Remember when every advisor had to build every client's portfolio by hand? It took forever and wasted endless resources. In today's industry, there's an app for that, and it's making early adopters and platform providers alike a lot of money.

Welcome back to the world of outsourced investments, which is hotter than ever this year after Assetmark's triumphant IPO and strong market performance from established companies like Envestnet and SEI. They're on the intersection between finance and technology, or "fintech" as the venture capitalists say.

Valuations are aggressive for a reason. These companies price above 4X revenue and bidding starts at 30X earnings because they're growing faster than traditional low-tech financial counterparts. The slow ones are expanding their AUM 10% a year.

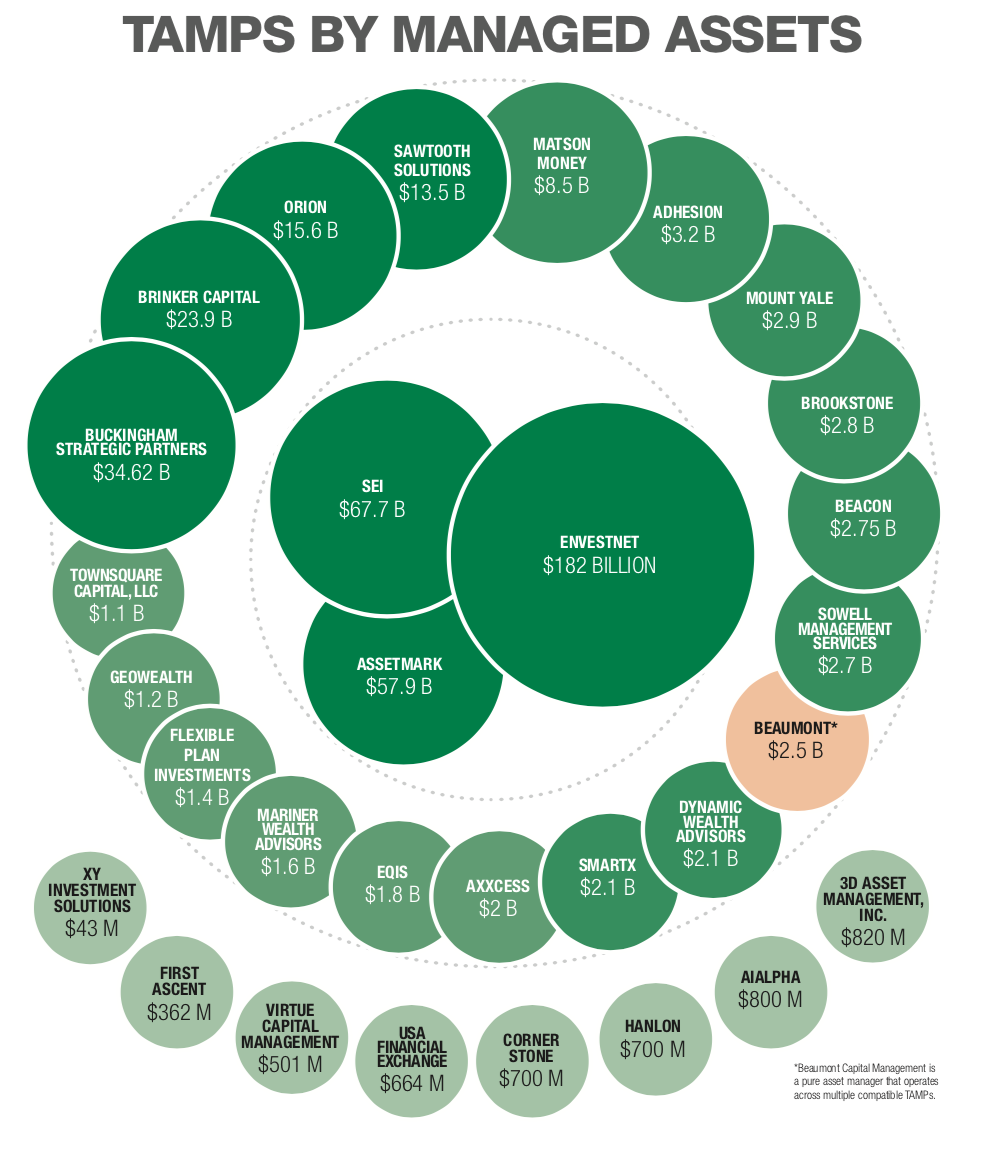

And there's a lot of AUM here. We profile about 30 of the most exciting portfolio providers and platforms in this year's America's Best TAMPs guide, which you can download HERE.

