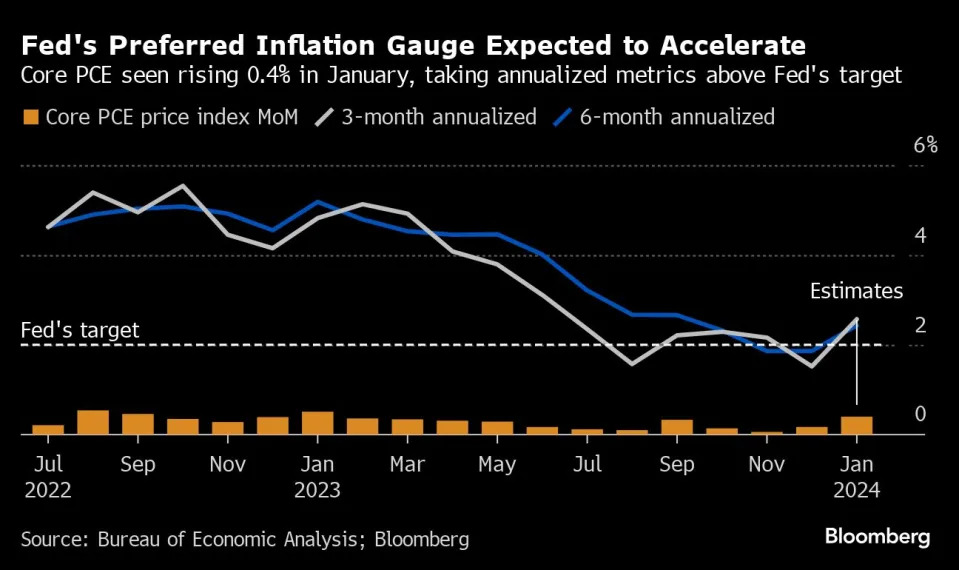

(Bloomberg) - Underlying US inflation probably rose in January by the most in a year, as tracked by the Federal Reserve’s preferred metric, highlighting the long and bumpy path to taming price pressures.

The core personal consumption expenditures price index, which excludes food and energy costs, is seen rising 0.4% from a month earlier. That would mark the second straight monthly acceleration in a gauge that’s largely been receding over the past two years.

And when annualizing the data on a three- or six-month basis, both would rebound above 2% after dipping below the Fed’s target in December.

Fed officials have stressed they’re in no rush to lower borrowing costs and will only do so once they’re confident that inflation is retreating on a sustained basis.

The PCE data, due Thursday, will likely validate that stance and possibly further diminish market expectations for an interest-rate cut in the coming months.

For more, read Bloomberg Economics’ full Week Ahead for the

Also due are the US government’s second estimate of fourth-quarter growth, durable goods orders, and the Institute of Supply Management’s manufacturing gauge for February. January figures for new- and pending-home sales will give the latest readout on the housing market, while the Conference Board and the University of Michigan will release separate measures of consumer sentiment.

What Bloomberg Economics Says:

“The stage is set for monthly PCE inflation to jump following hot CPI and PPI reports. While that certainly won’t put the Fed at ease, we think policymakers will largely look through the January increase. Temporary factors — including residual seasonality and the increase in prices of portfolio-management services — serve as critical drivers behind the January increase. Similarly, some of the expected gain in personal income comes from cost-of-living adjustments and an unsustainably high nonfarm-payroll print.”

Looking north, Canada will publish its growth data for the fourth quarter, for which preliminary numbers last month pointed to a rebound.

Elsewhere, crucial inflation reports from the euro zone, Japan and Australia will also keep investors busy, while Group of 20 finance ministers and central bankers are set to meet in Sao Paulo from Wednesday.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Asia

Central banks in Australia and Japan will get fresh inflation data that may either spur or diminish policy pivot bets in different directions.

Australia’s CPI is seen inching up to 3.5% year on year for January, a pace that would still be slow enough to sustain speculation over a rate cut by the Reserve Bank.

Japan’s January consumer inflation excluding fresh food may slow to 1.8%, dipping below the Bank of Japan’s 2% target for the first time since March 2022, but don’t be fooled: base effects are expected to trigger a resurgence in February, keeping the bank on track to end the negative rate in a month or two.

The Reserve Bank of New Zealand is expected to hold its official cash rate at 5.5% on Wednesday as inflationary pressure eases.

Among other statistics, India’s gross domestic product growth is seen slowing to 6.7% in the fourth quarter from a year earlier, while Taiwan’s economy probably expanded by about 5.1%.

An Indian government report this weekend showed that household spending has more than doubled in over a decade with discretionary items getting a larger share of expenditure.

On Thursday, Australian retail sales and capex may rebound a tad, while trade figures are due in Thailand.

The week closes with South Korean exports, which will have been skewed by the Lunar New Year holidays.

The same goes for China’s PMIs. Official data are forecast to show a slight improvement in factory activity, while the Caixin manufacturing gauge may hold mostly steady. The big question is will authorities adopt measures to support stocks, or wait until the NPC the following week?

