(CPAlliance) In our last few blogs, we discussed what a TAMP is, the role they play, and why the CPAlliance™ is the best fit for CPAs wanting to offer personal financial planning (PFP) services to their clients. The next crucial part: actually providing your clients with these services! As CPA Financial Planners ourselves, we've been helping our clients achieve financial independence for years. We're here to walk you through the entire process and help you begin offering personal financial planning services to your clients.

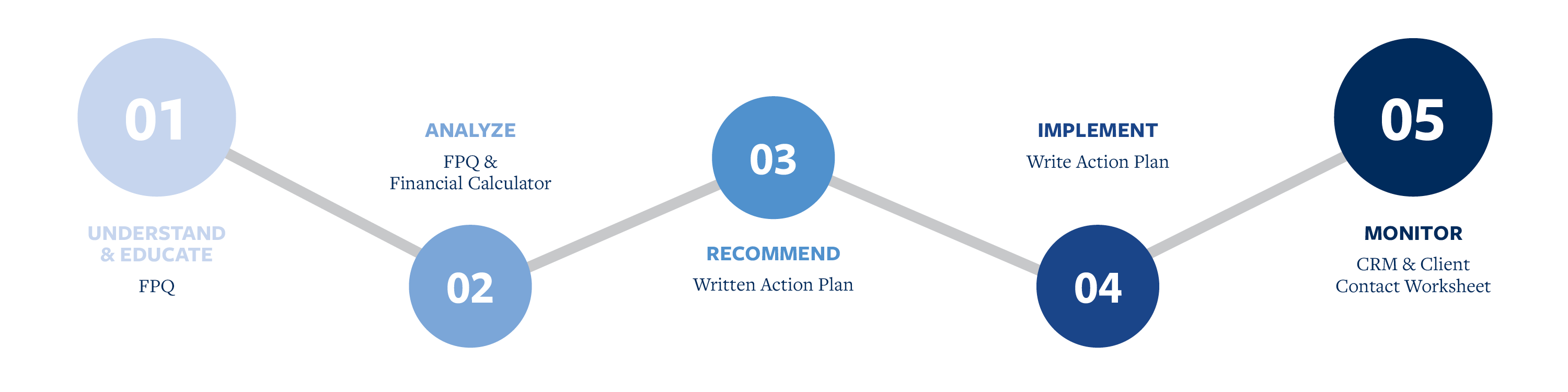

During CPAlliance™ new member initial training, we teach our advisors how to leverage the CPAlliance™ Playbook to ensure their engagements are fruitful and effective. The CPAlliance™ Playbook is a set of tools that complement the financial planning process, as prescribed by both the Certified Financial Planner Board of Standards and the AICPA’s Statement on Standards in Personal Financial Planning No. 1. In short, both standards fit into the following 5-step process: gather data, analyze, recommend, implement, and monitor.

Gather Data

The first step in the financial planning process is to learn about your client and gather their information and data. For CPAlliance™ Members, every engagement begins with fact-finding to get to know their clients as thoroughly as possible. For us to accomplish this, we created the Financial Planning Questionnaire (FPQ). Our CPA Financial Planners team members sit down with clients and review the FPQ together, allowing our advisors to ask questions and get to know their clients along the way. While this step seems like a no-brainer, far too few practitioners leverage this powerful tool and jump right to making recommendations or offering services that are not relevant and helpful to the client.

Analyze

After completing the FPQ, it's time to analyze your client’s current situation, goals, and objectives. While there are many tools out there to help CPAs do this well, we recommend keeping it basic and utilizing only the tools necessary to deliver easily understood and actionable information to your clients. Some firms use financial planning software to assist in this part of the process but, with an effective FPQ, financial calculator, and our knowledge, you can streamline this process into a simple written recommendation sheet, which takes us to the next step in the CPAlliance™ Playbook.

Recommend

The results of your analysis should result in a written action plan. In our experience, this step is the most important aspect in truly helping your clients make decisions, stay accountable, and ensure consistency and growth. While the financial planning questionnaire is a simple tool, the benefits and impact are huge. Other advisors and firms do not utilize similar tools and even fewer prepare written action plans. Presenting a written action plan to your clients will set you apart from 90% of the folks out there calling themselves financial planners. Done well, every client you take through the process will feel like they are your only client, getting a personalized, one-of-a-kind experience.

Think of it this way: if your doctor comes into your hospital room and is disheveled, unorganized, and unfamiliar with your illness, even though he has seen you four other times, you would feel deprioritized, unimportant, and disregarded. However, if your doctor instead references your past visits, custom treatment plan, and personal details of your situation, you would feel a lot calmer, reassured, and supported. The written action plan allows you to provide the latter experience over and over again. It not only gives you and your clients a roadmap but provides you a way to always give your clients the best experience possible, leading to better relationships and results.

Implement & Monitor

The final two steps of the CPAlliance™ Playbook are to help your clients implement your recommendations and monitor their plans to ensure life changes are accounted for in plan updates. In essence, the implementation phase is where most advisors want to get to quickly. However, CPAlliance™ Members have a personalized approach to the implementation step. We make sure our clients feel supported every step of the way by assisting with all aspects of their plan, including ensuring tax returns are completed, accompanying them to their attorney’s office for an estate plan, ensuring they have proper insurance coverage, and more. Once action plan recommendations have been implemented, it's critical for advisors to regularly (based on the complexity and need of the client) meet with their clients, reassess recommendations, and adjust accordingly. CPAlliance™ Members are equipped with robust client relationship management (CRM) software and a client contact worksheet to help ensure all client interactions are documented and effectively followed through. There’s nothing more disheartening to a client than feeling like they are not worth their advisor's time, energy, resources, or even a call or email response.

Members of CPAlliance™ take our fiduciary responsibility seriously and our clients reap the benefits. If you are offering or want to offer financial planning services to your clients, ensuring you have a consistent process, efficient tools, and supportive resources you need will not only help you manage your client's financial portfolio but will allow you to provide the support, service, and reassurance your clients need to build a long-lasting, trusting relationship.

Understanding how valuable the process and these resources can be makes all the difference. Experience it for yourself by downloading our Financial Planning Questionnaire and receive a free, 60-minute consultation to experience the benefits of personal financial planning for yourself. Click the image below to download now!