(Bloomberg) There are very few industry combinations are as alluring to investors as finance and technology. For the last decade fintech startups have found innovative ways to help people manage their money. As startups face more competition from tech giants and banks, investors are turning their attention to fintech in new markets. Here’s a look at some of the developments and trends that are driving the industry today.

A Gold Rush Overseas

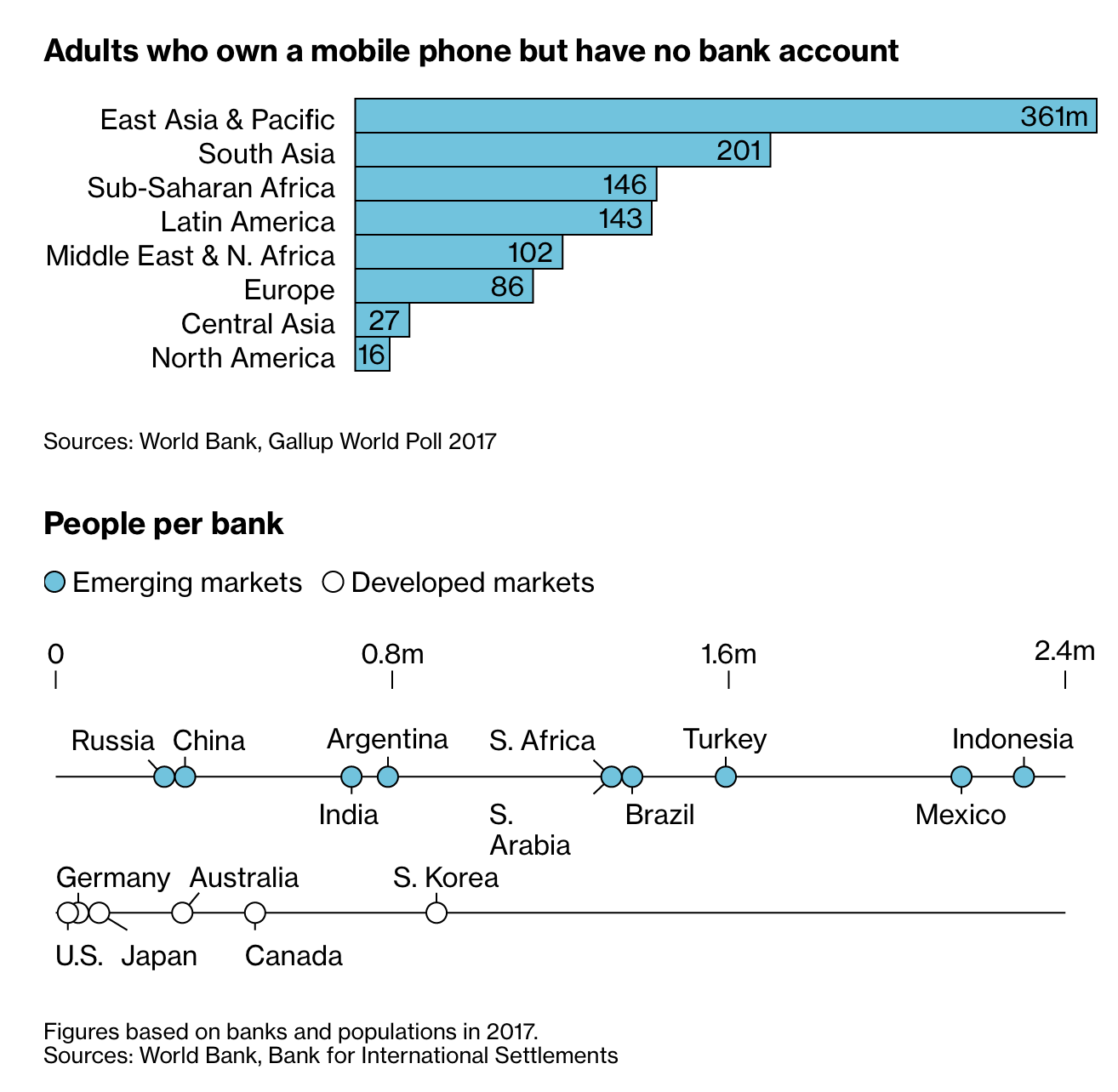

Mobile phones are transforming finance. While most Bloomberg Marketsreaders have a mobile phone and a bank account—and perhaps a bank app on their phone—millions of people around the world have the phone but no bank. These underbanked markets, led by countries in Asia and Africa, have inspired fintech innovation that’s leapfrogging the technology available in the developed world. The sheer number of potential customers doesn’t ensure success, however. The winners are the companies that have devised business models that can profit in less developed markets, or that expand to serve wealthier customers. Ant Financial Services Group’s Alipay and Tencent Holdings’ WeChat Pay in China, Paytm in India, and Safaricom’s M-Pesa in Kenya are some well-known examples.

