Coronavirus has affected everyone in the UK, but not everyone has been affected in the same way.

This is starkly apparent when it comes to money. Eight million people are on furlough, receiving 80% of their normal pay from the government’s job retention scheme, while thousands more have been made redundant.

Many self-employed individuals and business owners are likewise under extreme financial pressure because of the lockdown.

But for others, the coronavirus has been a very different experience. Millions have been able to work from home on full pay but with significantly reduced outgoings – no commuting, no expensive coffees or sandwich shop lunches, no dry cleaning bills.

With shopping and entertainment options severely curtailed, general spending has dropping dramatically. According to pollsters YouGov, 1 in 6 people have been able to add to their savings, while 1 in 10 have managed to pay of their debts.

Perhaps not surprisingly, white collar professionals have been better able to improve their finances. Those in manual occupations are more likely to have continued going into work rather than working from home and enjoying the associated cost savings.

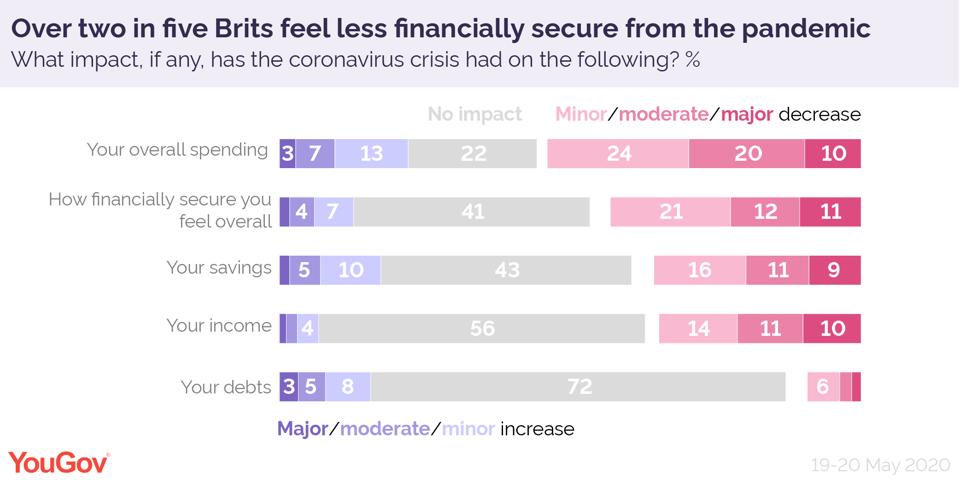

Worryingly, YouGov found that 36% of Britons have dipped into their savings to meet their bills during the pandemic, with 44% feeling less financially secure as a result of the crisis.

Additionally, 16% have reported that their debts have gone up, while over a third (35%) have reported that their incomes have decreased.

Government intervention

The financial situation for many people would undoubtedly have been worse had it not been for swift intervention by the government on an unprecedented scale.

The job retention scheme, originally due to run until the end of July, has been extended until the end of October – although from August employers will be expected to contribute towards the cost.

Businesses are also able to access a range of loans underwritten in full or in part by the government, including the Bounce Back Loans Scheme and the Coronavirus Large Business Interruption Loan Scheme, where the maximum loan size was increased from £50 million to £200 million earlier this week.

Additional funding has also been made available to large corporations by the Bank of England.

Other government measures include the Self Employment Income Support Scheme. However, at present, this only provides payments to cover the months of March, April and May, and there has been no suggestion that it will be extended in the same way as the job retention scheme.

Mortgage payments holiday

The government is planning to extend its mortgage payments holiday initiative, whereby banks and building societies are instructed to allow borrowers to miss repayments on the understanding they will make up the accrued capital and interest debt over the rest of their loan.

The scheme was originally due to run until 20 June 2020, but under propoals expected to be rubber-stamped this week, those who have already taken payment holidays will be able to apply for an extension of up to three months, while those who have not yet applied will be able to do so until 31 October 2020.

UK Finance, which represents lenders, says 1.82 million mortgages were subject to a payments holiday as of 20 May – roughly 1 in 6 of all mortgages.

