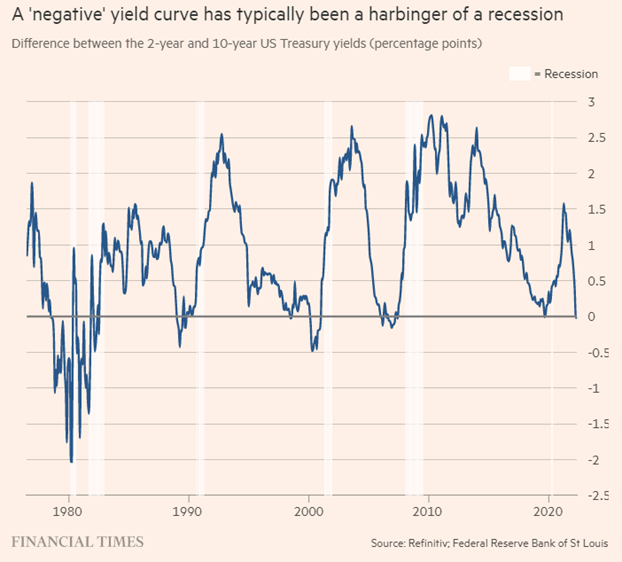

(Donoghue Forlines) The 2-year vs 10-year yield curve has inverted for the first time since 2019 (chart 1). This bond market phenomenon means the rate of the 2-year note is now higher than the 10-year note yield. Historically, when this curve inverts there has been a better than two-thirds chance of a recession at some point in the next year and a greater than 98% chance of a recession at some point in the next two years. So, should we start the countdown to recession?

Chart 1 Source: Financial Times; from 1975-2022

First, we believe the financial media focuses too strongly on the 2s10s curve and a more comprehensive look at the treasury term structure is needed to add context. It is true recessions have always been predated by inverted yield curves, but not all inversions have led to recessions. Investors are rightfully concerned that inversions raise the probability of a recession, but recession alarms shouldn’t really start ringing when just one portion of the yield curve inverts. Instead, the odds of a recession rise as an increasing number of points in the yield curve invert. For instance, while 2s10s has inverted, the three-month vs 10-year curve is nowhere even close to inverted and was recently at its steepest level in five years. Historically, when just a few points of the yield curve invert, the probability of a recession only marginally increases. It isn’t until most points in the curve invert that a recession in the next two years becomes increasingly inevitable.

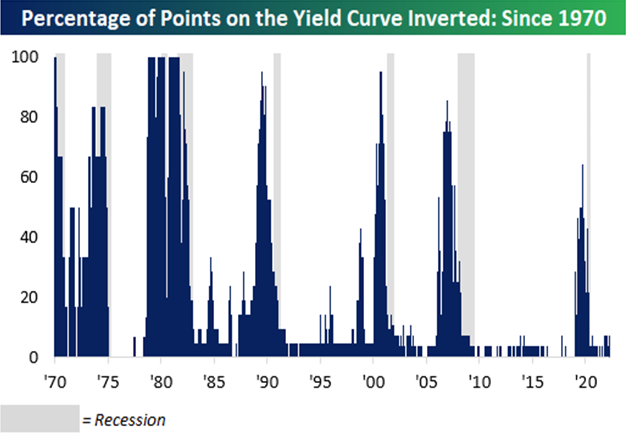

Chart 2 Source: Bespoke Investment Group

In chart 2, it shows all possible combinations of the constant maturity Treasury curve and calculated how many of those curve points were inverted on any given day going back to 1970. As you can see, the economy has gone into a recession in the two years following every point at which more than half of the points in the yield curve that inverted.

Based on historical trends, with just a few points in the yield curve inverted (7.1% of the points tracked), there’s little in the way of a recession warning.

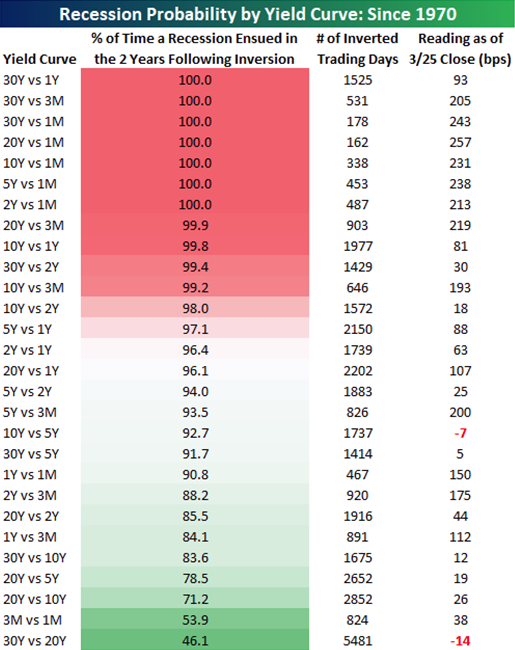

And not all yield curves should be treated equally (chart 3). There are seven yield curves that, when inverted, have historically resulted in a recession at some point in the following two years 100% of the time, and all seven of those points on the curve remain relatively steep with a minimum spread of 93 bps and all the others at more than 200 bps. Looking ahead, we’ll need to see more points on the Treasury curve listed at the top of the table start to invert before fully expecting a recession.

