(Forbes) Over the years, Donald J. Trump has been a hardnosed Republican, an independent firebrand, a left-leaning Democrat, then a Republican once again. He has called for the rich to pay more in taxes, he has proposed plans that allow them to pay less. Yet one thing has remained consistent: His pure hatred of the estate tax—a “lousy tax” and a “horrible weapon that has destroyed many families.” Such animosity makes sense, given the state of his finances.

If Trump were to die today, his heirs would likely find themselves stuck with more than $1.3 billion in state and federal estate taxes, a tab so immense that they might have to sell off the Trump Organization’s entire New York City real estate portfolio—or take on a cash flow-suffocating loan to cover it.

Forbes estimates that Trump has paid each of his three eldest children—Donald Jr., Ivanka and Eric Trump—some $35 million in salary, commissions and bonuses for their work as executives at the Trump Organization, and he has given them modest stakes in a handful of relatively insignificant ventures. The rest of the first family—daughter Tiffany, son Barron and wife Melania—don’t seem to have received much at all. That leaves 73-year-old Donald Trump firmly in control of a $3.1 billion tax time bomb.

Simply put, it’s bad planning. The president of the United States, one of the wealthiest people in America, appears to have one of the worst tax strategies in the country. “It’s puzzling,” says Bruce Steiner, a New York estate lawyer who advises high-net-worth clients. “At death if he’s given away nothing, half of it disappears.”

Then again, Donald Trump is also in position to relieve his family of much of the burden by simply repealing the federal estate tax altogether. It’s something he has already tried and failed to do once. Now, two years after the Trump tax cuts tweaked the estate tax rules, but not enough to impact the super-wealthy, Trump’s allies in Congress are trying to kill the tax once more. If they prove successful, it would likely save the Trump family more than $1 billion—enough to make it the most lucrative deal of Donald Trump’s life.

Yu can tell a lot about a wealthy family by how they split their money. In Trump’s case, it’s all his. The president owns 40 assets through a maze of hundreds of holding companies—all of which are owned, in the end, by the Donald J. Trump Revocable Trust. While trusts are a common tool for transferring assets to heirs, this one simply holds investments “for the benefit of Donald J. Trump,” according to documents filed with the District of Columbia.

In fact, despite years as top execs at the Trump Organization, Trump’s three adult children own a meaningful stake in just one significant project: the Trump International Hotel in Washington, D.C. There Trump’s kids, who helped turn the former U.S. postal service building into a luxury hotel, each own a 7.5% share, worth $5 million apiece. Big money for most people, including the Trump children, but cumulatively just 0.5% of the family’s wealth.

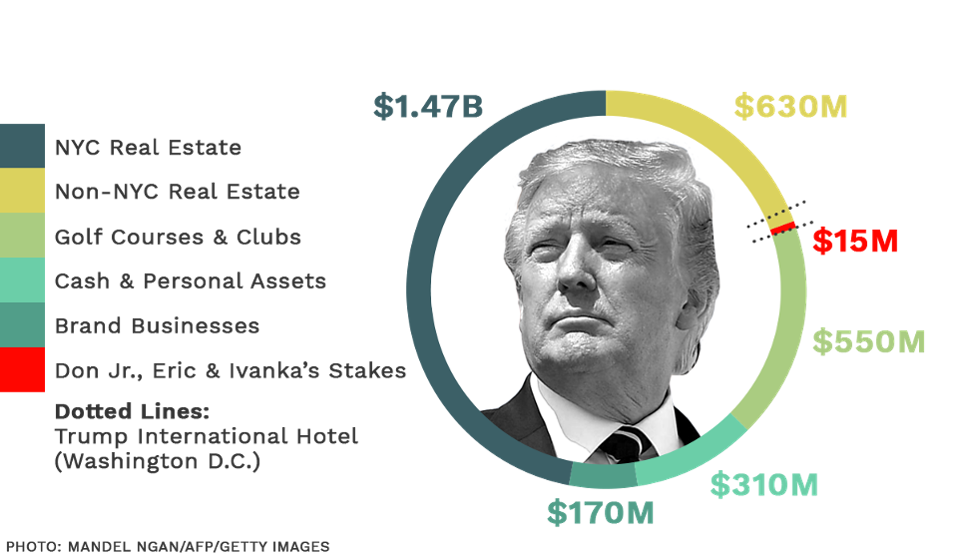

The Trump Family Fortune

Across the president’s $3.1 billion portfolio, he has cut members of his family in on just a single meaningful deal: a $15 million stake in the Trump International Hotel in Washington, D.C.

