(Northern Trust) - As COVID-19 concerns fade, the global economy has the opportunity to make further progress. But a sustained bout of inflation and geopolitical tensions have taken center stage. Inflation continues to surge, with the peak yet to be seen in some countries. The Ukraine-Russia conflict is fueling uncertainty and pushing down sentiment.

For now, risks are tilted to the upside, and central banks will be tightening policy in response. The end of accommodation reflects an orderly return to the pre-crisis normal. But a broader conflict in Eastern Europe could provoke a wholesale reevaluation of the outlook.

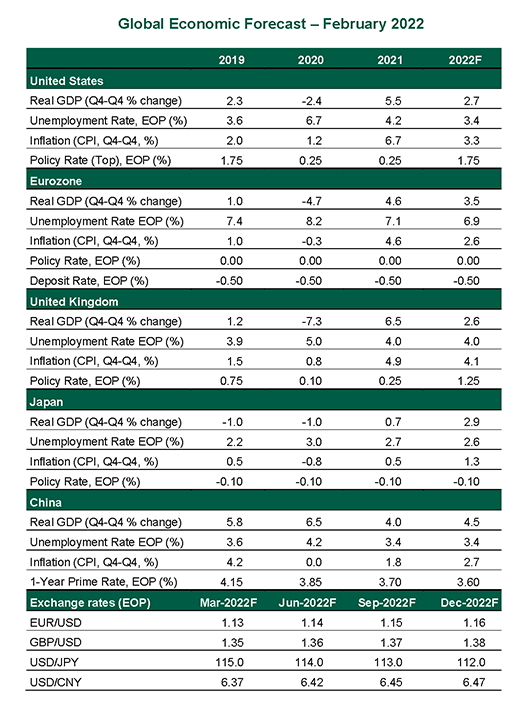

Following are perspectives on how major economies are poised to perform.

United States

- Inflation persists at uncomfortable levels, with the consumer price index (CPI) gaining 7.5% during the year ending in January. Rapid appreciation of rents, energy costs and most categories of food have been among the biggest contributors. As the pandemic recedes, consumption patterns may shift away from goods and towards services, which would alter but not diminish price pressures in the months ahead.

- At its January meeting, the Federal Open Market Committee affirmed a course of ending asset purchases in March, with rate hikes set to commence at their March meeting. The Fed will have to raise rates steadily to combat inflationary forces, though some are beyond their control. We expect considerable tightening through 2022, with the policy rate peaking at 2% early next year.

Eurozone

- Incoming data and surveys such as the Purchasing Managers’ Indices (PMI) are presenting a picture of economic optimism. But will worries over the Ukraine-Russia tensions dampen the positive sentiments? Although the direct economic impact of the conflict should be limited, the resulting higher energy prices will further squeeze real incomes of European consumers. A wider conflict would cause more serious social and economic costs.

- The eurozone economy is on track for a strong rebound following a soft patch during the winter. But lasting inflationary pressures have forced the European Central Bank (ECB) to adopt a slightly hawkish shift. In our view, the ECB will likely accelerate the tapering process of its asset purchases. However, rate hikes remain off the table in 2022.

United Kingdom

- A 0.2% month over month decline in the December gross domestic product (GDP) confirmed a modest hit to activity from the Omicron variant. With restrictions out of the way, a strong rebound has commenced in the services sector, with PMI rising to an eight-month high of 60.8. That said, the rising cost of living in the U.K. is a major headwind for the British economy. A higher energy price cap and rising global commodity prices mean that inflation will remain higher for longer, peaking at over 7%. As a result, the drag from a real income squeeze is a more immediate concern than the risk of a wage-price spiral.

- High inflation coupled with a tight labor market will continue to force the Bank of England (BoE) to tighten policy. We expect three more rate hikes of 25 basis points each, taking the Bank Rate to 1.25% by year-end. This is a little less aggressive than markets are pricing in.

Japan

- The Japanese economy posted a robust recovery in the last quarter of 2021, driven by strong consumption. But momentum didn’t last for long, thanks to the Omicron variant and the related decline in mobility. Higher energy costs will also weigh on the consumption recovery in the near term. That said, the outlook beyond the first quarter looks positive. The release of pent-up demand and the continuing recovery in exports should continue to support growth.

- Japan’s parliament approved the second-largest expenditure package in the nation’s history. But the economic boost will likely be limited. Half of the budget is intended to provide compensation and support to affected firms and households in the form of cash benefits and grants. The other sizeable chunk consists of long-term growth measures. Slow deployment of the funds will limit their stimulative effect.

China

- The Chinese economy has had a disappointing start to 2022 on the back of a real estate downturn and sluggish consumption. While goods sales posted a robust reading during the Chinese New Year holiday, demand for services remained weak, owing to the government’s stringent approach to virus control. The city of Baise, also known as the “aluminum capital of southern China,” was recently placed under stringent curbs. Restrictions like these in key parts of the country will continue to provide an unwelcome boost to commodity prices.

- The Evergrande default hasn’t yet led to a broader contagion, but the tone and actions from policymakers continue to suggest that additional easing will be required to keep a floor under GDP growth. The pickup in local government bond issuance should underpin infrastructure spending in the first half of the year. The increase in credit growth suggests monetary policy will also continue to play its supporting role. More stimulus could be announced during the National People’s Congress next month.