Facebook’s Plan to Bring Cryptocurrency to the Masses

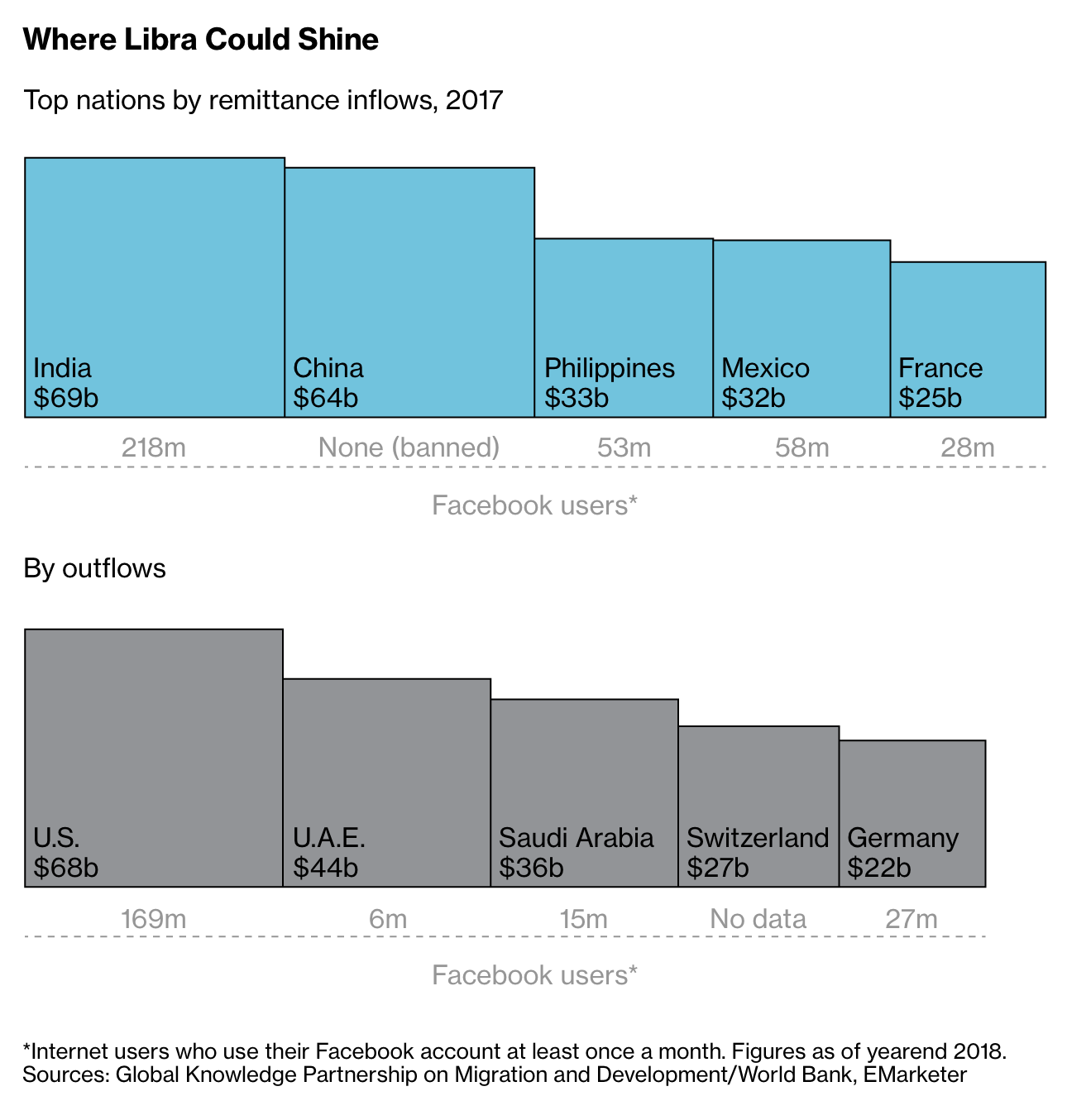

Fintech innovation is no longer dominated by scrappy startups—big tech companies are getting involved. Take Facebook Inc.’s plan to launch a digital currency called Libra in 2020. The social network’s gigantic reach—more than 2.4 billion active monthly users—could draw a much wider audience to Libra than has used previous cryptocurrencies. For instance, global remittances by migrants reached a record $689 billion last year, according to the World Bank. If Libra tapped into even a portion of that, the potential would be huge. So far, policymakers in the U.S. and other major economies are resisting the tech giant’s plan, which could undermine their monetary authority. In August, Bank of England Governor Mark Carney suggested that central bankers could create a digital currency themselves.

Who’s Funding the Revolution?