The three-month payment holiday for credit cards and other credit-based products is under active review – we may hear more on that from the Financial Conduct Authority in the coming days.

Impact on motoring

One area of the economy that has seen a huge contraction is motoring, from car sales to fuel consumption.

The number of new car registrations collapsed in April, the first full month of the lockdown, falling 97.3% year on year, from 161,064 in 2019 to 4,321 in 2020.

The restrictions imposed by the lockdown inevitably led to most people driving less or not at all, which had a knock-on effect on sales of petrol. The reduction in supermarket pump prices to below £1 a litre earlier in May was a clear indicator that supply was well ahead of demand.

Research from Lloyds Bank suggests fuel spending in April was down 58%, while day-to-day commuting expenditure was 86% lower.

Online car retailer CarWow reckons more than two fifths of Britons have spent less than £10 on petrol during the last month, with a third purchasing no petrol at all.

Vix Leyton at CarWow, said: “After more than two months in lockdown, the idea of a regular petrol station top-up no doubt seems like a distant memory to the millions of British motorists who’ve not needed fuel - or perhaps even driven - for weeks.”

With some of the lockdown restrictions beginning to easy, Leyton suggests now might be a time to fill up: “For those wanting to take advantage of low pump prices, now is arguably the time to do so - providing you can do so safely - before lockdown measures are eased even further and long queues begin forming.”

Bike use - and thefts - on the up

Another effect of the lockdown has been an rise in the number of people cycling for their permitted daily exercise, but a consequence of this has been an increase in the number of bicycles being stolen.

David Fowkes of insurer Admiral said: “Several cycle retailers have reported that they’ve sold out of many models. We’ve seen a 46% increase in the number of bicycle theft claims over the last seven weeks compared with the same period in 2019. That’s incredible when you consider that overall theft claims have fallen during the lockdown as people have stayed at home, deterring burglars.”

Admiral won plaudits in April when it became the first UK insurer to give a cash rebate (£25) to all its car insurance policyholders. Only LV has made a similar pro-active gesture, leading the Financial Conduct Authority to impose a package of measuresthat require insurance companies to provide support to customers in financial distress as a result of the pandemic.

Energy bills

With more people working from home and staying at home in line with government stipulations, there has been an increase in domestic energy consumption, with comparison site Compare the Market suggesting annual bills could rise by £400.

However, global demand for energy has reduced sharply, with factories and offices mothballed and travel services limited.

Stephen Murray, energy spokesperson at MoneySuperMarket, says cheaper domestic energy deals are available as a result: “A cocktail of factors have come together to make this is a great time to switch supplier.

“There’s been a major drop in the wholesale element of domestic energy prices of nearly 40% - something partly explained by oversupply in the market due to declining business energy usage as a result of the coronavirus crisis.”

As economies gradually emerge from lockdown and energy demand increases, there is likely to be an impact on prices in the opposite direction.

Tips to keep your finances in shape

Here’s a to-do list for anyone wanting to save money and get their finances in the best possible shape:

- Compare energy prices: use a comparison site to see if you can save money by switching. If you’ve never switched or haven’t switched for two or three years, there are likely to be cheap fixed rate deals available

- Talk to your insurer about saving money: the regulator has told car and home insurance companies to help customer whose finances have been harmed by coronavirus, but it’s up to you to contact them to discuss the options, such as reducing the estimated annual mileage on your car insurance and getting a premium refund

- Don’t automatically renew insurance: whenever a car or home insurance policy comes up for renewal, run a quote on a comparison site to see if there’s a better deal out there

- Get the best broadband deal: check you’re on the best deal, especially if you’re working from home or using streaming services more than usual. You need the best combination of speed, capacity, reliability and price. See if your existing service provider can improve its offer

- Talk to your lender: if you have debt, such as a mortgage, personal loan, credit card balance or car finance, and you are struggling to meet your repayments, talk to your lender to see what options are open to you. Don’t be tempted simply to stop making payments as this will have a long-term effect on your financial record.

If you are in financial distress as a result of the pandemic, or it has made your situation worse, contact a debt charity such as National Debtline or Stepchange for advice and support.

This article originally appeared on Forbes.