Chart 3 Source: Bespoke Investment Group, as of 3/25/22

And there are other factors that make this “signal” less meaningful. For one, the curve did not spend much time at all inverted and has already begun to steepen. And in general, we believe the bond markets signaling power has been weakened since the 2008 crash because of central bank intervention, regulatory pressure on banks, and liability-driven investors that hold bonds regardless of price or risk, like pension funds and insurers. The only example of 2s10s inversion since the QE era is 2019. And while that signal did prove correct, it was more like a broken clock being right than an accurate economic forecasting tool because of the policy induced recession brought on by the covid pandemic. Therefore, we must consider other factors like the strong job market, strong earnings, strong household and business spending, and a strong housing market.

Additionally, if the signal is correct, in chart 4, history shows us the previous four times the 2s10s yield curve inverted, the S&P 500 rallied for another 17 months and gained 28.8% until the ultimate peak. Therefore, panic selling into an inversion has never been a good idea. And in fact, this would mark the first time that the S&P 500 declined in the three months leading up to an inversion.

(Chart 4) Yield Curve Inversions Can Be Bullish for Stocks

2 YEAR / 10 YEAR YIELD CURVE INVERSIONS

| Date of Inversion | Bull Market Peak Date | S&P 500 Index Return | Months Til Bull Market Peak |

|---|---|---|---|

| 12/13/1988 | 07/16/1990 | 33.2% | 19.1 |

| 05/26/1998 | 03/24/2000 | 39.6% | 20.0 |

| 12/27/2005 | 10/09/2007 | 24.6% | 21.4 |

| 08/27/2019 | 02/19/2020 | 18.0% | 5.8 |

| Average | 28.8% | 17.1 | |

| Median | 28.9% | 20.2 |

Chart 4 Source: LPL Research, St. Louis Fed 03/30/2022 (Last Four Inversions)

All indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.

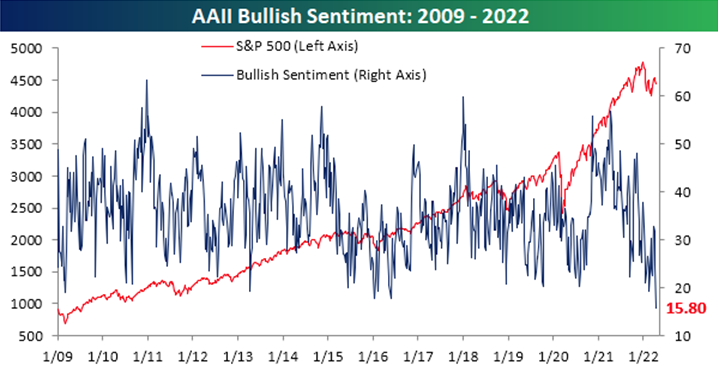

In summary, we don’t believe the 2yr-10yr signal to be a golden rule of investing. The golden rule of investing is simple: don’t bet against stocks unless you think that there is a recession around the corner, because equities and bear markets tend to overlap. While the US may not be able to avoid a recession like it did during the 2010s expansion, an economic downturn is unlikely until 2024. Therefore, we re-affirm our positioning that the 2021 selloff in risk assets is a buying opportunity, especially with sentiment at recession level lows as seen in chart 5.

Chart 5

The coming investment environment is set to be defined by the Federal Reserve’s twin effort to raise interest rates and shrink its bloated balance sheet. Rate hikes began last month, and the latest Fed minutes suggest that quantitative tightening may be kicked off at its May 3-4 meeting. The nice thing about analyzing this twin tightening cycle is that the only time it has happened before was in the very recent past, and so the lessons should be relevant. Last time around, the Fed hiked interest rates from December 2015 to December 2018 and conducted QT from October 2017 to July 2019. While, the Fed will move at a faster pace to confront inflation than the last episode, there is a bigger liquidity buffer, and we expect a similar environment for assets. For the time being, we believe bond yields and inflation may be near a short-term peak and we believe equities will rise modestly over the next year.