(Morningstar) - The Original Argument

Two summers ago, I suggested that cash might protect portfolios against inflation. The article was theoretical, prices having long been stagnant, but economic conditions do change. Besides, several readers had expressed their concern that inflation would resurface when the economy recovered. Correct they were.

My claim was as follows: The United States had suffered three inflationary periods during the previous century. The first occurred during and after World War II. Cash—meaning Treasury bills or other short high-quality debt, rather than currency stuffed under a mattress—performed disastrously because the Federal Reserve steadfastly kept short-term interest rates near zero.

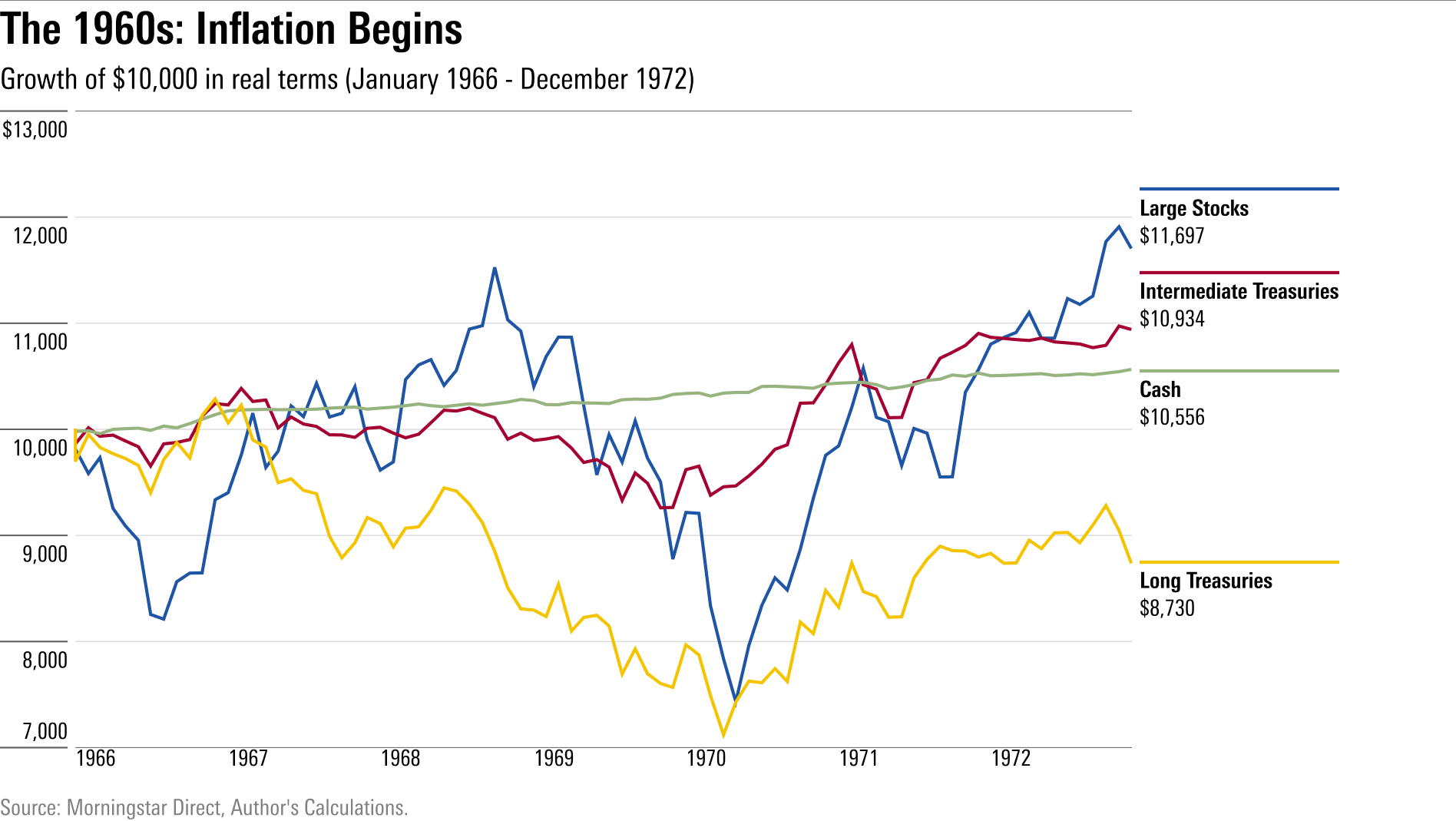