-

For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

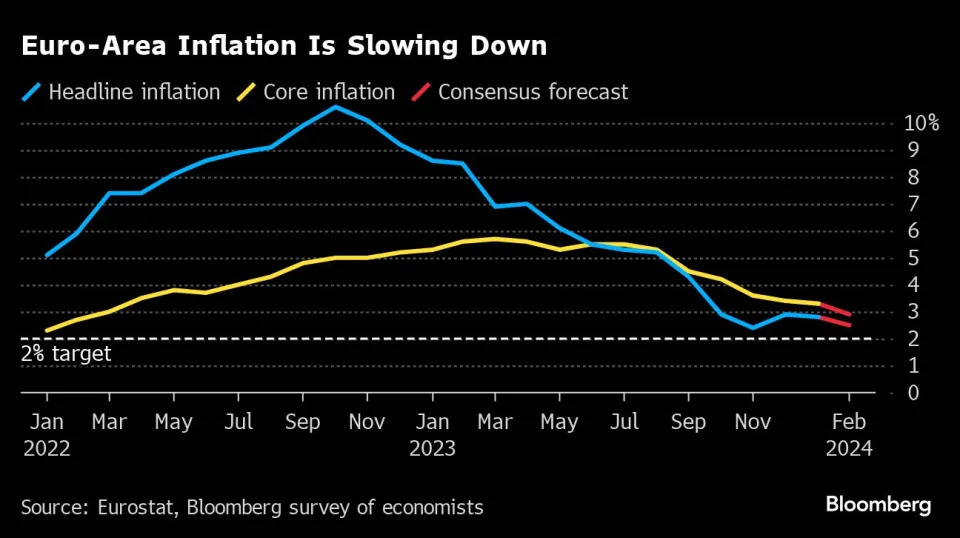

Inflation in the euro zone will be a highlight in what’s going to be a big week for gauging the strength of global price growth.

Friday’s report will land along with Italy’s at the end of a 24-hour flurry of releases from around the region, with France, Spain and Germany all scheduled to publish national gauges on Thursday.

Economists anticipate the overall euro-area outcome at 2.5%, marking some - but not enough - progress toward the 2% goal. Similarly, the underlying measure that strips out volatile elements such as energy is expected to weaken to 2.9%.

Those numbers will be pored over by European Central Bank officials before their March 7 meeting. They’ll enter a blackout period on Thursday in advance of that decision. Before that kicks in, ECB President Christine Lagarde speaks to European Union lawmakers on Monday.

-

For more, read Bloomberg Economics’ full Week Ahead for EMEA

Elsewhere in Europe, GDP reports in Switzerland, Sweden and the Czech Republic may draw attention. The UK has a quieter week, with mortgage numbers among the highlights.

Bank of England policymakers including Governor Andrew Bailey will be out in force Monday and Tuesday at the central bank’s research conference, known as BEAR. Chief Economist Huw Pill, whose most recent comments suggested a rate cut is still months away, caps off the week with a speech at Cardiff University on Friday.

There are also some rate decisions scheduled this week in the wider region:

-

On Monday, Israel’s central bank may again cut borrowing costs, though some economists expect officials to stay on hold to protect the currency.

-

A day later, Hungary’s central bank will set the pace of easing as the first split emerges among policymakers after eight years of unanimity, amid pressure from the government to add more stimulus.

-

Also on Tuesday, Nigerian officials hold their first rate meeting since an overhaul of the central bank’s leadership. The monetary policy committee is widely expected to sharply raise the benchmark rate to rein in the fastest inflation in almost three decades.

Latin America

In a busy week, four of the region’s big economies report unemployment figures for January. Labor markets in Brazil and Mexico are at historically tight levels, whereas those in Chile and Colombia are closer to their long-term levels.

Mexico watchers will be on high alert for any shifts in Banxico’s outlook for inflation and growth in its quarterly inflation report on Wednesday, with the central bank still on hold a year after its last hike.

In Chile, the end-of-month data dump of seven separate indicators may include signs of green shoots in January GDP-proxy data.

Brazil’s mid-month reading on consumer prices and its broadest measure of inflation should both continue to tick lower, more than enough to keep the central bank easing at its March meeting.

Consumer prices in Peru’s mega-city capital of Lima may have picked up slightly in February from January’s 3.02% reading. Analysts surveyed by Bloomberg expect inflation to be back in its target range of 1% to 3% as soon as next month.

Output data from Brazil may show that the drag from double-digit borrowing costs brought growth in Latin America’s biggest economy to a standstill in the fourth quarter.

-

For more, read Bloomberg Economics’ full Week Ahead for Latin America

(Updates with ECB, BOE in EMEA section)

By Molly Smith and Craig Stirling

With assistance from Monique Vanek, Paul Wallace, Paul Richardson, Robert Jameson, Vince Golle, Laura Dhillon Kane, Piotr Skolimowski and Brian Fowler