(Bloomberg) -- The best quarter for US stocks in a decade has come to a close, but signs are emerging that appetite for risk may have room to grow.

It’s apparent in the rush of investors trying to get access to growth stocks, a strategy that got pummeled in the fourth-quarter meltdown.

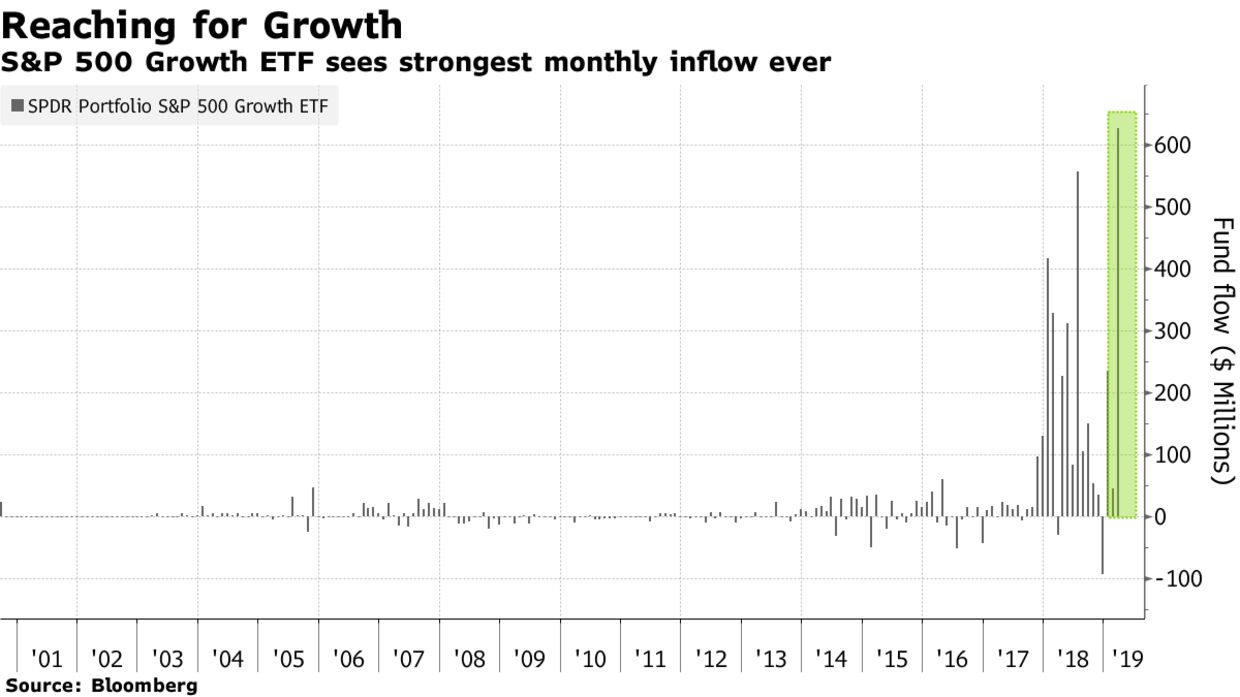

The $4.54 billion SPDR Portfolio 500 Growth ETF, ticker SPYG, took in nearly $630 million in March -- the largest monthly inflow on record for the almost 19-year-old fund.

That happened as the S&P 500 Index rounded out its strongest start to a year since 1998, with SPYG outperforming its value counterpart by more than two percentage points.

The money initially flowed into safer areas such as low volatility stocks and fixed income, but now that caution may be fading.

“People are falling back in love with stocks,” said David Russell, vice president at TradeStation Securities. “This is actually a nirvana situation for growth stocks. The macro environment right now is favorable to high-multiple growth companies because you have low-interest rates and steady growth.”

The Federal Reserve’s change of course in January has ushered in a period of lower-for-longer interest rates. Inflation remains steady while data show the global economy is slowing but isn’t yet recessionary. That’s helped push technology companies to the best-performing spot in the S&P 500 this year, up more than 20 percent. It’s a change from the fourth quarter, when the industry was the third worst.

One-fifth of SPYG is comprised of technology companies, with the popular FANG cohort making up a sizable portion. In fact, Microsoft, Amazon, Facebook, and Google-parent Alphabet account for nearly 22% of the fund’s holdings.

While the growth fund is already up more than 15% this year, some strategists say there could be more room to run.

“As economic activity matures, growth factors usually outperform as the outlook for global growth softens,” Dennis Debusschere, head of the portfolio strategy at Evercore ISI, wrote in a note.

“Growth and momentum will likely continue to outperform over the coming months until there is clear improvement in the economic and earnings outlook.”