That episode demonstrated that high inflation accompanied by low payouts is a terrible investment. (You probably guessed that already.) The experience was, however, anomalous. When inflation returned in the mid-’60s, the Fed altered its tactics by raising short-term rates. Cash was therefore able to record a modest real gain. (All calculations in today’s column adjust for the effect of inflation. For further information on the computations, see the End Note.) Although cash trailed both stocks and intermediate bonds, it at least avoided long bonds’ fate.

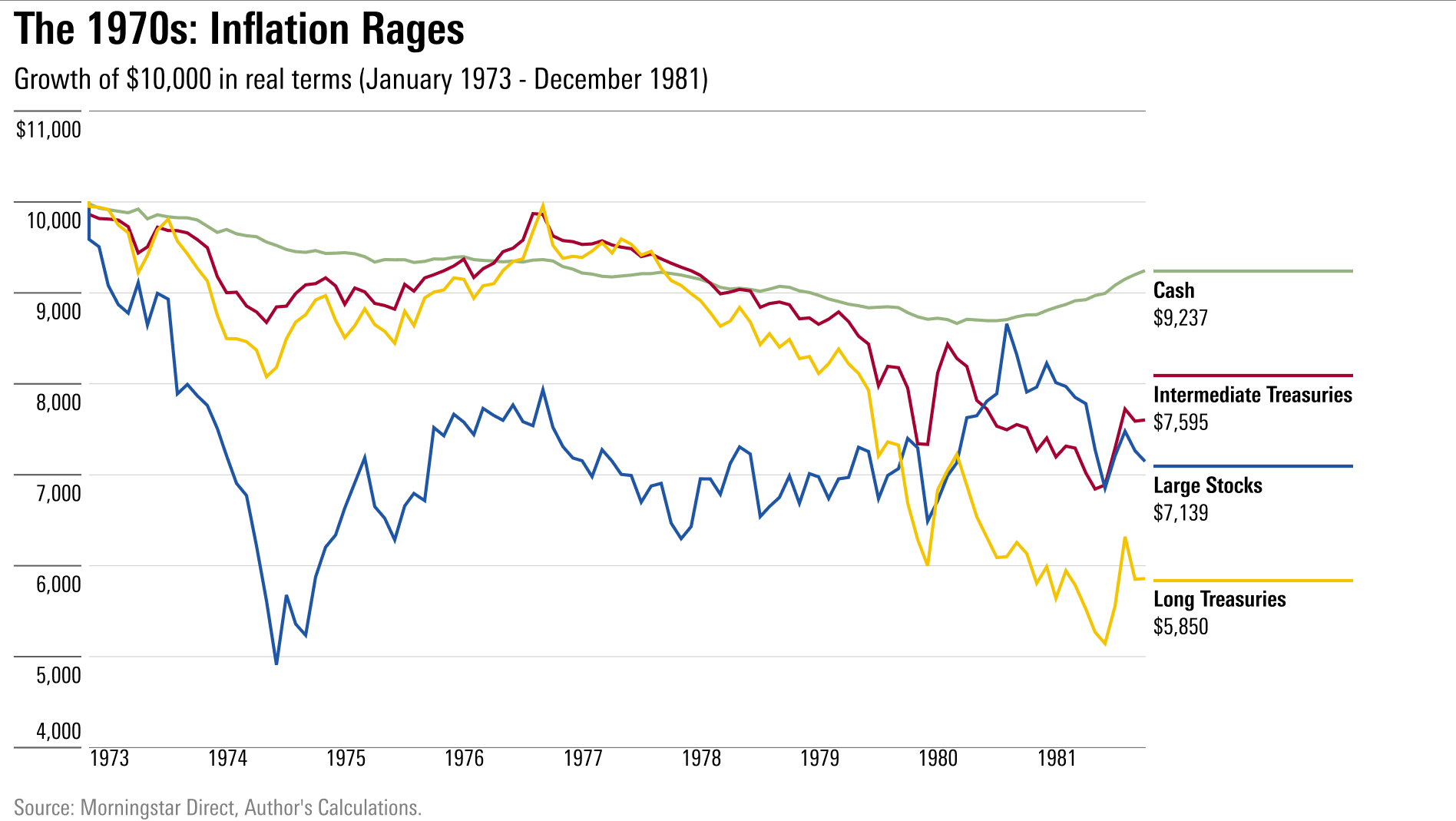

When inflation increased further, in the early ‘70s, cash became the relative star. True, it lost some purchasing power through the period, but it handily bested stocks and bonds. Better a haircut than a scalping.