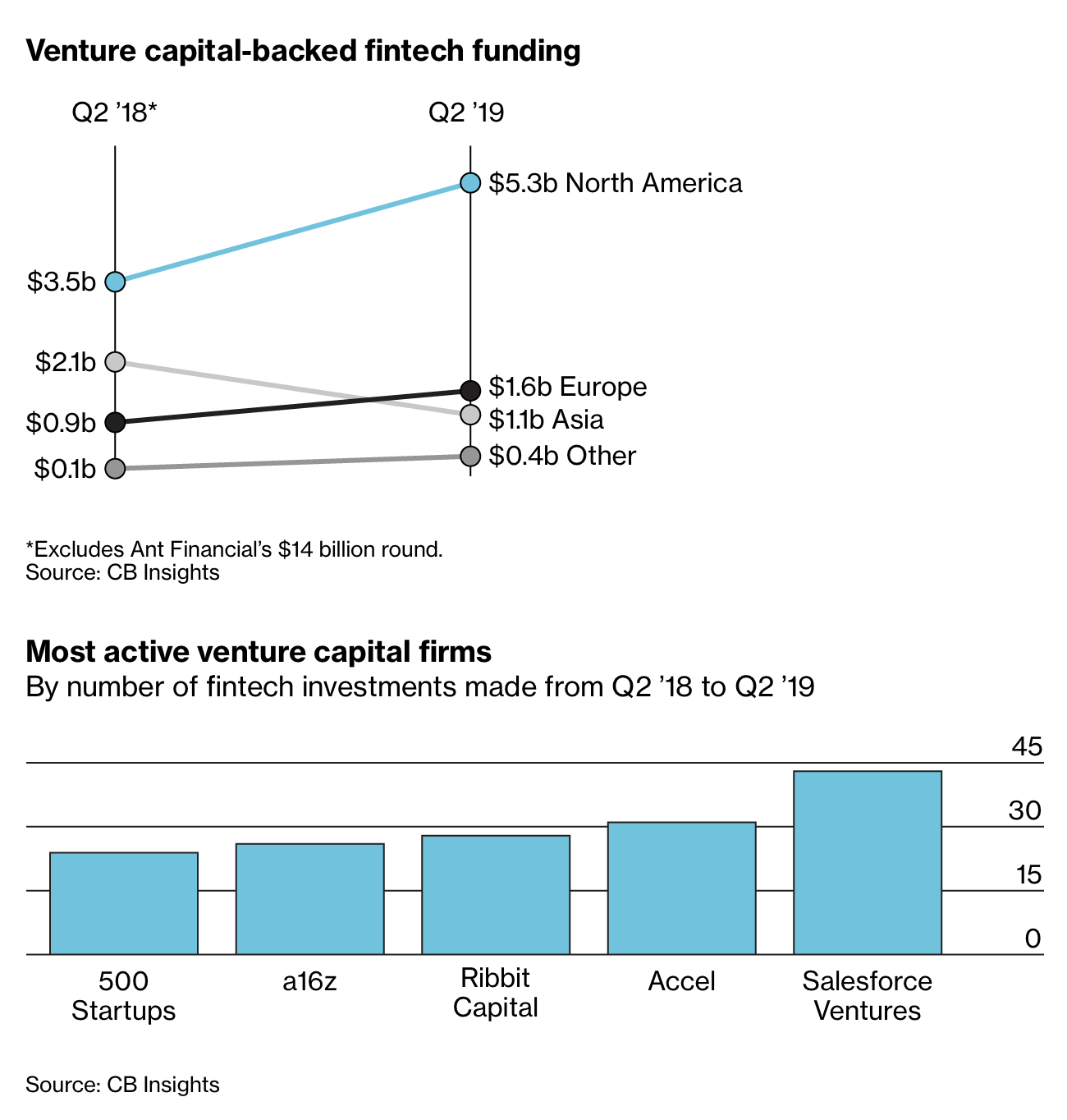

Startups in almost every sector have benefited from a surge in venture capital investment. Fintech is no exception. North America holds the top spot in terms of dollars spent. Some VC firms are making multiple bets on fintech. San Francisco-based 500 Startups staked 43 such companies in the 12 months ended June 30. Some manage funds that specialize in particular areas, such as Andreessen Horowitz’s crypto-focused a16z.

