(Dynamic Advisor Solutions) If you’re a young parent, you’ve likely either experienced yourself—or know someone who has—the familial burden that lingering student loan debt can cast over careers, monthly expenses and wealth accumulation. At a time when you may still be grappling with your own student loan debt, you’re likely already thinking about how to finance college for your children at a time when the cost of higher education continues to rise.

In fact, average student loan debt in 2024 for federal student loans was approximately $37,850 in 2024, although individual totals vary considerably. If you have small children today, the cost of college is predicted to significantly escalate over the next two decades. For example, if you have a four-year-old who would be likely to start college in 2037, the cost of four years at an in-state college is close to $150,000, according to the Massachusetts Educational Financing Authority.

In this environment, prudent college planning with a financial advisor may offer opportunities to lessen the burden for the next generation by the time they eventually receive their hard-earned diplomas and pursue career goals. To achieve this outcome, American families are increasingly turning to 529 college savings plans as a strategic financial tool. These plans, named after Section 529 of the Internal Revenue Code, offer a compelling combination of tax advantages, investment growth opportunities, estate planning options, flexibility and control. These benefits make them an attractive component of contemporary college financing strategies.

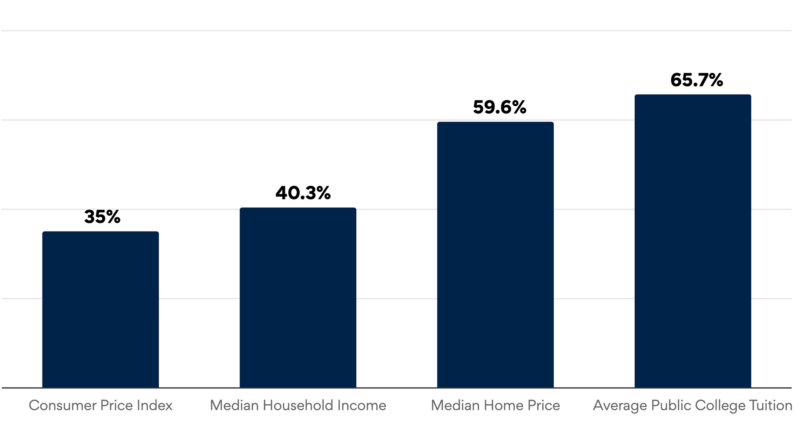

Cost Inflation From 2001-2021

Source: BestColleges.com

Tax Efficiency: A Core Benefit

One of the foremost benefits of 529 plans is their tax efficiency. Contributions to these plans are made with after-tax dollars, but the investment growth is federally tax-deferred. More significantly, withdrawals used for qualified education expenses—such as tuition, room and board, and required supplies (textbooks, laptops, etc.)—are completely tax-free. Compared to taxable account alternatives, this tax-free growth may enhance the overall return on investment and simplify taxes over decades.

In addition to federal tax advantages, many states offer their own incentives. Over 30 states provide residents with either a tax deduction or credit for contributions made to a 529 plan. While these benefits vary widely in their specifics, they collectively represent a powerful incentive to prioritize 529 contributions.

For example, New York allows a state income tax deduction of up to $10,000 for married couples filing jointly, which can significantly lower the effective cost of contributions in higher state tax states. Advisors seeking to add value to their clients’ college planning journey should research the best 529 account for clients given their state of residence and tax situation.

Investment Growth Potential

Another compelling feature is the potential for investment growth. Unlike some other education savings vehicles, 529 plans typically offer a range of investment options, including age-based portfolios that automatically adjust the asset mix as the beneficiary approaches college age. This can provide a balance of growth and risk management, tailored to the time horizon of the student’s educational needs.

Estate Planning Advantages

From an estate planning perspective, 529 plans offer unique benefits. Contributions are considered completed gifts for tax purposes, meaning they can reduce the taxable estate of the contributor while allowing them to retain control of the funds. Contributors can also leverage the “five-year election” to front-load up to five years’ worth of gifts. For example, a married couple can use the $18,000 per year annual gift limit to contribute $180,000 total to one 529 account. Because gift taxes are not triggered under this scenario, grandparents, for example, can make use of this option to manage potential future estate taxes.

Flexibility and Control

529 plans are also deployed for their flexibility. Account holders retain control over the funds, allowing them to change beneficiaries if the original beneficiary opts not to pursue higher education. This feature makes 529 plans not only an effective tool for parents but also for grandparents looking to support their grandchildren’s educational goals. Furthermore, the funds can be used at accredited institutions nationwide, in a limited capacity for private pre-college education, and even at many international universities—expanding the scope and utility of these plans.

Additionally, with the onset of SECURE Act 2.0, unused 529 funds held for 15 years have the added ability to transition up to $35,000 per lifetime per beneficiary to a Roth IRA account which can jumpstart retirement savings and may alleviate potential tax burdens of non-qualified distributions if unused 529 funds cannot be repurposed for another family member.

529 Plans: A Beacon of Hope

In an era where the burden of student loans looms large, 529 college savings plans emerge as a beacon of hope. Their tax advantages, investment flexibility and estate planning benefits make them an attractive tool for families planning for future educational expenses.

As tuition rates continue to climb, the prudent utilization of 529 plans can make the dream of higher education more attainable for the next generation. Families exercising this strategic foresight provide increased opportunities for young family members to forego the stresses and restrictiveness of pursuing their dreams with cumbersome student debt. Young parents should strongly consider partnering with a trusted financial advisor to discuss how a personalized education savings plan can potentially create generationally better outcomes in their financial plan.