When inflation increased further, in the early ‘70s, cash became the relative star. True, it lost some purchasing power through the period, but it handily bested stocks and bonds. Better a haircut than a scalping.

Inflation Resumes

Thus ended my August 2020 article. (In 200 words, I have recapitulated what previously required 1,000. It appears that I have become smarter.) Because today’s Federal Reserve figures to fight price increases rather than ignore them, I concluded that cash would likely prove a useful hedge, should inflation rekindle. That thesis can now be tested.

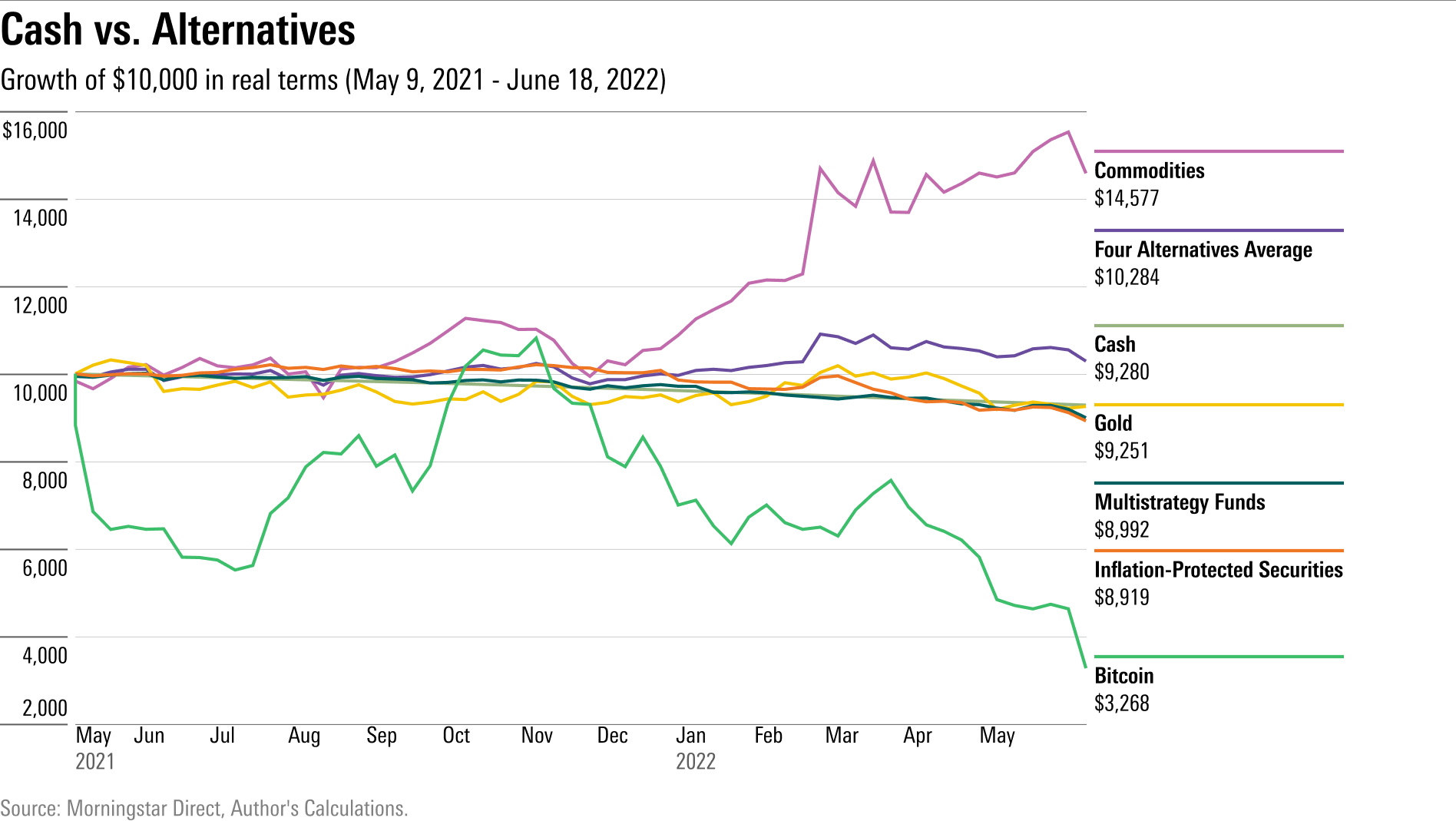

The first Bureau of Labor Statistics report to ring the inflation bell was released on May 12, 2021, indicating that the Consumer Price Index had risen by 4.2% over the previous 12 months. My comparisons therefore begin with that week. They indicate how stocks, long bonds, intermediate bonds, and cash have performed during the current inflationary cycle. (Foreign equities, regrettably, have traded much like their American counterparts.)

Commodities, in particular energy, have flourished since inflation resumed. Not only has the commodities index thrashed all investment rivals, but it also carried the Four Alternatives Portfolio to second place. Then came cash, closely followed by the remaining three alternatives. As for bitcoin ... sigh. Not that long ago, many pundits, including this idiot, wondered if cryptocurrencies might protect against an unanticipated increase in inflation. We wonder no longer.

The Four Alternatives Portfolio would also have outdone cash when inflation attacked in the ‘70s. True, neither inflation-protected bonds nor public versions of hedge funds had yet been invented, so the portfolio could not have existed in that form. Replace those investments with pretty much anything, however, and the Four Alternatives would yet have thrived, thanks to huge gains from its gold and energy positions.

The sample size is small but the pattern strong. When inflation has exceeded predictions, commodities have prospered. It therefore seems probable that if high inflation lingers—a condition that would indeed defy government forecasts, as the Congressional Budget Office projects next year’s U.S. inflation rate to be 3.1%—the Four Alternatives Portfolio will continue to succeed. In such a climate, cash should perform respectably, particularly as rising rates create higher payouts, but it would likely trail alternative portfolios that contain commodities.