Where the Biggest Fintechs Live

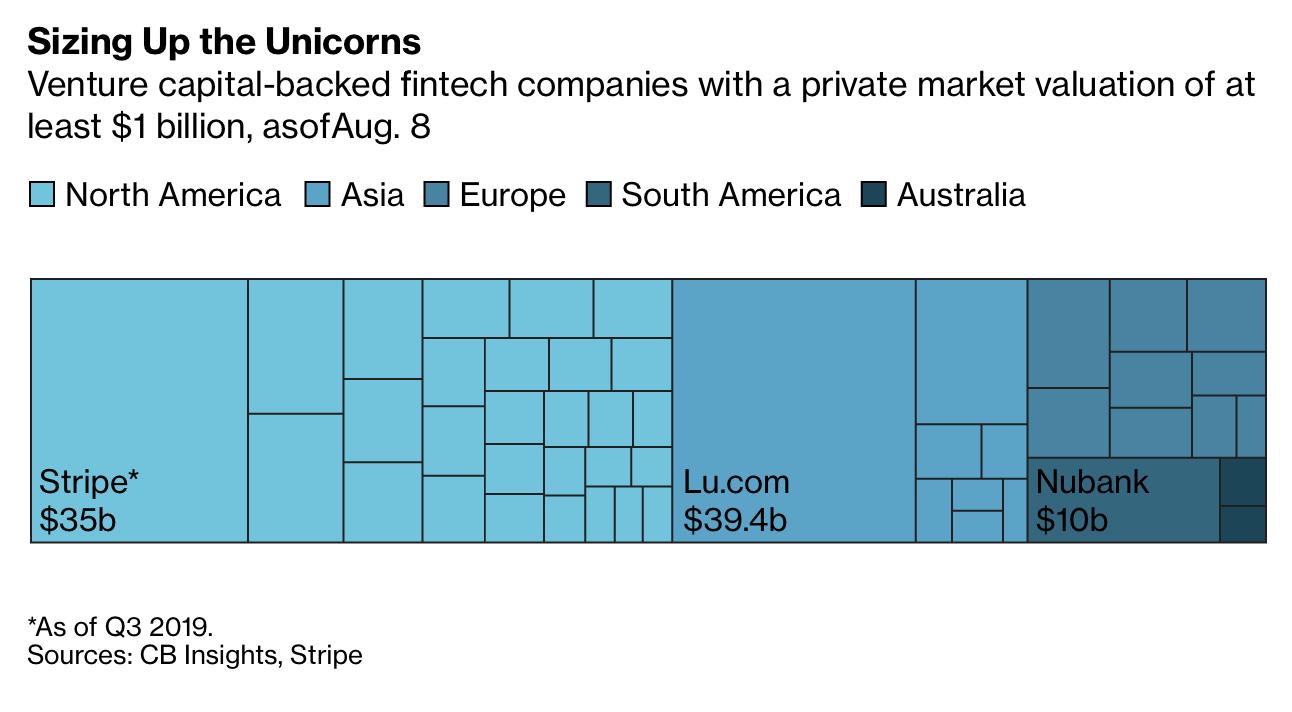

North America, with the most venture capital, is also home to many of the hottest fintechs. Payments startup Stripe Inc.’s $35 billion valuation exceeds that of more than half of the S&P 500’s members. Cryptocurrency platform Coinbase, free trading app Robinhood Financial, digital bank Social Finance, and credit score platform Credit Karma are each valued at $4 billion or more.

In the second quarter, India—home of mobile payments startup Paytm—surpassed China in the number of deals. But China still boasts the most valuable fintech. Lu.com, the wealth management platform backed by Ping An Insurance (Group) Co., was most recently valued at $39 billion.

In Europe and Latin America, 2018 and the first half of 2019 have been good to the digital banks raising new capital. OakNorth, Monzo, and Revolut in the U.K., N26 in Germany, and Nubank in Brazil are among the most valuable fintechs in those regions.

For Wall Street, It’s Innovation by Acquisition

As of August, U.S. banks had already made 24 fintech investments in 2019. The most active were Goldman Sachs, Citigroup, and JPMorgan Chase. Each has looked at deals with startups in a variety of areas, including consumer-facing personal finance applications and data analytics and aggregation capabilities that are deep in the back office. Payments and the capital markets business have driven a lot of the investment by these banks.

Rival banks don’t often invest in the same companies, but in the fintech space it’s not unheard of. Digital Asset Holdings LLC, a blockchain startup, is backed by all three, for instance, while Plaid Inc., which connects bank customers’ data to third-party finance apps, is backed by Goldman and Citigroup. Last year, Goldman acquired Clarity Money, a personal finance website in which Citigroup had previously invested.

