As January came to an end, the stock market found another victory with a third consecutive month of positive returns as the S&P 500 gained more than 1%. The stock market had a nice runup in the two weeks leading up to the Federal Reserve (Fed) meeting on Jan. 31, 2024. As expected, there was no rate change at this meeting. Unfortunately, the market had a negative reaction as Fed Chairman Jerome Powell announced that they may not be comfortable enough to cut rates in March. That said, he did add that we’re likely at the peak of the tightening cycle and reinforced that rate cuts would likely begin this year. The question remains as to when.

In other news, we found out that the U.S. economy is still quite strong:

- Purchasing Managers Index (PMI): PMI is a monthly survey of purchasing managers across various industries within manufacturing and services sectors, designed to measure the potential direction of economic trends. A reading above 50 indicates expansion, and below is contraction. January U.S. PMI, as reported by S&P Global, had a surprise jump to 50.3 for manufacturing, well above expectations. This is also the first expansionary reading since April 2023 and the highest reading since October 2022. This may be a sign that the manufacturing portion of the economy is starting to stabilize. Additionally, services PMI strengthened to a seven-month high while also beating expectations in expansionary territory at 52.9.

- Gross Domestic Product (GDP): GDP is the total value of all goods and services produced within a country and is perhaps the best gauge of economic health. Fourth quarter GDP growth, as reported by the U.S. Bureau of Economic Analysis, came in at an annualized 3.3%, well above expectations of 2.0%. This marks the sixth consecutive quarter of U.S. economic growth over 2.0%, despite the headwinds of higher interest rates. While growth may moderate in 2024, it’s reassuring to see these strong numbers, supportive of a “soft landing” scenario for any potential recession.

As inflation moderates, economic growth remains strong and the Fed maintains interest rate cuts are on the horizon, investors could see continued support within both stock and bond markets.

Investing at Market Highs

The S&P 500 isn’t just off to a great start in 2024, it has reached a record high in January for the first time in two years (since January of 2022). This officially means the index is in “bull market” territory, given it is measured from trough to peak when a new record high is set. From the low point (trough) set on Oct. 12, 2022, to the most recent high (peak) on Jan. 30, 2023, the market has been up more than 36%.

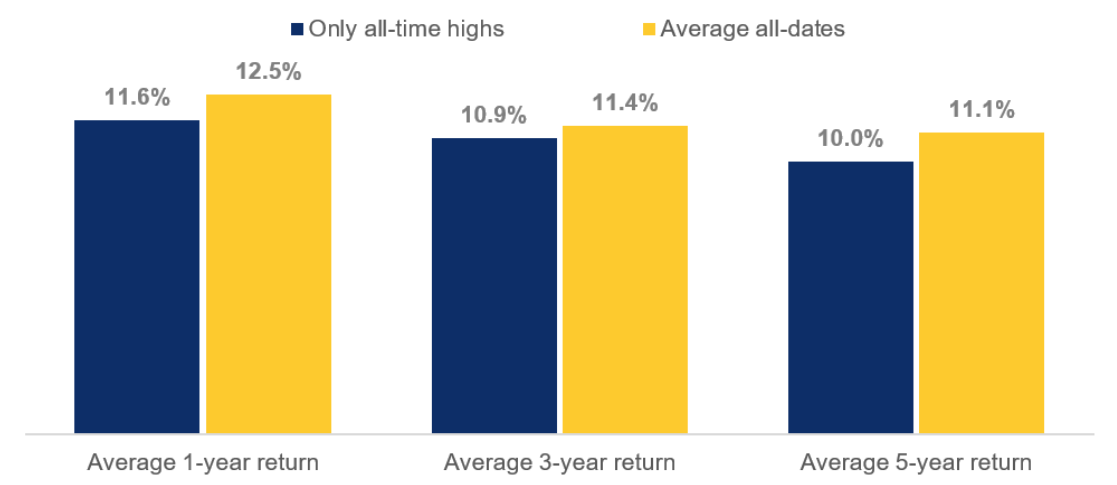

Seeing a return of this magnitude and the market continuing to set new highs may give some investors pause. Investors start to ask, “Is this the right time to be adding money into the stock market? Should I be on the sidelines until there is a pullback?” The chart below, “Investing at All-Time Highs vs. All Dates,” provides some answers:

- Only Invest at All-Time Highs: Investing at all-time highs has a component of fear and emotion behind it, but it may not be as scary as it seems. Even if you’re the unluckiest investor in the world and only manage to invest at the worst possible time over the last 70 years (at all-time highs), you still end up with double digit growth on average. Thus, investing when the market hits peaks is not a losing proposition, however a long investment horizon is the key to success.

- Investing Any Other Time: Timing the market is hard. Waiting for a correction before investing could lead to missing out on significant gains. Perhaps “any time” is a good time to invest in the stock market. As you can see the average returns are quite strong regardless of when you invest. And most interestingly, it’s only slightly higher than investing at all-time highs.

- Long-Term Investors Win: Over the long-term, the market is more than just a coin flip. This is because over longer time periods the market is based on economic growth and corporate profits. Those two variables tend to go up over time as we innovate and produce more goods and services. Now the market can be choppy over shorter time periods and economic disruptions may happen, but staying invested for the long-term allows you to cut through the noise and participate in long-term growth.

Stay diversified my friends.

Investing at All-Time Highs vs. All Dates

S&P 500 Annualized Rolling Returns from Jan. 1, 1950, to Dec. 31, 2020

Source: Bloomberg, RBC GAM. Data for S&P 500 as of January 1, 1950, to December 31, 2020. All-dates refers to rolling 1-, 3- and 5-year returns starting from each trading date during this time. Returns in U.S. dollars. An investment cannot be made directly into an index. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.