The rest of the projects Trump owns alongside his children are even less significant: a few management companies tied to licensing deals that have yet to pan out and a share of an ecommerce startup selling Trump merchandise. In 2018 those businesses only produced about $1 million in combined revenues.

Then there are Scion and American IDEA, the two hotel brands the Trump children tried to launch around the time of the election. Mid-priced and in Middle America, they stood in stark contrast to their father’s glitzy, Trump-branded luxury hotels. With a name like Scion—a “nod to the Trump family”—the venture seemed to herald the new generation of Trumps that would oversee it. But the ownership structure was all too familiar. It was Donald Trump who really stood to benefit. He took 77.3% of the equity; the scions split the leftovers.

All of this baffles wealth experts. Mark Zuckerberg stashed pre-IPO Facebook stock in trusts long before his children were even born. The Waltons are the richest family in America today because Sam Walton handed his kids 80% of his Walmart stake decades before it became a multibillion-dollar business, correctly reasoning that “the best way to reduce paying estate taxes is to give your assets away before they appreciate.”

Jared Kushner’s father, Charles, has been passing on his family’s real estate fortune for years. Roughly the same age as Ivanka, Jared holds stakes in hundreds of Kushner family investments, worth millions of dollars. When Kushner Companies buys a property, he often gets a stake. His siblings probably do too.

“Some of the wealthiest people I represent die with almost nothing in their name,” says Robert Keebler, a Wisconsin-based accountant for the rich. Which raises the question, why would Donald Trump of all people, a notoriously close-fisted billionaire who has said not paying taxes “makes me smart,” leave himself vulnerable to the biggest tax of all?

The Trump Organization would not comment for this story. The president could be planning on giving his fortune to charity—though this seems unlikely. A partial explanation might come from one quirk in the tax code, called the step-up in basis. When someone dies owning an asset they acquired for cheap, the basis used for capital gains tax calculations jumps up to the market value at the time of death, saving heirs a fortune if they ever decide to sell. Trump scored some of his trophies, including Mar-a-Lago and 40 Wall Street, for bargain prices—putting them on the hook for big capital gains taxes if they were ever sold. According to tax experts, the capital gains taxes the Trump family would save through step-up might offset much of the estate tax hit. Trump could also pass his assets to his 49-year-old spouse tax free, potentially giving the family extra time to plan for succession.

Still, that doesn’t explain why Trump hasn’t been handing out more equity in new projects to his heirs. Especially since one of his major businesses—licensing his name to other people’s buildings—is perfectly suited for such moves. Because he invests little in the projects, he could transfer those deals without paying much gift tax. The cash flow and any future appreciation in value would go directly to his heirs, bypassing the estate tax entirely. Sounds like a no-brainer, yet Trump hasn’t done it.

Like most things with Donald Trump, it all might boil down to one thing: ego. By hoarding all the equity, Trump remains in control of his empire—key if he plans on retaking the reins after he’s done with politics. Then there’s loyalty. His children may not need an incentive to remain fiercely loyal to their father, but dangling a ten-figure inheritance over their heads ensures they have a billion reasons to stay in line. Just before taking office, Trump made clear he would be keeping a close eye on them. “I hope at the end of eight years, I’ll come back and say, ‘Oh, you did a good job.’” he said. “Otherwise, if they do a bad job, I’ll say, ‘You’re fired.’”

In the meantime, however, Trump’s enormous tax liability continues to fester. And it’s not like there isn’t a better way. As anyone with a family business knows, there are plenty of ways to maintain control while passing down equity to minimize estate taxes. Shareholders’ agreements, voting stock or limited partnerships could all do the trick—and potentially save the Trump family over a billion dollars.

Unless the president is banking on a repeal of the estate tax. It was a cornerstone of his 2016 platform and part of early GOP tax cut plans in 2017, but it slipped out of the final tax overhaul amid resistance in the Senate. In January, Republicans in Congress introduced long-shot bills to kill the tax.

That would be especially valuable if the president is headed back to Trump Tower after he leaves office. There will be deals waiting for Trump as soon as the cloud of ethics concerns and partisan politics lifts. Former partners remain ready to rekindle their arrangements, not to mention the scores of potential new partners he’s met while traversing the globe as the leader of the free world. He may even revive Scion, the brand apparently meant to signify the torch being passed to the next generation. After all, he’s the majority shareholder.