitter feed,” said Christopher Reeve, director of investment solutions at Aspect, one of the UK’s largest computer-driven hedge funds. “It’s not beyond the realm of possibility that we might, but it would be hard to design something systematic for this.”

Many discretionary hedge fund traders (where humans dictate trading strategy, as opposed to systematic hedge funds that make rule-based, computerised trading decisions) continue to underperform relative to the S&P 500 index and are desperate to generate outperformance, or alpha, by any means necessary. Some of them say Trump’s Twitter feed has been a godsend.

“[Trump’s tweets] have increased volatility,” said Oliver Dobbs, founder of multi-strategy credit hedge fund Credere Capital. “So if Trump says, ‘Ban the Chinese’, and then, ‘Don’t ban the Chinese’, there’s more volatility. If you’re long on volatility you can make money out of it. People aren’t guessing what he’s going to tweet, it’s more he keeps changing his position and that increases the volatility.”

A global oil commodities hedge fund trader, speaking on condition of anonymity, said Trump’s tweets have redrawn the rules of the commodity investing game.

“A lot of firms are struggling with Trump being the arbiter of the price of oil,” they said. “If the price gets too high, he tweets angrily [about the Organization of the Petroleum Exporting Countries].”

In April 2018, when the price of crude oil rose towards $70, Trump tweeted: “Looks like OPEC is at it again… Oil prices are artificially Very High. No good and will not be accepted.”

However, the trader said, “if the oil price gets too low, like in the fourth quarter of 2018, he reverses his antagonistic stance”. They added that at the hedge fund where they work, “we call him the black swan of Mar-a-Lago”.

Last month the debate over Trump’s economic Twitter musings became even more inflamed. A Vanity Fair article written by William Cohan, journalist and former managing director at JPMorgan, argued that the timing of significant trades of futures linked to the S&P 500 suggested that information about policy decisions was being leaked ahead of events and traded on.

“Do [the traders] have access to information that other people don’t have about, say, Trump’s or Beijing’s latest thinking on the trade war or any other of a number of ways that Trump is able to move the markets through his tweeting or slips of the tongue?” Cohan asked. “Essentially, do they have inside information?”

No, replied other finance commentators. Slate’s Felix Salmon called it a “fantasy”, writing that there is “no evidence at all that anybody made any money here, let alone billions of dollars”. George Pearkes, global macro strategist for Bespoke Investment Group, a New York-based financial market research company, called the claim “ridiculous” in an article for Business Insider. He told Financial News: “The evidence presented doesn’t even reach the level of circumstantial (on top of the inaccuracies).” According to Cohan’s article, CME Group, the owner of the trading venue where the trades in question took place, dismissed his allegations as being of no concern.

Despite being outside the economic consensus, Cohan stood by his findings. “It’s unclear why so many people — mostly fellow reporters — have jumped down my throat for being reportorial,” he said.

Insider-trading allegations aside, Cohan said that Trump’s tweets were certainly market-moving. “This is a president who defines his self-worth and success as a politician on how the stock market is performing — he is the first to tweet when the stock market hits new highs and retreats when the market corrects. You would have to be an idiot if you were a trader not to see how easily he’s able to move the market and not make bets accordingly,” he said.

Yet many in the hedge fund space say the impact of the Trump tweet has been overstated. Said Haidar, whose New York-based macro fund Haidar Capital Management has $550m in assets under management, said there are limits to the president’s manic musings.

“I don’t think we really trade on Donald Trump’s tweets for the most part,” he said. “The problem is if Trump tweets he wants a weaker dollar and the dollar sells off, unless he’s doing something about it, it doesn’t really matter that this is what he wants.”

Haidar added that the US president cannot easily affect macroeconomic forces via social media. “It’s a great aspiration but the primary mechanism for a weaker dollar is the Fed cutting interest rates,” Haidar said. He conceded Trump’s tweets “do create market volatility, but the market moves and then there may not be any further follow-through. You just have to accept it can cause a short-term tailswing either for you or against you.”

Other funds find it hard to get meaningful gains from Trump’s Twitter.

