U.S. stocks have started the week in subdued fashion, after closing higher on Friday following weaker-than-expected jobs data for May.

Comments made by U.S. Treasury Secretary Janet Yellen are also in focus, after she said higher interest rates down the line would be “a plus” for policy makers, in an interview on Sunday with Bloomberg News. Investors will be closely watching the latest U.S. inflation figures when the consumer-price index is published on Thursday.

Investors are also digesting another volatile weekend for cryptocurrency assets.

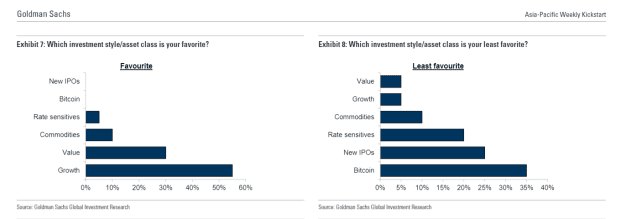

Our call of the day comes from a Goldman Sachs GS, -0.89% survey, in which chief investment officers said bitcoin was their least favorite investment.

The world’s No. 1 crypto has had a volatile few months and moved lower on Sunday, on reports that Chinese social media platform Weibo had suspended a number of crypto accounts. A warning from the People’s Bank of China against using crypto for payments last month sparked a bitcoin crash, as it fell below $40,000 from a mid-April peak of $64,829.

Bitcoin’s rally to that peak had been partially attributed to more institutional adoptions of the crypto assets, according to some analysts and commentators.

However, a number of chief investment officers made their views on bitcoin clear in a recent survey conducted by Goldman Sachs.

“We held two CIO round table sessions earlier this week, which were attended by 25 CIOs from various long only and hedge funds,” said the Goldman strategists. The CIOs were surveyed on their views and outlooks, including their favorite investment styles and asset classes.

“Their most favorite is Growth style but least favorite on bitcoin,” added the strategists, led by Timothy Moe. In fact, 35% said the world’s No. 1 cryptocurrency was their least favorite, followed by new initial public offerings with 25%, and rate sensitivities with 20%.

Source: Goldman Sachs Global Investment Research

In contrast, Bank of America’s global fund manager survey for May found that long bitcoin was the most crowded trade. The survey of 216 panelists with $625 billion in assets under management was conducted between May 7 and May 13. While the surveys differ in their context and size, a month is a long time in the markets, particularly for crypto assets. The price of bitcoin on May 7 was $57,699, according to CoinDesk data. On June 7 it sits at $36,316.

In better news for bitcoin, the president of El Salvador, Nayib Bukele, is set to propose legislation making the cryptocurrency legal tender in the Central American country.

Goldman’s CIO survey produced a number of other results, finding that chief investment officers were most bullish on China A shares and Japan’s benchmark Nikkei 225 NIK, -0.19% index. Their biggest concern for the market was inflation and interest rates, expecting the U.S. Federal Reserve to start tapering in the first half of 2022, with the first interest rate increases coming in the second half of next year.

This article originally appeared on Yahoo! Finance.