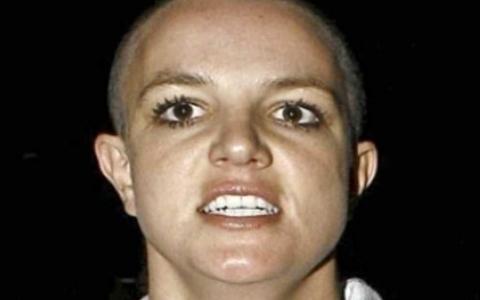

With nearly $60 million on the books, government benefits eligibility isn’t even an afterthought. But the fragile pop star could use all the structure her support team can establish before court-appointed conservatorship ends.

Britney Spears has seemed relatively happy to have her father and managers run her life since she entered a conservatorship in 2008.

However, life rarely sits still for long. When all this started, the logic was all defensive, revolving around resolving what had become a highly volatile situation out of control.

Now circumstances have shifted just enough to give everyone an occasion to really think about what makes sense for the long term.

After all, she’s been under other people’s supervision for most of her adult life now. And as she approaches middle age, that adult supervision needs to be able to flex with her needs.

That logic points to something like a special needs trust, but not necessarily for the usual reasons.

Not fighting for freedom

Start with the essential question. Whatever pressure drove Britney Spears to erratic behavior in the past, there isn’t a lot of push to declare legal independence now.

With a history like hers, proving that you can be responsible is hard enough when you’re motivated. She just doesn’t seem to care about charting her own course.

As long as she gets to shop, watch movies and occasionally see her kids, the only thing that really bothers her is when she gets into fights with the people who make the real decisions.

That’s historically been her now-68-year-old father who helped build her career in the first place. Like a lot of kid stars’ parents, he signed off on the early deals and picked the people who handled the details.

But when she grew up, she made bad choices. Dad came back in a similar legal capacity.

Could she figure out life on her own? Should she? Right now, the answers don’t matter.

The important details right now revolve around their relationship and his health. Neither are great.

When he took a break last year for surgery, getting a professional fiduciary to step in was apparently a breath of fresh air. Her eyes opened and her lawyers petitioned to continue the arrangement for the foreseeable future.

That timeline is up for review in February. In theory, the conservatorship will end then if Britney seems ready and willing to take control of her own life back.

In practice, it’s probably time to make sure her money lasts the rest of her life, protected from opportunistic predators looking to take advantage of her vulnerabilities.

Trusts, special needs and otherwise

Britney has essentially retired at this point. Her father is no longer interested in motivating her to perform and after cancelling her last major concert schedule I would be surprised if big promoters are eager to hire her anyway.

That leaves her with a carefully nurtured $60 million investment portfolio, 21-acre California compound and significant overhead.

Her lifestyle is relatively modest. She apparently spends about $400,000 a year on herself, plus another $240,000 to support her ex-husband and $128,000 to reimburse her father for his time.

That last detail is a little unusual because most family conservators don’t get paid, but that’s what the judge mandated and so it is what it is.

We know all of this because he keeps detailed records showing that he keeps his hands out of her accounts. He might be living up to a de facto fiduciary standard, truly being able to prove he acts in what he perceives as her best interests.

As he recedes one way or another, that discipline goes away. Someone needs to make sure cash keeps flowing through the accounts instead of out at an unsustainable rate.

Normally a business manager or family office would handle that for someone who can handle the responsibility but simply doesn’t want it. Britney, unfortunately, seems to be letting the managers go.

With this much money on the table, there needs to be an adult in the room somewhere. While a wealth manager could run the investments impeccably, we just don’t know what Britney would be spending on her own.

Maybe she’s happy going to Target once a week. As remarkable as it sounds, it’s hard to blow $60 million at Target.

The real danger is that she’ll accumulate an entourage of freeloaders who then run up the bills or worse, marry their way into a legal share of her money.

The situation hasn’t come up yet but the conservatorship presumably won’t let her get married without a firm prenuptial contract in place. If that structure goes away, Las Vegas awaits.

Historically, putting family wealth into a trust has alleviated the risk here because the kids never really own the assets and so there’s no marital estate to divide if they marry the wrong person.

The trust writes checks to the beneficiary, not the spouse. Britney could use something like that.

She’s already paying $20,000 a month to support the man she was married to for a couple of years. He wants more.

A trust would fill in for the conservatorship, protecting her money and lifestyle from bad decisions.

Would this be a “special needs” trust? We don’t know a lot about her mental and medical state or whether any impairment is permanent.

What we do know is that she doesn’t really need to remain eligible for disability payments to make ends meet. That’s the usual role that special needs trust play in structuring ownership and income without jeopardizing government benefits.

Her current co-conservator is also her care manager, looking out for her personal safety and hiring help when required. These people are professional fiduciaries.

Like a lot of family conservators and family trustees, Britney’s father isn’t really trained for any of that. All he has is his experience as a parent and a human being, which for most of us is good but not always perfect.

He’s done all right with her assets, buying a lot of solid blue-chip stock and then doling out the dividends, but that’s practically luck of the draw.

Even if the conservatorship continues, he’s on his way out one way or the other. Fiduciaries will be able to take a close look at the financial plan and decide how the assets should be structured to best support Britney and her kids across their lives.

After all, anyone with $60 million should at least consider a trust anyway to facilitate intergenerational transfer. I don’t care how volatile your mood can be or how much you know about finance.

Rich people, no matter how competent, have special needs. That’s Britney Spears. She doesn’t have to call all the shots herself to make sure she gets the best possible use out of that money.