The coronavirus pandemic couldn’t have come at a worse time for New York City’s On Deck Capital. The once-promising fintech unicorn, known for massaging big data with algorithms to make loans for small businesses, started life with such promise. It had blue chip backers like Peter Thiel, Khosla Ventures and Tiger Global. It went public in December 2014, and almost immediately its stock soared 40% to a peak market value of $1.9 billion. But long before COVID began making headlines, On Deck hit a rough patch. As competitors flooded its small business niche, customer acquisition expenses ballooned, and margins plummeted. By the end of 2019, more than $1.6 billion of its market value was gone, and On Deck was attempting a turnaround strategy.

What had been a challenging future for On Deck has turned into a desperate one. In the first quarter of 2020, the company reported a $59 million loss on flat revenues of $111 million, mostly because an alarming COVID-19-related spike in loan delinquencies forced it to boost its reserve for credit losses. It has also tapped $987 million of its $1.1 billion credit facility in an effort to stave off a liquidity crisis. Employees have had their hours cut, and with On Deck’s shares now trading below a dollar, one activist investor is demanding that CEO Noah Breslow and two other board members be fired.

The company isn’t commenting, but a person familiar with the situation says Evercore has been hired to shop On Deck in what amounts to a fire sale.

On Deck Capital is just one of many finance startups in the throes of an existential crisis. The fintech boom of the last decade has produced a vast landscape of new companies and novel technologies. Many may soon need to find merger partners.

A surge in deals began just as the contagion was spreading. In January Visa announced it would pay $5.3 billion to purchase San Francisco’s Plaid, a tech platform connecting bank accounts to apps, and in February Intuit said it would pay $7.1 billion for Credit Karma. The coronavirus pandemic—and the business disruptions it is causing—will quicken the pace of transactions over the next year. Already, Motif, a 10-year old stock investing fintech backed by Goldman Sachs and JPMorgan that was once valued at $440 million, announced that it would shutter and sell its tech and intellectual property to Charles Schwab. Some like Motif and On Deck will end up in shotgun weddings, but others will find happy marriages of convenience.

Salt Lake City-based Galileo is a fintech that powers payments for trading app Robinhood, money-transfer company TransferWise and digital bank Chime. Despite its $77 million venture capital raise in October 2019 valuing it at $1 billion, it jumped into the arms of SoFi for $1.2 billion in early April. Conversations for that hurried deal began the first week of March, just after COVID-19 cases started officially being recorded in America. Galileo CEO Clay Wilkes, 59, will walk away with a net worth north of $700 million. The SoFi-Galileo deal claims to be the first major acquisition in history completed virtually. It won't be the last.

Banks should move now to acquire fintech startups, Nigel Morris says. “Never waste a good crisis.”

“You’re going to see a lot of fallen angels that can’t get the capital and are going to get scooped up over the next three to twelve months,” says Steve McLaughlin, founder and CEO of fintech-focused investment bank FT Partners. Two other categories of acquisitions will transpire, he says. Big companies like PayPal, Mastercard and Visa “will still be in attack mode, because they’re all in a fierce battle.” And a middle-market segment will include companies that aren’t yet desperate but are underperforming in this new economy—they’ll get bought at lower prices than they would have fetched otherwise.

Nigel Morris, the cofounder of Capital One and managing partner of venture capital firm QED, says incumbent banks should jump at the opportunity to snap up startups with innovative technologies and significant customer bases. “If there was a time to make a move on a merger or acquisition, this would be it,” he says. “Never waste a good crisis.”