The Danger Zone

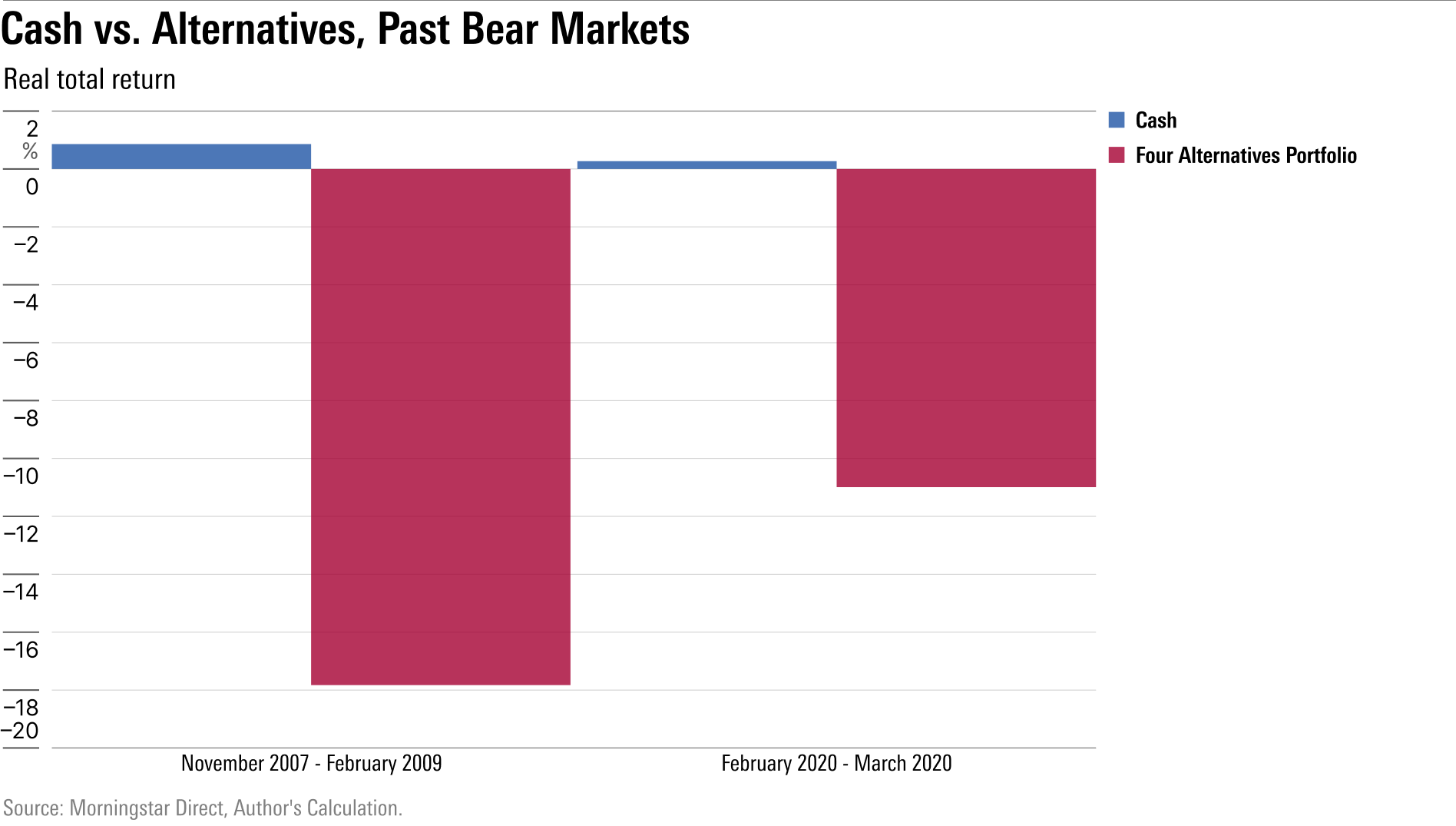

So far, alternative investments seem superior to cash. However, things are not so simple. The Four Alternatives Portfolio has only been better when inflation persists—and frequently, it has not. In 1987, it sounded a false alarm by abruptly tripling, only to recede. History repeated from spring 2007 to 2008, when both inflation and oil prices surged, before heading back to whence they had come.

I cannot compute what the Four Alternatives Portfolio would have returned when stocks crashed in late 1987, due to a lack of data, but I can illustrate how that investment would have performed through the 2008 financial crisis, as well as during the brief but painful coronavirus lockdown of 2020: not well. Not well at all.

Parting Words

To summarize:

1) If inflation persists, alternatives will likely lead the way, followed by cash and/or stocks, with intermediate bonds being somewhat weaker and long bonds worse yet. (About bitcoin’s fate, I will not speculate.)

2) If inflation subsides and employment remains healthy, stocks and bonds should rebound, with alternatives and cash lagging.

