(The Street) - Windows - Funny how perception evolves. Sometimes it takes a lifetime. Sometimes it seems like a flash.

"There are things known and there are things unknown, and in between are the doors of perception." -- Aldous Huxley

Sometimes, the man in the darkened window can't wait for me to get to my office at zero dark thirty, ready to talk out the day's events, as much as the events of the day prior. Other days, the man in the darkened window toils quietly, head down, almost hoping that I won't start an early morning conversation meant for no one else. Today is one of those days.

I look at the man in the window, ready to speak. He pretends not to notice. Such is life. Thanks, Steve. See you tomorrow. I guess.

President Biden renominated sitting Fed Chair Jerome Powell to the same position on Monday. This was at first well taken by financial or more specifically, equity markets. It was Powell who worked so well with former Treasury Secretary Steven Mnuchin to literally prevent the U.S. economy from falling into outright and immediate "depression" at the onset of the pandemic through the most aggressive and pervasive injection of liquidity across all required levels in monetary history.

The close cooperation and intersection of monetary policy with a deliberate extension of fiscal power, bolstered all budgets from the federal on down to the household. All while keeping the lines of both commerce and transaction as open and as available as possible. In addition, it is also well known that should, God forbid, another crisis arise prior to unwinding the impacts of this most recent shock, that Powell gets along both personally and professionally with current Secretary of the Treasury and former Fed Chair Janet Yellen.

The president also nominated current Federal Reserve Board Governor Lael Brainard, the only registered Democrat currently serving on that board, to serve as the 22nd Vice Chair of the Federal Reserve Bank. Assuming confirmation by the U.S. Senate, Brainard would succeed Richard Clarida whose term as a Federal Reserve Board Governor expires this January.

Beyond these two nominations, the Fed's seven-seat Board of Governors already has one vacancy in addition to the departure of Clarida, and the expected retirement at year's end of Randal Quarles, whose term as a governor does not expire for another decade, but was not renominated upon the expiration of his term as Vice Chair for (Banking) Supervision.

This leaves the president with a wide open opportunity to remake the Federal Reserve Board of Governors as he sees fit, and to strengthen banking regulation significantly, as it is expected that one of his three expected coming nominees would be chosen for that post. In addition, the incoming Vice Chair has in the past opposed the easing of capital and liquidity requirements for U.S. banks, even at a time of national/global crisis.

Doors

We know that Fed Chair Jerome Powell, outside of the impacts of pandemic, wants to normalize policy. This is what put him at odds in 2018 with President Trump who had originally elevated him to that position for political purpose. Powell's aggression at that time nearly put the economy into recession. That was then. There is no doubt that he and his FOMC were magnificent throughout the pandemic.

That said, consumer-level inflation is now, after all of that joint fiscal/monetary accommodation, after some overt errors in energy-based domestic policy made early on in the Biden administration, and after global supply chains kinked up due to pandemic issues, at 31-year highs. Powell's Fed has now moved toward the methodical removal of the regular addition of increased liquidity.

Though several members of the FOMC have stated often that removing new accommodation does not equal any liftoff in short-term rate targets, several officials, including the (expected) outgoing Vice Chair have appeared to back the acceleration of this tapering of monthly asset purchases, probably to be announced at the December policy meeting.

While I myself do see the currently very hot pace of consumer-level inflation as peaking, and as an economist, I do see the annual pace of that inflation noticeably cooling (pandemic impact pending) perhaps as soon as the second quarter of 2022 (and that would make me an ally of the Fed at this time), I also see the clear possibility that I and others might be wrong and therefore must agree with the need to be in a flexible position as soon as possible. This economy is just about ready (new fiscal spending pending) to try something close to free market pricing for Treasury securities, and the removal of regular purchases of mortgage-backed securities is actually almost a full year late (I have been quite vocal on this).

The Future

This is just my opinion, but I think the next Fed is going to have a tough road ahead. While the Fed has always had to work towards fulfilling its twin mandate of trying to achieve price stability, while working toward maximum sustainable employment, this push-and-pull mandate must be balanced in such a way that fosters economic growth. In a normally functioning free-market economy, allowing that this economy has been warped to some degree for quite some time now, an independent central bank must make choices that either focus on controlling consumer-level prices or improving labor conditions.

This next Fed, while at least going through the motions of getting the economy back to such a place, will also face pressures and perhaps even an adjusted mandate that adds such issues as inequality and climate change to what must be addressed. I do not think that the central bank currently has the tools to address issues beyond their current mandate, but this bears close watching as responsibility for these issues has historically resided within the executive and especially the legislative branches of government. Assigning the Federal Reserve responsibilities extending beyond the adjustment of monetary policy creates an unknown that I do not think we can assume outcomes for.

The Fed will also have to rehabilitate its reputation after a small number of Fed officials appear to have traded for their own accounts while holding power over policy, which is just completely beyond what is comprehensible. The mailroom clerk at any Wall Street brokerage firm appears to have been more restricted in what he or she could or could not do for themselves without being called on the carpet.

Then we'll get to the digital dollar at some point. When? I don't know. The Chinese have already gone there. India has tried to go cashless. It is in the best interest of a fiscally starved federal government to be able to track and tax all transactions, so we will go cashless at some point. That will also be the day that a surcharge is imposed on all savings accounts as the lockbox under your bed will have become obsolete. Hence, I may have gone too far. Yet, we all know, that too far is precisely where "things" are headed.

