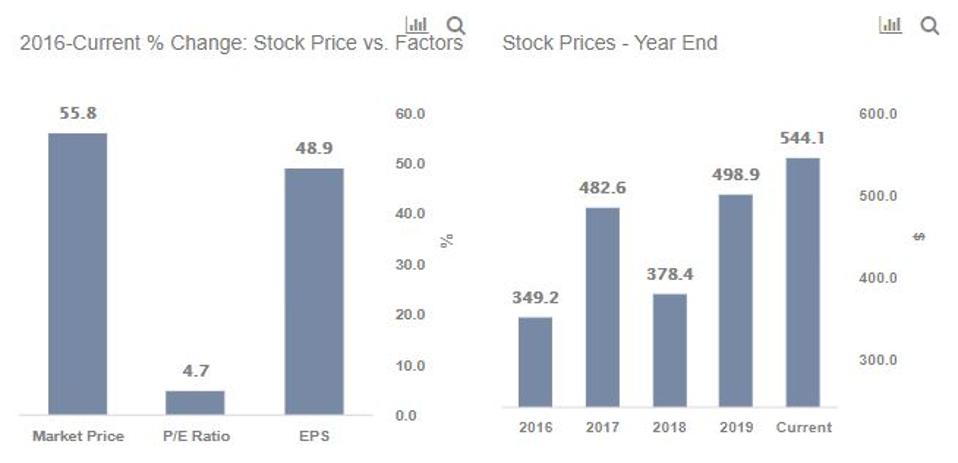

Despite being the asset manager of choice to direct the Fed’s bond-buying programs, we believe BlackRock’s stock (NYSE: BLK) has limited upside potential. Our belief stems from the fact that BlackRock’s stock has gained around 65% of its value since March 23 to scale $550 – 10% higher than the multi-year high seen at the end of 2019. Further, while BlackRock’s role as the Fed’s asset manager would boost the company’s asset base, it won’t help the top line much as due to fee waivers ((Fed’s investment management agreement)). Our dashboard Why BlackRock Stock moved 55.8% between 2016 and now provides the key numbers behind our thinking, and we explain more below.

A part of the rise in the company’s stock over the last three years is justified by the roughly 30% growth seen in BlackRock’s revenues between 2016 to 2019, which translated into a 41% increase in Net Income. Earnings per share grew almost 50% due to the added benefit of share buybacks. Specifically, the company has invested about $5.4 billion in repurchases in the last three years, resulting in about 5.1% lower outstanding shares.

While BlackRock’s P/E ratio dropped from about 18.1x at the end of 2016 to around 17.4x at the end of 2019, the P/E multiple is up to about 19.0x now – the highest level over the recent years. Hence, we believe there is limited upside for BlackRock’s P/E multiple when compared to levels seen in the past years.

How Is Coronavirus Impacting BlackRock’s Stock?

BlackRock could suffer due to a drop in asset valuations driven by net market losses. The asset management giant derives a significant chunk of its revenues from investment advisory, administration fees, and securities lending revenue, which are charged as a percentage of Assets under Management (AuM). While the company’s results for Q1 showed some positive growth, we believe that Q2 results will confirm the hit to its revenue. It is also likely to accompany a lower Q3 as-well-as 2020 guidance.

This article originally appeared on Forbes.