Financial markets have shrugged off the violence and chaos on Capitol Hill, with both the Dow DJIA and S&P 500 SPX hitting new highs on Wednesday and the Nikkei 225 notching another 30-year record on Thursday.

But investor optimism could be tempered as we continue into 2021, as Citi’s global strategy team said that global stocks will be flat over the year, in our call of the day.

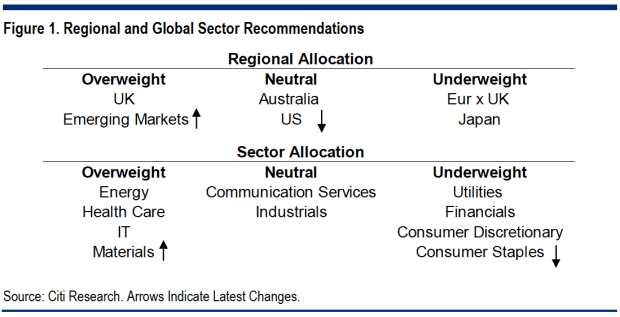

The investment bank’s strategists have predicted just a 2% increase in the benchmark MSCI All Countries World Index over 2021, and have neutralized their inclination for growth sectors in favor of a rotation into value stocks.

Lowering the temperature on their long-held bias toward growth stocks, which has historically kept their rating on the U.S. market overweight, is part of the rationale behind downgrading the U.S. market to neutral.

They also viewed the U.S. fiscal deficit as a threat to the dollar, which they expected to weaken this year, boosting emerging markets and commodity stocks.

But bond yields could be lifted, helped by a recovery in the global economy, with Citi projecting that the 10-year U.S. Treasury yield (currently at 1%) will hit 1.25% in coming months and 1.45% by the end of the year. They said this should help financial and energy companies, which are value stock stalwarts.

The best returns are expected in the U.K., where Citi forecasts 7% growth for the FTSE 100 UK:UKX, and Australia, where they expect the S&P/ASX 200 AU:XJO to rise 6%. Emerging markets, notably China, Korea, and Russia, are singled out by the strategists for growth.

Their “mildly optimistic” view on global equities hinges on the success of COVID-19 vaccines in restarting the world economy. Citi’s economists are predicting a 5% increase in global gross domestic product in 2021, after 2020’s 3.9% contraction.

Both of these factors should boost the recovery in corporate profits, with earnings per share in the most battered sectors rebounding the most.

The Citi strategists said that much of their forecast on recovery may already be priced into the market, because the MSCI All Countries World Index is trading at 20 times consensus earnings per share — far higher than the long-term median of 15 times. By that measure, the U.S. is the most expensive of the major markets, and the U.K. the cheapest.

As for sentiment, Citi said we’re deep into euphoria territory in the U.S. Panic/Euphoria index, indicating that corrections may be coming. Their suggestion? Buy the dip.

This article originally appeared on MarketWatch.