(Gemmer) The more you dig into how the inflation numbers are calculated the more perplexed you become. Take housing costs.

Home prices do not go into the inflation computation, only rental prices. The line of thinking is that buying a house is basically an investment rather than a consumption good. Which sorta makes sense, but then again, a lot of people have to pay something to live somewhere. A bit like food, which is considered a consumption good. Anyhow, rental prices make up a good bit of most inflation indexes. Shelter makes up 32.8% of the CPI index, and rent makes up almost 24%.

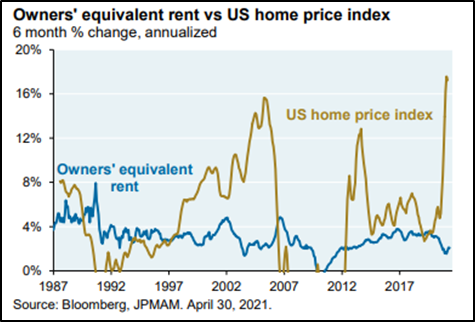

Obviously, home prices have been on a tear the last few months, with prices up roughly +17% over the last six months. Rental prices are up just 2%, as you can see below.

Another way to show this is through the price-to-rent ratio. It’s at its highest point in history. As a result, we have this weird disconnect between homes as an asset and shelter as an expense. As The Economist notes:

‘Over the long run, however, economic theory suggests that rents and prices should move in tandem (ie, the ratio of house prices to rents should be stable). If rental growth catches up with prices, that could have a big effect. Rents make up one-fifth of the basket used to calculate “core” personal-consumption-expenditure (pce) inflation, which excludes food and energy—the gauge most closely watched by the Fed. If annual rent inflation rose to 4% a year—not far off where it was shortly before the pandemic—overall core inflation would rise by 0.5 percentage points.’

Why does this matter? Because the Fed would probably look at this type of move as permanent inflation, not transitory, and tighten policy accordingly. But there are also structural reasons that could keep home prices elevated relative to rents (low interest rates, a slow pace of new home construction, development restrictions, etc.). Time will tell how this play out, but if it feels like there is a disconnect between the cost of living and the inflation data, there is!!

Published by Gemmer Asset Management LLC The material presented (including all charts, graphs and statistics) is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The material is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objective, financial situations, or needs of individual clients. Clients should consider whether any advice or recommendation in this material is suitable for their particular circumstances and, if appropriate, see professional advice, including tax advice. The price and value of investments referred to in this material and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Fluctuations in exchange rates could have adverse effects on the value or prices of, or income derive from, certain investments. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Gemmer Asset Management LLC (GAM). Any mutual fund performance presented in this material are used to illustrate opportunities within a diversified portfolio and do not represent the only mutual funds used in actual client portfolios. Any allocation models or statistics in this material are subject to change. GAM may change the funds utilized and/or the percentage weightings due to various circumstances. Please contact GAM, your advisor or financial representative for current inflation on allocation, account minimums and fees. Any major market indexes that are presented are unmanaged indexes or index-based mutual funds commonly used to measure the performance of the US and global stock/bond markets. These indexes have not necessarily been selected to represent an appropriate benchmark for the investment or model portfolio performance, but rather is disclosed to allow for comparison to that of well known, widely recognized indexes. The volatility of all indexes may be materially different from that of client portfolios. This material is presented for informational purposes. We maintain a list of all recommendations made in our allocation models for at least the previous 12 months. If you would like a complete listing of previous and current recommendations, please contact our office.