(Dynamic) At the Fed press conference, Chairman Jay Powell mentioned he didn’t believe the economy was in a recession, pointing to a strong labor market. Given that employment is arguably the most important measure of economic performance, I tend to agree with the chairman; there is more ammunition than just low unemployment and job market strength. Other favorable factors impacting the economy include:

- Consumer Spending: Retail sales rose 1% in June, slightly beating estimates, despite the continued high inflation, according to the Gross Domestic Product, Second Quarter 2022 This points to continued strength in consumer demand, particularly within services (such as spending at restaurants as we return to a post-Covid normal), and resilience in the face of rising interest rates and inflation.

- Business Spending: Also in the GDP report, while there were declines in corporate spending on physical equipment and structures (perhaps due to higher borrowing costs), there was strong growth in the investment of intellectual property such as software and research and development—things typically related to improvements in operational efficiencies (cost reductions) and future earnings growth.

- Government Spending: According to the report, while overall spending fell due to a reduction in pandemic stimulus payouts, defense spending, a relatively large portion of overall spending, grew by 2.5% as military aid continued to flow to Ukraine.

- Corporate Profits: With about 56% of S&P 500 companies reporting second quarter results, 73% reported a positive earnings surprise and 66% a positive revenue surprise. The blended earnings growth rate for Q2 is currently at 6% and revenue growth is at 12%. While growth may be slowing from the strong levels we experienced last year, it would appear that companies are still growing their profits based on FactSet data as of July 29, 2022.

- Industrial Production: According to the Board of Governors of the Federal Reserve System, industrial production, which measures the inflation-adjusted value of manufacturers, mines and utilities, had a year-over-year growth of 4.2% through the end of June, a slight reduction from the previous month, but staying above its historic average. Meanwhile, according to the latest Manufacturing ISM® Report On Business®, manufacturing’s Purchasing Managers Index (PMI), a gauge of economic activity in the manufacturing sector, grew in July for the 26th consecutive month with a positive reading of 52.8%, indicating an expansion in the overall economy.

Stock Market Performance Around a Recession

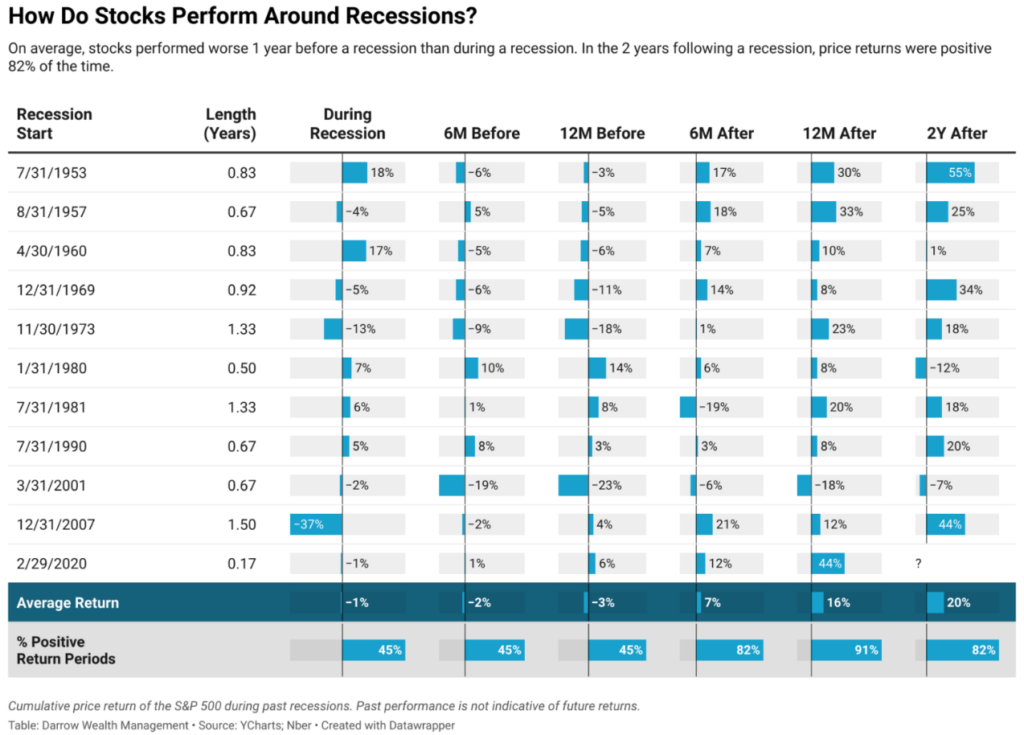

If we did enter into a recession (or are currently in one), what implications would it have for the stock market? The chart below, “How Do Stocks Perform Around Recessions?” helps answer that question. Key takeaways:

- Looking at the “Average Return” row: A recession itself doesn’t necessarily signal bad performance, although the six to 12 months prior to a recession tend to be lower, leading to the notion the stock market is actually a leading indicator to a recession by about six to 12 months. Note: Time periods coming out of a recession (columns 6M After, 12M After, 2Y After) tend to be a great opportunity for the market.

- Looking at the “% Positive Return Periods” row: This row points to the notion that it’s difficult to time the market regardless of the relationship to a recession, given that prior to and during a recession the market is still up almost half the time. Thus, reinforcing the concept that it’s always best to stay invested. That said, after a recession, the market probabilities are generally skewed in favor of investors.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team.