3) If inflation subsides and a recession lurks, bonds will be the safest refuge, with cash close behind. Further back will be alternatives, and then stocks.

For me, cash is a more appealing inflation hedge than commodities. Although cash will not match the alternatives’ performance if the first scenario transpires, neither does it face the possibility of cratering should a recession loom. That said, alternatives are the sounder choice for investors who fully, truly believe that inflation is here to stay.

End Note

This column’s first three exhibits were created by data from several Ibbotson Associates indexes: 1) Large Stocks, 2) 30-Day Treasury Bills, 3) Intermediate-Term Government Bonds, 4) Long-Term Government Bonds, and 5) Inflation.

The final two exhibits use: 1) Morningstar 1-3 Month Treasury Bill Index, 2) Consumer Price Index data, and, as proxies for market returns, 3) Vanguard Total Stock Market VTSAX, 4) Vanguard Long-Term Treasury Index VLGSX, 5) Vanguard Intermediate-Term Treasury VFIUX, 6) Vanguard Inflation-Protected Securities VAIPX, 7) iShares S&P GSCI Commodity-Linked Indexed Trust GSG, 8) SPDR Gold Shares GLD, and 9) United States Oil USO. Finally, the exhibits use the 10) Multistrategy Fund Category average.

Whew.

By John Rekenthaler