Markets

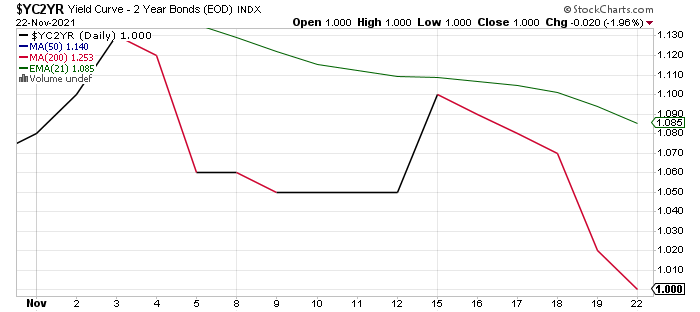

Equity markets, at first rejoiced at Powell's renomination. Treasury markets took it in the teeth, most significantly right in the middle of the yield curve with the 2-Year through 7-Year Notes suffering the most severe pressure with slightly less selling pressure on the long end. Later in the day, Treasury Secretary Janet Yellen appeared on CNBC and said, "Over the long run, the Fed needs to play an important role to make sure that (inflation) doesn't become endemic." Yellen added, "I know that he can be counted on to do that."

Though Yellen didn't really say anything disruptive, the suggestion that her friend Powell could be trusted to rein in inflation was enough for high-speed, keyword-reading algorithms to seize the day from the early morning to midday bulls, and try to force some downside overshoot.

What markets have been trying to price in, especially debt, currency and certain commodity markets even more than equity markets, is when that first short-term rate hike actually hits the tape. You saw the U.S. dollar resume its surge on Monday. You saw both Gold and Bitcoin fall out of bed. Futures trading in Chicago are now pricing in a 75% probability of a first increase being made to the target for the Fed Funds Rate at the June 2022 meeting, with a nearly 50% (47%) chance of that first hike being moved up to May.

Obviously, just the thought of higher rates has been disruptive to growth-type stocks. The Dow Jones U.S. Internet Index gave up 2.3% for the session on Monday. The Internet as an industry is housed under the Communication Services sector. That SPDR ETF ( XLC) surrendered 1.2% itself.

The Technology sector select SPDR ETF ( XLK) backed up 1.1% on Monday, led lower by the Dow Jones U.S. Software Index (-2%), and the Philadelphia Semiconductor Index (1.7%). The broader sector was not down as much because telecom was hot, and telecom equipment providers are housed under technology. Financials ( XLF) , at +1.4%, did well as the yields in general moved higher despite the fact that the belly of the yield curve actually flattened on the day.

Check this out.

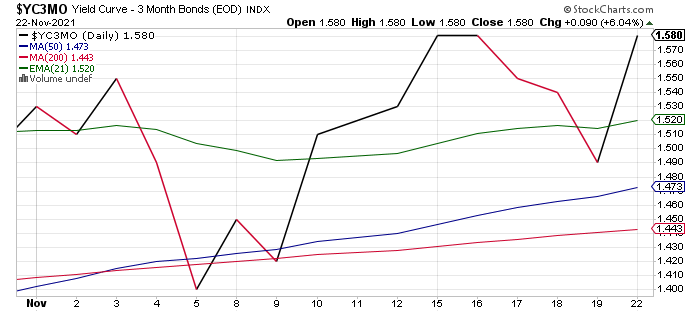

While the 3-Month/ 10-Year yield spread has done this in November:

The 2-Year/10-Year yield spread has done this:

Seems healthy to you?

Breadth

Losers beat winners at both of New York's primary equity exchanges on Monday, decisively so at the Nasdaq.

Aggregate trading volume increased on Monday from Friday at both exchanges, while advancing volume comprised 53.5% of the composite for NYSE-listed names (where most of the big banks and big oil firms are listed), but just 36.9% of the composite for Nasdaq-listed names. That's where most of your semis, software, and internet names live.

Hypersonic Weapons

Do we even have time and space for this today? At least what I have been pounding the table on for something like two years now has finally been confirmed by someone in authority. U.S. Space Force General David Thompson said, "We're not as advanced as the Chinese or the Russians in terms of hypersonic programs." Duh. Was I talking to the wall all this time?

Now, suddenly, the Pentagon wants to pour money into Northrop Grumman ( NOC) , Lockheed Martin ( LMT) , and Raytheon Technologies ( RTX) in the hopes that the Army can field defensive hypersonic weapons by 2024, and the Navy can arm destroyers with such defensive weapons by 2025 and submarines by 2028. Meanwhile, the Russians have already successfully tested weapons that could be used offensively, and the Chinese now have hypersonic missiles that can not only fly around the world at five-plus times the speed of sound but also fire secondary missiles of their own, perhaps as decoys meant to confuse our much slower, much less maneuverable defenses.

Folks, we have a problem, and nobody in D.C. is paying attention. We are not the world's military superpower if our "near peer" adversaries are ahead of us in the arms race, and now have indefensible weapons that can hit us anywhere, anytime. Wake up. This has to be the fiscal priority, above all else, and above even current defense spending programs.

Does anyone really think a lot of F-35 pilots are going to see air-to-air combat? Does anyone really think in light of these recent developments that such concepts as aircraft carrier groups are not sitting ducks?

The way to defend ourselves while we develop missiles as fast and maneuverable as already possessed by our adversaries has to be found in areas where we may still have a technological lead. Think software, think the cloud, think artificial intelligence. Just think, darn it. The way to stop these missiles for now, has to be found in taking away their control after launch. Now, Washington, get this done, you worthless pukes.

By STEPHEN GUILFOYLE

Tue, November 23, 2021