In January, Doll offered his annual set of 10 Predictions that were based on the premise that the economic expansion was getting “long in the tooth but still had some life left.” In April, amid the height of the bear market and sharp recession, Doll recast his earlier predictions to provide new perspective about where things might be heading. Now, he provides an update to both his original and revised predictions.

“At this point, we think conditions will continue improving, but we are also growing more concerned about rising market risks,” Doll writes in his update.

Citing data from the IMF, Doll notes that U.S. GDP is expected to fall 8% and global GDP 5% in 2020, but adds that the recession may be less severe than what was expected in late March and early April, and, in fact, may have already ended.

“So far, the recovery has looked like a ‘V-bottom,’ but we think that will trail off and we expect a slow and uneven recovery worldwide,” Doll says, further noting that the country may not get back to expansion mode until late 2021 or early 2022.

One thing that could hamper growth going forward, however, is a stalling labor market, Doll notes. Additionally, he observes that the power of monetary policy is likely to wane.

Doll explains that central banks have accelerated monetary policy at an unprecedented rate, which has been “great news” for the economy and risk assets, but the “bad news” is that policy is no longer accelerating and has become about as accommodative as it can.

“Investors easily ignore market negatives and risks when policy is quickly moving in a positive direction, but that’s harder to do when it is not,” he emphasizes.

Doll also questions how the country will pay for all the economic stimulus. In addition to the monetary policy support, he notes that the U.S. has already increased federal spending by $2.9 trillion since the pandemic began, with more spending possible.

“For now, the world remains in a deflationary environment, but at some point (probably late next year and into 2022), we’ll all need to figure out how to pay for this stimulus,” he writes.

Possible options, according to Doll, include settling for a long-term slower rate of growth, raising taxes or expanding the money supply to generate inflation and depress the value of the dollar.

“We’ll probably see some sort of a combination of all three approaches, with specifics depending on the results of the November elections,” he observes.

The Nuveen strategist further predicts that one year from now stock prices will be higher than they are today, but notes that this is not going to be an easy investing environment. “Assuming the economy continues to recover, even if slowly, earnings should start to grind higher by the end of the year and into the first part of 2021,” Doll says.

Likewise, he notes that his firm expects improving growth to put “modest upward pressure” on interest rates and that all of this should lead to a marginally stronger stock market. “Investors should focus on selectivity, be nimble and flexible and rely on diligent research to uncover opportunities,” he says.

Regarding those predictions, Doll’s mid-year update offers a scorecard on both his January and April predictions, but here we are including only his revised predictions for the remainder of 2020:

1. The U.S. and world experience a sharp, but reasonably short recession with noticeable recovery before year-end—heading in the right direction.

2. All-time low yields move higher during the second half, with the 10-year Treasury closing the year above 1%—too early to call.

3. Earnings collapse, but rise smartly by the fourth quarter—too early to call.

4. Stocks, bonds and cash all return less than 5% for only the fourth time in 25 years (no change from original prediction)—too early to call.

5. The dollar weakens as global growth strengthens in the second half—heading in the right direction.

6. Value and cyclicals outperform growth and defensive stocks in the second half—too early to call.

7. Financials, technology and health care outperform utilities, energy and materials in the second half—too early to call.

8. Active managers outperform their indexes for the first time in a decade (no change from original prediction)—heading in the right direction.

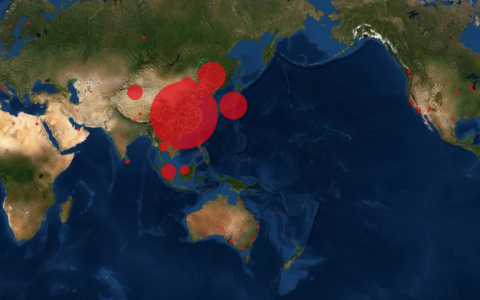

9. The cold wars within the U.S. and between the U.S. and China continue (no change from original prediction)—heading in the right direction.

10. The Coronavirus recession and rise in unemployment cause Donald Trump to be a one-term president—too early to call.