David Wismer is Director, Communications, for Flexible Plan Investments, Ltd.

A few weeks ago, I wrote about a financial adviser’s analogy between the strategy in a Kansas City Chiefs 2021 playoff game and investor behavior.

In that example, the point was how financial advisers could help their clients with the concept of “behavioral adherence,” or sticking with a well-constructed and risk-managed investment plan even when times get tough.

The adviser concluded, “Clients are far more willing to stick with an investment plan if a significant percentage of their portfolio incorporates active, or tactical, risk-managed strategies.”

NASA’s Mars mission

Another recent event got me thinking further about analogies to principles of investment management.

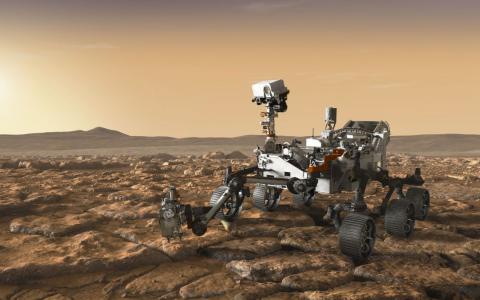

After its recent landing on Mars, NASA’s Perseverance rover kept much of the nation transfixed with the remarkable images it sent back to Earth.

After the culmination of the spacecraft’s seven-month trip through space, acting NASA Administrator Steve Jurczyk said, “Perseverance is just getting started, and already has provided some of the most iconic visuals in space exploration history. It reinforces the remarkable level of engineering and precision that is required to build and fly a vehicle to the Red Planet.”

Risk management is paramount for any space exploration mission and is implemented in many ways through exhaustive preparation and testing and numerous system redundancies.

A recent article noted, “For NASA, redundancy is all-important. … From the dawn of the Space Age through the present, NASA has relied on resilient software running on redundant hardware to make up for physical defects, wear and tear, sudden failures, or even the effects of cosmic rays on equipment.”

In our adviser interviews for Proactive Advisor Magazine, I often ask the question, “Do you ever use analogies with clients in explaining your firm’s approach to investment management, and, specifically, to risk management?”

I have never been told about an analogy to space exploration, but several advisers we have interviewed are former Air Force officers or airline pilots.

One told us, “The Air Force teaches the importance of emergency training first. … Investments are much like that in that we always need to be prepared with contingency plans in case of tumultuous times in the economy or the markets.”

“You don’t start thinking about what to do when the wings are on fire in a jet. … You should know that already. Same thing with investments in terms of having active strategies that are already prepared to react to changes in market conditions.”

Making risk management relatable through visualization

Behavioral psychology research often talks about the power of “visualization.” In the case of behavioral finance, this can often refer to visualizing future outcomes, like the eventual purchase of that perfect retirement home in the ideal location. It is a way of reinforcing the importance of discipline in adhering to a financial and investment plan, with definite goals outlined for the future.

“Visualization” is also a well-known teaching technique, one often used by financial advisers.

A 2018 article in Investor’s Business Daily noted,

“Advisors spend lots of time explaining financial concepts to clients. And they have a secret weapon to demystify complicated ideas: the analogy.

“The ability to compare a highly technical concept to something that's easy for laypeople to understand requires a command of the subject matter. It also involves stepping into someone else's mind—and conjuring up an image or story that will resonate with that listener.”

One of the analogies I often hear related to investment risk management is about as simple as it gets.

Several advisers have told me that they will ask clients the question, “If you were standing on a railroad track and a train was bearing down on you, wouldn’t it make sense to get off the tracks?”

When they get the inevitable head nod “yes,” they go on to relate this concept to the practical wisdom of employing risk-managed investment strategies that can reduce market exposure partially or completely when market trends and indicators are pointing toward a potentially significant market downturn.

An adviser in the upper Midwest uses weather extremes to provide an excellent analogy to tactical money management. He told us,

“On the tactical side, [we have] some excellent client materials and presentations that help explain active management … market cycles, risk and return, the math of drawdowns, and the need to play both offense and defense with your portfolios. We look together at some numbers showing how portfolios protected against downside risk … can perform over time versus just sticking with the performance of a market index.

“I also use some simple analogies. My favorite involves a thermostat. I will ask my clients what their ideal temperature is in their house all year round. Let’s say they answer 70 degrees. In [our area] weather can go above 90 degrees in the summer and below zero in the winter. However, if you have a thermostat, a furnace, and an air conditioner, you can keep your home at a comfortable temperature all of the time.

“That is the goal of tactical money management—to make your investing experience less volatile. Sometimes you need to run the furnace and other times you need the air conditioner. It is nice to have a thermostat to help keep things comfortable and under control. I try to relate this back to the markets and the fact that you cannot do the same thing in all market conditions—it just does not make practical sense.”

Seeing analogies come to life

I have heard many different types of analogies from advisers describing active risk management, with common themes revolving around sports, stormy weather, safeguards in building construction, farming, going on a trip, driving a car, or piloting a boat. They all have merit.

One phrase I particularly like is, “Having a risk-managed portfolio is like bowling with the bumper or guard rails raised on the lane.”

It also is gratifying to see risk-management concepts come to life, in real time.

2020 presented such an opportunity for the financial advisers and investors who work with Flexible Plan Investments (FPI).

From January 1 through March 24, 2020, encompassing the worst of the pandemic-related market downturn, 99% of FPI strategies outperformed the S&P 500. Notably, drawdown levels for all assets under management by FPI were significantly less than those for the SPX or a typical balanced portfolio.

While it would be a pretty big stretch to compare FPI’s approach to investment management to a NASA scientific mission, they both do share a belief in the concepts of exhaustive data analysis, sophisticated algorithms and models, computing power appropriate to the task at hand, and “redundant systems.”

For example, turnkey QFC portfolios from Flexible Plan Investments do not rely on simple investment diversification, but rather apply dynamic risk-management techniques at three distinct levels, effectively enhancing the probabilities for managing investment risk in all types of market environments.

According to NASA, the Perseverance rover mission is just one step in the Mars Exploration Program, “a long-term effort of robotic exploration.” Congratulations to all involved for a job well done!