They collectively support about $500 billion in client assets. That's two and a half Warren Buffetts. Only the biggest fund complexes, custodians and wirehouses can compete with that combined market footprint.

That’s not a niche market segment or a fringe technology for people who love computing for its own sake. This is as close to the status quo as it gets without hitting State Street or Schwab Ameritrade scale.

At the most elemental level of AUM, the turnkey asset management program (TAMP) has finally arrived as an alternative to traditional methods of building the client portfolio. If you’re not engaged with these systems, odds are good now the decision was deliberate and not a matter of never hearing the message.

You know how these systems work now. Any advisor with ambition can outsource the portfolio to outside managers and focus on other aspects of the business like prospecting new accounts and keeping existing clients happy.

It's a way to scale for growth without investing more time than you have on squeezing a few basis points of outperformance out of the same stocks as everyone else. And that's where it gets exciting. As the TAMPs have layered additional business functions around the portfolio, you can provide more for your clients than they'd get anywhere else.

The message is out there. The power of the approach is clear.

It’s up to the vendors to make the case that their platform is the perfect fit for your practice. And that’s where this year has already gotten extremely interesting.

Wall Street’s ocean turns red

Wall Street’s ocean turns red

When asset prices stop giving AUM a natural lift, most advisors delay strategic decisions in order to focus on riding the storm.

We’re seeing that. Four out of five of our readers tell us they’re diverting behind-the-scenes technology budgets to initiatives that directly feed client satisfaction and retention.

They’re hesitant about chasing growth even though there’s clearly blood in the water. Maybe they’ll stop playing defense when the market mood calms . . . months or years from now.

In the meantime, it takes confidence to rock the boat knowing your choices will either land big fish or sink you outright.

The elite $500 billion Wealth Advisor club of TAMP providers is dealing with these dynamics too. When the ocean turns red, their scale almost ensures that they’re the ones nursing wounds. Some retreat. Others press the attack.

They’re eating the industry’s lunch. And on a larger level, the TAMPs looking to grow in 2020 and beyond are looking for weak swimmers.

You don’t have to be the biggest or even the best platform around. All you need is to be a little better than someone else.

And there's nothing stopping you from becoming a provider as well as a consumer. Many of the firms we profile this year are new to the industry. They have less AUM on the platform than you do.

What they have is a differentiated competitive proposition and the ambition to back it up. They're fighters. They're open to the idea of partnering with venture capitalists to take their businesses to the next level.

After all, add a little technology to the market math and suddenly the dullest brokerage or fund company is worth a lot more. It dazzles.

Consider how hot robot investing is. Silicon Valley understands the investment proposition. These companies are the disruptors. You can be a disruptor or at least get disruption on your side.

The alternative is getting disrupted. Nobody wants that for themselves. And in the meantime, every $1 billion rivals can carve off the giant is practically a feast. These accounts are transformational in terms of scale, worth chasing.

Platform and product, scale and service

Platform and product, scale and service

When times are good, technology is the sizzle that entices prospects onto a platform. Provide a few differentiated tools (at a discount or even at a loss) and sooner or later you’ll get a chance to sell a deeper relationship.

But when fees are racing to zero, you want to add value for both your clients and ultimately internal stakeholders. Mutual fund revenue is dropping at an alarming rate. TAMP revenue is expanding. This is the future.

And it keeps the advisor at the center of the relationship. Put yourself in your client’s position for one moment. Which aspect of your operation matters to them?

They don't care about your process or your profit margins. But for a potential merger partner, these considerations are the entire conversation.

Look at BlackRock. We admire their size but I wouldn’t tell anyone to buy the stock right now when Fidelity and Vanguard have crashed expense ratios for all but a handful of prestige players.

Most of the TAMPs we profile this year are prestige players or want to be. Curated platforms. Startups with innovative ideas. These are the big fish of tomorrow. The future will be won by better ideas.

This year’s edition of America’s Best TAMPs is ready for download HERE.