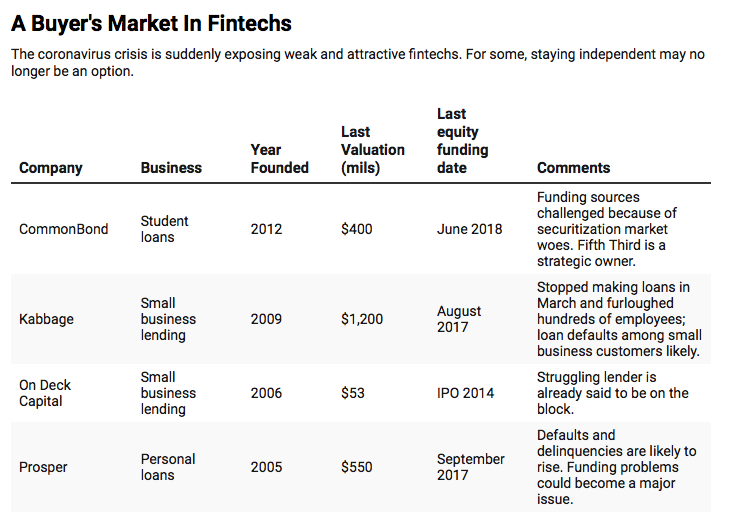

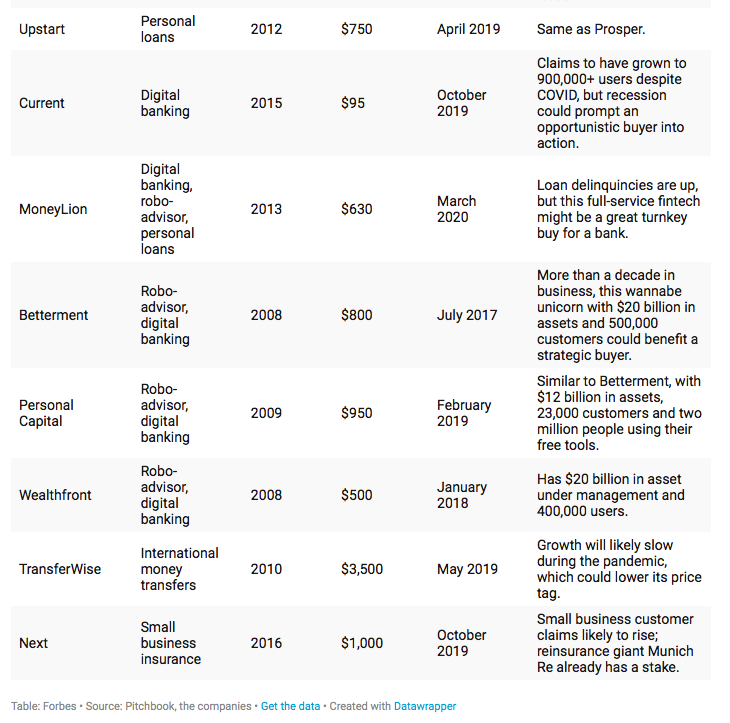

Forbes spoke with more than a dozen venture capitalists, bankers, entrepreneurs, consultants and professors about the outlook for fintech acquisitions over the next year. Based on these conversations, we identified twelve likely fintech targets (see table below).

Nearly all we spoke to agreed that online lending fintechs like On Deck were the most vulnerable for takeover. While companies like LendingClub, Avant and GreenSky used their novel technologies to drive impressive user growth, they have ultimately failed to live up to their promises of disruption. All have struggled with funding costs. Without the benefit of their own deposits, like traditional banks, the fintechs have had to rely on strategies like securitization, which is not only costly, but in times of severe market uncertainty, tends to evaporate altogether.

Student loan fintech CommonBond has lent money to over 500,000 customers since its inception in 2011. It says that 2019 was its best year on record, and revenue grew 40% to roughly $40 million. But the coronavirus pause could throw a wet blanket on its momentum. Since CommonBond began lending, securitized loans have made up one-third of its funding. With that market effectively frozen, one wonders whether CommonBond will ride out the pandemic or perhaps be consumed by one of its strategic owners, like Cincinnati’s Fifth Third Bank, which led a $50 million investment round in the startup in 2018.

Likewise, Progressive Insurance might want to double-down on fintech Upstart, which it invested in during a $50 million round in 2019. The Silicon Valley company makes subprime personal loans ranging from $5,000 to $30,000 and uses artificial intelligence to assess risk. With unemployment rampant, Upstart’s future could be bleak. An Upstart spokesperson claims it’s well-funded, but the company says that 10% of its borrowers have already either defaulted on loans or negotiated a due-date extension through April. Moreover, some of Upstart’s loans are trading at the distressed levels of just 65 cents on the dollar.

Several online lenders fit into the fire-sale category. San Francisco-based Prosper, like online lender LendingClub, has long struggled to build a sustainable business. COVID-19 could hasten its ultimate demise or sale. Kabbage, the Atlanta small business lender that was last valued at $1.2 billion in 2017, recently furloughed hundreds of employees and hit pause on originating new loans before pivoting to focus on facilitating loans for the government-stimulus Payroll Protection Program.

Digital banks are faring better than pure lenders, but unemployment and uncertainty will shrink valuations and spur acquisitions. New York-based MoneyLion caters to middle-income customers and has more than six million users. Recent business closures have had a “massive impact on our customer base from an employment perspective,” CEO Dee Choubey says. Nearly 10% of its customers are late on their personal loan payments, roughly double the typical level. It’s also seeing slower growth in its $20-a-month membership tier. MoneyLion, last valued at $630 million, would make a nice meal for an incumbent bank or tech company. “We’re always having conversations about our future, but there is nothing imminent on the horizon,” a MoneyLion spokesperson says.

Current, another New York digital bank, has struck a chord with teens and low-income customers. CEO Stuart Sopp says growth has accelerated over the past two months. He plans to raise more funding this year, claiming he could do so today but wants to wait until the fall, when investors may be open to higher valuations. Current was last valued at $95 million in October 2019. “Since we started three years ago, we’ve been approached multiple times every year [about being acquired],” he adds.

Payments companies have been the darlings of fintech over the past year, and TransferWise has built an impressive business worth $3.5 billion by helping consumers make international money transfers at rates cheaper than what banks offer. Scott Harkey, chief strategy officer at payments and technology consulting firm Levvel, thinks PayPal, or Visa or even a large technology company is a likely acquirer. “COVID is likely to have a negative impact on TransferWise’s business, and that could lower their value and weaken their position in a way that makes them an attractive acquisition target,” he says.

Robo-advisors like Betterment, Wealthfront and Personal Capital may also find themselves on the auction block. About a decade after their start, robo-advising has gained its fans and customers, but the service alone hasn’t proven to be a sustainable business model. They’ve started to diversify, launching debit cards last year and competing aggressively with rates on savings accounts. Now that the Federal Reserve cut interest rates to zero, these points of differentiation have been watered down.

“It doesn’t come as a surprise to hear that Wealthfront is coming up in boardroom conversations as an M&A target,” says Wealthfront spokesperson Kate Wauck. “We’re feeling great about the business despite these challenging times.”

This article originally appeared on Forbes.