If the Trump Administration is skeptical about social and environmental goals in investing, individual savers are not. People are piling into funds with ethical themes. This survey of socially conscious investing identifies the best buys: 10 open-end and 13 exchange-traded funds with low expense ratios.

It’s a bit incongruous that the government would be highlighting the bottom line just when many people are becoming more sensitive to which corporations are combatting racial inequalities and global warming. But maybe that was the point. Labor Secretary Eugene Scalia recently declared that it’s a dereliction of fiduciary duty for pension mangers to consider anything but maximizing returns when picking securities.

Leave to lawyers the debate over whether Erisa, the pension protection law of 1974, compels a narrow focus on the almighty dollar at corporate pension plans. When individuals manage their own pension money in the form of IRAs and 401(k)s, they are free to set their own priorities.

Morningstar counts 303 mutual funds and ETFs, as of December 2019, in the category it calls “sustainable.” They still account for a small fraction of fund industry assets, but they are gaining momentum. The fund data house calculates that they attracted $21 billion in net inflows last year; the pace accelerated to $10.5 billion in the first quarter of 2020.

Sustainable, or socially responsible, portfolios address environmental, social and governance objectives; hence the ESG that often appears in a fund’s name. The environmental angle usually focuses on carbon fuels. The social part mostly has to do with workplace diversity, although other criteria, such as avoiding tobacco or weapons production, come into play. Governance has to do with shareholder democracy.

Morningstar is paying ever more attention to this aspect of investing. It recently completed the acquisition of Sustainalytics, an ESG evaluator profiled in Forbes three years ago. On July 6 it published a research report arguing for more disclosure from public companies about their environmental and social policies.

Since ESG funds tend to have very similar portfolios, it makes sense to shop for low costs.

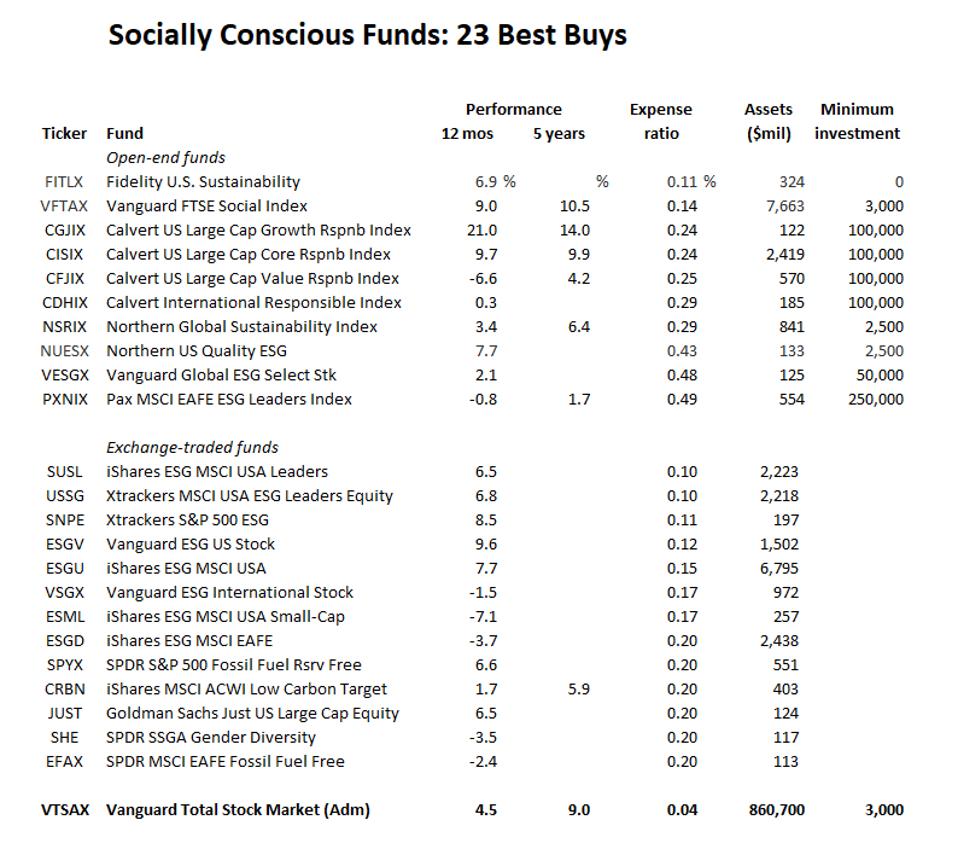

Here are the 23 ethical funds with low expense ratios. The open-end funds on this list, most but not all of them actively managed, have ratios no higher than 0.5% ($50 annually per $10,000). The exchange-traded funds, most but not all passively managed, cost no more than 0.2%.

There was a time when socially responsible funds were expensive. Competition has changed the market dramatically in recent years. Now the cheapest products cost only 0.1% a year more than the kind of index fund that would please Secretary Scalia.

There are, to be sure, reasons to hesitate before diving into socially conscious investing. One is that in reforming the planet, a portfolio decision is more symbol than savior. Selling your shares of Exxon Mobil to another investor does not alter the amount of fossil fuel being burned. To have an effect on sustainability, turn down your air conditioner. You might be unwilling to do that.

Next is that environmental or social purity is elusive. Amazon and Alphabet (Google’s parent) are favorites in the ESG sector because they do not pollute the environment, at least not directly. But they gobble electricity. Even though Amazon is making huge investments in renewable energy, its server farms are connected to power grids whose marginal supplier remains the gas-fired turbine. Until the utility industry becomes carbon-free, any draw of power contributes indirectly to global warming.

The last matter is that ESG funds tend to chase after the same stocks. At the top of their buy lists are the Faama Five: Facebook, Amazon, Apple, Microsoft and Alphabet. Vanguard ESG US Stock, iShares ESG MSCI USA, SPDR S&P 500 Fossil Fuel Reserve Free and Goldman Sachs Just US Large Cap Equity all have positions in all five Faama stocks, and for each fund the combined allocation to Faama falls within the narrow range of 20% to 23%.

Virtuous companies are getting to be a crowded trade. For now, that’s more a feature than a bug: Their popularity has pushed up their prices and enabled ESG funds to boast of good recent returns. But favorites eventually fall out of favor, at which point the commitment to ethical investing would cease to be painless. To stick with it, you really have to believe that you’re doing good.

This article originally appeared on Forbes.