Some market environments are easier to explain than others. But whether the cards on the table make sense or not, we all have to play the hand the market deals us.

That's a central message in the 2Q 2020 Review and Outlook from Global X. We all read too many of these. This one is refreshing in the way it acknowledges the facts all investment professionals need to keep in mind while we navigate the day-to-day noise.

1. Markets can behave irrationally. As the Global X team points out, "To some, the recent market optimism has been befuddling." The best quarter in 20 years simply doesn't make conventional sense in the face of the worst pandemic in a century and a potentially deep consumer recession.

We just don't know what we don't know. The outlook avoids speculating about what shape the recovery will take or even how and when the economy can open up again after months of quarantines.

Even when the numbers are encouraging, shell-shocked investors are all waiting for the next shoe to drop. Is the recovery sustainable? Is the virus even under control? Again, we all read a lot of hot takes, so it's refreshing to see CIO Jon Maier abstain from taking sides.

He doesn't have to take sides. He isn't making high-conviction contrarian bets one way or the other, and he isn't asking people who use Global X funds to do that, either.

So what's going on? The Fed is in control. You don't fight the Fed. Easy money reduces systemic risk as long as it's flowing. This is perversely a risk on environment despite all the threats and challenges that we would normally interpret as sell signals.

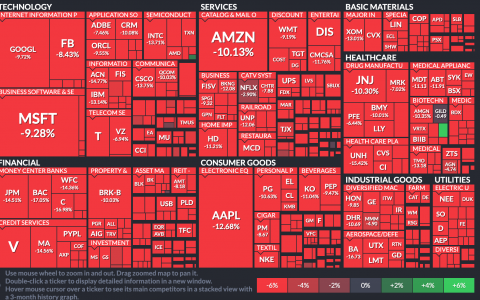

2. Allocation still matters. Unless you're content with a total market portfolio, you're always going to see the distribution of hot and cold spots influence short- and long-term performance.

This is a nice point to highlight right now because so many other tenets of normal market life have been suspended. You can add value by pivoting in the right direction. And if you're overweight the cold spots, you need to be able to argue for patience until conditions improve.

Global X concedes right away that it's going to be a long road for real estate. As with many of us, the company relied on REITs as a key component of its income portfolios, and with malls and offices shut down NAVs are going to remain depressed until we see clarity.

It's ironic that a bulwark of the "defensive" style has so much red ink to mop up, but that's simply where we are. For now, dividends keep flowing. That should be enough for income-oriented clients.

And in a "risk on" environment, Global X is well positioned to give investors access to fine-tuned growth themes. "Growth maintains the upper hand," the team says.

After all, when a company is growing, it isn't actually in a recession. Maybe that expansion rate slows to reflect stagnant macro conditions, but growth is growth. The only question is where you choose to capture it.