(MarketWatch) Got a problem with your taxes? Get ready for a long and winding road.

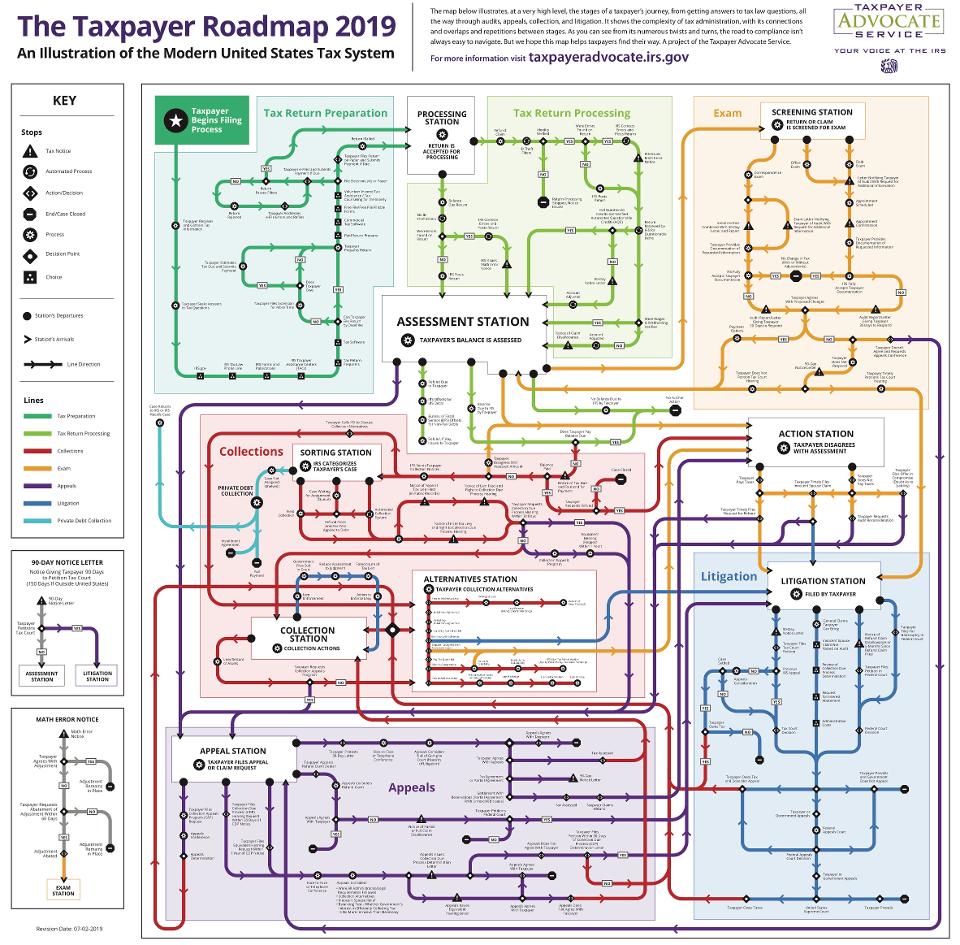

A new “roadmap” charts the labyrinth inside the Internal Revenue Service for taxpayers who have questions about IRS rules or want to fight their tax bills — and the end result looks like a mind-boggling subway system that could rival transit operations in New York City or Tokyo.

National Taxpayer Advocate Nina Olson released the map Wednesday in one of her final acts leading the watchdog agency within the IRS.

The multi-colored map shows the circuitous route for tax preparations, return processing, collections, appeals and litigation within the IRS, an agency that received 141.5 million individual income returns as of May.

“Anyone looking at this map will understand that we have an incredibly complex tax system that is almost impossible for the average taxpayer to navigate,” said Olson, who is retiring at the end of this month.

The map isn’t meant to further flummox taxpayers. Olson said the Taxpayer Advocate Service’s hope is to make an interactive map in the coming year so taxpayers and their representatives will know what lies ahead.

“It is my firm belief that taxpayers must have knowledge about their rights within a bureaucracy as complex as the IRS,” Olson said. “If only taxpayers who are represented by tax professionals have access to that knowledge, then we do not have a fair and just tax system.”

Olson could be touching on a unifying idea when there’s wide disagreement these days about the tax code’s consequences.

The rules on federal taxes were overhauled in 2017 with the Tax Cuts and Jobs Act and the roll-out included a postcard size 1040 meant to be simpler.

Supporters stress that the law slashed tax liability rates, but critics says the changes still favored the rich and businesses. About two-thirds of Republicans say the current federal tax system is fair, while one-third of Democrats think so, according to the Pew Research Center.

But for all the division on results, many people say the tax filing process itself is far too complex.

Just over half of Americans either disliked or hated the idea of doing their taxes because of the complicated paperwork and inconvenience, according to a 2013 Pew Research Center survey. Taxpayers had the same levels of animus when the organization polled taxpayers two years later.

The IRS itself estimated Americans spent 12 hours filing their return in 2017.

‘Brilliant and frame-worthy’

Lisa Perkins, a professor at the University of Connecticut School of Law and director of the school’s low income taxpayer clinic, called the map “brilliant and frame-worthy.”

As a one-time federal prosecutor handling tax-crimes cases, Perkins is well-acquainted with the system’s ins and outs. “Visually, for someone with no experience, it’s like me looking at the New York City subway map. It’s frightening,” she said.

Perkins said the tax code was too complicated and the recent changes with the Tax Cuts and Jobs Act only made things more complex.

Some people traveled the map’s many routes more than others, she said. “Unfortunately, more low-income taxpayers can get caught in the system than most who can afford representation,” she said, noting the extra IRS scrutiny when taxpayers claimed the Earned Income Tax Credit (EITC).

On Wednesday, Olson also released a report on the EITC. In Fiscal Year 2018, 37% of all audited individual returns were picked because of the EITC claim. Returns with an EITC made up 18% of all individual returns in 2017, Olson’s report said.