(SmartAsset) - Investing money can help you build wealth, but taxes can take a big bite out of your earnings. Following a buy, borrow, die strategy is one way to minimize your tax liability and preserve more of your wealth.

The concept of “buy, borrow, die” was developed by Professor Ed McCaffery in the 1990s as a way to explain how people get rich and stay that way.

Nearly 30 years later, the term has resurfaced amid discussions of tax inequality and what regular people can do to reduce their tax burden, which we discuss below. If you’re looking for help with your investment strategy, consider working with a financial advisor.

What Is Buy, Borrow, Die?

Buy, borrow, die is a concept that attempts to explain how wealthier people are able to hold on to their wealth by minimizing what they pay in taxes. The theory holds that rich people aren’t gaming the tax system with loopholes or fraudulent practices. Instead, they’re limiting what they have to pay in taxes through strategic investing and planning.

It’s called buy, borrow, die because those are the three components of how the strategy works. McCaffery developed the concept to help explain how rich people position themselves to pay less in taxes proportionally compared to the average American.

How Does a Buy, Borrow, Die Strategy Work?

Buy, borrow, die is actually a pretty straightforward strategy once you understand what each of the three steps stands for. Let’s take a look at each step, or piece of the strategy, one at a time to better understand what happens along the way.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Step 1: Buy

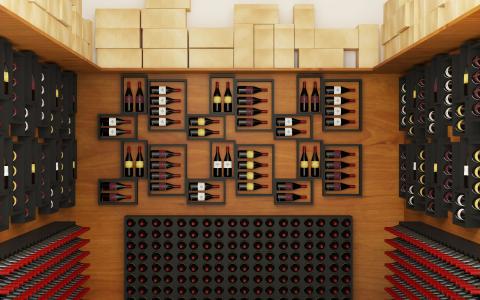

The “buy” part is what it sounds like. You use part of your wealth to purchase appreciating assets. Appreciating assets include things like:

-

Other Collectibles

The purpose of doing so is to capitalize on the increase in value those assets realize over time. Real estate, for example, tends to go up in value year over a year unlike vehicles and other forms of real property. Owning property can also be a way to hedge against rising inflation or increased volatility in the stock market.

Moreover, buying real estate can lead to tax breaks if you’re able to write off the depreciation. You can also generate current income if you own a rental property that you lease out seasonally or on a full-time basis.

Ideally, you buy assets that will grow in value on a tax-deferred basis and yield passive income. Passive income is money that you don’t have to work to earn. Dividends earned from stocks, for example, are another form of passive income.

Part 2: Borrow

Once you’ve bought appreciating assets, the next step is to borrow against them. In other words, you use those assets as collateral for loans.

Why would you do that? According to the buy, borrow, die strategy, leveraging assets as collateral allows you to borrow money while preserving the value of the underlying assets. Rather than selling off investments for cash and incurring capital gains tax, you can borrow against your assets instead.

There’s a double tax benefit here since you’re not on the hook for capital gains tax and the loan proceeds are not counted as taxable income.

Of course, it’s important to use the right assets as leverage for a loan. Again, that’s where owning real estate can come in handy as you can use it as collateral to secure loans. Taking out a loan from your retirement account, on the other hand, can drain your wealth and potentially result in a tax hit.

When you take out a 401(k) loan, for example, you’re borrowing from yourself but any money you take out isn’t growing on a tax-deferred basis. That can shortchange your wealth-building strategy in the long run. There’s an added risk in that if you’re unable to pay the loan, the IRS treats the entire amount as a taxable distribution.

Part 3: Die

Thinking about death isn’t pleasant, but wealthy people understand the importance of estate planning and what happens to assets when you pass away. Minimizing estate tax is often a top priority, as doing so can help you to leave behind more of your wealth for your loved ones.

In a buy, borrow, die strategy, the individuals who inherit your estate can use some of the assets you’ve passed on to pay off outstanding loans. That allows them to avoid having to settle those debts out of their own pockets.

Additionally, your heirs benefit from a step-up in the cost basis of those assets once they receive them. That step-up allows them to avoid any capital gains tax due on the sale of assets they inherit. The other option is for them to hold on to the assets and not sell them. Should they decide to go that route, they can continue implementing a buy, borrow, die strategy for themselves and the next generation of heirs.

Does Buy, Borrow, Die Really Work?

A buy, borrow, die strategy can be an effective way to minimize taxation for people who have the capacity to follow it. Buying appreciating assets allows you to benefit from their long-term growth in value while potentially enjoying some current income. You can then use those assets to secure loans that are not taxable income.

The main flaw with the buy, borrow, die is that it requires a certain amount of money to take advantage of this approach. Someone whose net worth is in the four- or five-figure range, for instance, may not have sufficient means to buy appreciating assets. That may not be an issue for someone with a net worth of $1 million or more.

In other words, it takes wealth to create wealth using a buy, borrow, buy strategy, which isn’t realistic for most people. If you own a home, you might already have an appreciating asset to start with. But your only options for borrowing against it may be limited to a home equity loan or line of credit.

Using a home equity loan or HELOC to access cash can be problematic if you’re not able to keep up with the payments. Should you default on the loan, the lender could initiate a foreclosure proceeding against you. In the worst-case scenario, you could end up losing your one appreciating asset.

The Bottom Line

Buy, borrow, die is a legitimate way to minimize what you pay in taxes as you work on building wealth. Implementing this strategy can be difficult, however, if you don’t have a lot of financial resources on tap yet. In the meantime, you can work on increasing wealth through more traditional means. For example, maxing out your 401(k) or opening an Individual Retirement Account (IRA) can be an excellent way to begin creating wealth on a tax-advantaged basis.

Estate Planning Tips

-

Consider talking with your financial advisor about how you might be able to include buy, borrow and die into your financial plan. Your advisor may also be able to offer other ideas on ways to minimize your tax burden through tax-efficient investments. If you don’t have a financial advisor yet, finding one doesn’t have to be difficult. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Tax planning is just one consideration when creating an estate plan. It’s also important to think about how your assets will be passed on to your heirs. Creating a will is a basic step in estate planning but you may also want to explore the benefits of establishing a trust. Other elements to consider include life insurance needs and the creation of additional streams of income. An annuity, for instance, can provide you with a consistent source of income in retirement so that you don’t have to spend down other assets.

By Rebecca Lake