Changing Fortunes

Some will go public, others will evolve. Here’s a list of private fintech companies to keep tabs on in 2020.

Stripe

Likely to pursue an initial public offering, joining other payments companies among the most highly valued fintechs. Stripe’s founders are Ireland’s richest entrepreneurs.

Credit Karma

A key question for this credit monitoring service is how many of its more than 30 million weekly users are actually applying for credit cards on the site.

Nubank

This Brazilian challenger bank has raised almost $1 billion since its founding in 2013. Now it has a $10 billion valuation and has expanded into Mexico.

Plaid

You may not have heard of it, but chances are you’ve used it. Plaid helps send information from your bank to any app or service that needs it (think Venmo). Banks don’t love it, but customers do.

Robinhood

The free trading app’s checking account idea ran afoul of regulators last year. It’s since raised more funding and launched a new version, this time after working more closely with D.C.

Silicon Valley Has a Seat at the Table

It’s not just Facebook. Most big tech companies have started dipping their toes into finance. They’ve been strategic, picking businesses that are subject to less regulatory scrutiny than banking and leveraging partnerships with banks. Apple Inc. teamed up with Goldman Sachs Group Inc. on a new credit card and worked with a variety of banks on Apple Pay. Facebook has had dozens of partners to help with Libra, including Visa Inc. Amazon.com Inc. lends millions of dollars to sellers on its platform each month—always through partnerships with banks. Sense a trend?