“It is definitely a factor, there are apparently people who are doing well from trading those tweets,” said George Papamarkakis, co-founder of London-based global macro hedge fund North Asset Management. “But we’re focusing on the fundamentals and not reacting that much. In the first year of his presidency we tried to, not necessarily trade, but certainly take [his Twitter] into account and then we stopped. A lot of the tweets turned out to be rhetoric that didn’t pan out.”

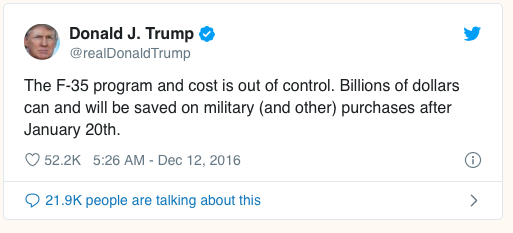

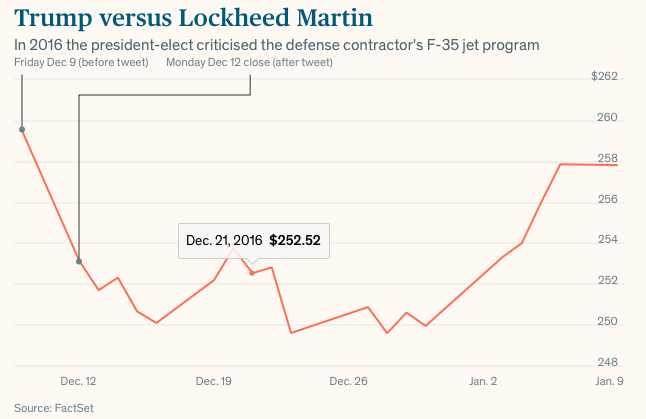

One hedge funder said his investment company generated more revenue off the back of Trump’s tweets earlier in his presidency, when they affected specific companies. When markets closed December 12, 2016, the share price of US defence company Lockheed Martin had fallen by 2.5%, decreasing its market value by more than $1.8bn – the day Trump tweeted that the company’s “F-35 [fighter jet] program and cost is out of control”. Other large US companies he has criticised include carmaker General Motors, online retailer Amazon and aerospace company Boeing.

Trump versus Lockheed Martin

In 2016 the president-elect criticised the defense contractor's F-35 jet programSource: FactSet

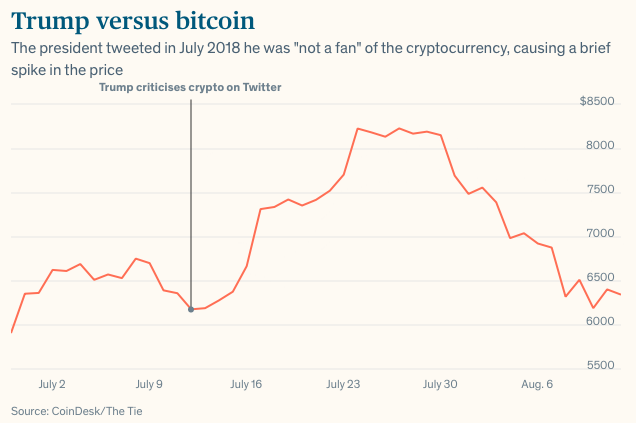

While corporate America might be relieved Trump is tweeting about companies less, cryptocurrency financiers wish he would tweet about them more often. Joshua Frank, chief executive of cryptocurrency data analytics platform The Tie, noted that when the president tweeted “I am not a fan of Bitcoin” last July, the price of the cryptocurrency spiked upwards. “The idea of Trump getting involved, even if his tweets are more negative in nature, leads to a huge increase in tweet volume which tends to lead to upward price movement,” Frank said.

Trump versus bitcoin

The president tweeted in July 2018 he was "not a fan" of the cryptocurrency, causing a briefspike in the priceSource: CoinDesk/The Tie

Recently Trump has been tweeting less about the economy and more about his impeachment hearings. That has been bad news for JPMorgan’s Volfefe index. The bank said in a research note in October that less than two months after creating its custom metric, the volatility in the bond market caused by Trump’s tweets is declining. “We find a waning influence on rates volatility, as the president’s frequent topics of discussion have shifted away from trade and monetary policy,” it said.

Devotees of traditional market practices will hope the shift is permanent.