‘Discouraged workers’ or U-6 unemployment figure is a huge warning sign for investors. And I’m not talking about shrimp.

If you don’t know what “U-6” employment data is, this is a great time to learn. Many years ago, someone told me that U-6 is a classification of shrimp. A U-6 is a big guy in the seafood world. That means 6 of them make up a pound. So, your typical grocery store shrimp ring more likely contains U-16 or U-20 sized shrimp.

But I am talking about another form of U-6 that matters more to your money. So, let’s move on to a more kosher subject.

Beyond seafood analogies

The U.S. unemployment report came out last week. It was a blazing success. Lots of new jobs created, and the unemployment rate ticked up just a smidgen, from 3.5% to 3.6%. However, as I have said here before, just when it seems like it can’t get any better, look for signs it might be getting worse. This may be the new story with U.S. unemployment.

You see, while the headlines are made by the commonly-used U-3 government unemployment rate, it does not tell the true story of America’s jobless situation. That is contained in the government’s U-6 unemployment figure.

What is the U-6 unemployment rate? Why does it matter?

U-6 is different from the standard U-3 rate because it includes folks who are underemployed, or are working multiple part-time jobs when they really want a full-time job. Or, they are working at levels below their skill set just to get by. They are employed, but far from happy with their state of employment.

Perhaps the most important part of the U-6 unemployment rate is its inclusion of discouraged workers. These are people that have decided to stop looking for a job. A decade ago, there was a big group of Americans referred to as the “99ers.” They had been unemployed for a least 99 weeks. And, despite receiving some extensions from an emergency act of Congress in early 2009 well above the previous standard of 26 week), they were still out of work, and their employment benefits ran out.

Start of a discouraging trend? Here’s the data.

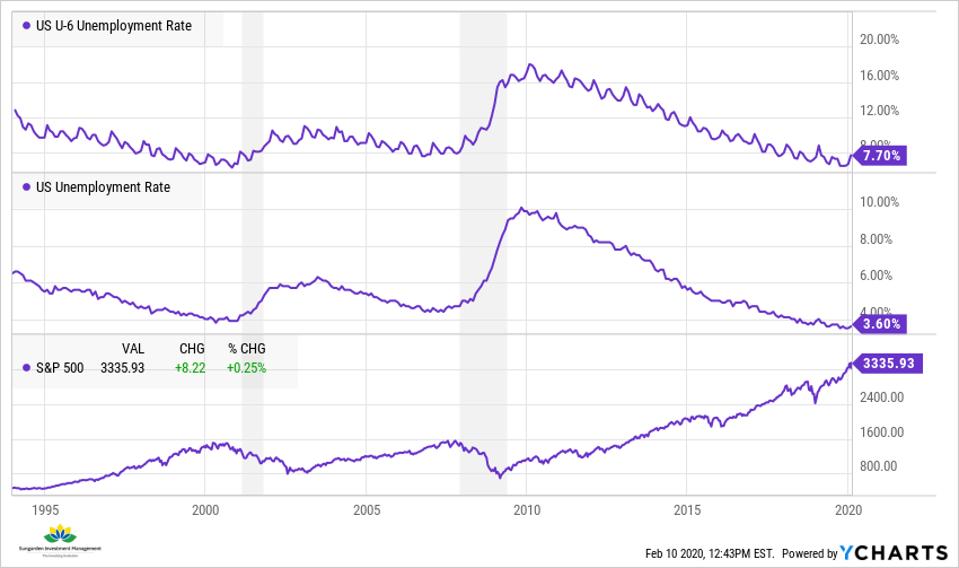

We are nowhere near the 16% level of U-6 unemployment that led to that mess over a decade ago. But based on last Friday’s report, we may be seeing the early stages of a bounce off the lows in U-6 similar to what occurred before the last 2 recessions. That’s reason enough to pay close attention to that figure in the months ahead.

The chart above shows that U-6 stood at an all-time low of 6.5% in November of 2019. In December it ticked up to 6.7%. In January, it vaulted to 7.7%. That did not make the kind of headlines that the “regular” unemployment rate did. It should have. It is a proverbial canary in a coal mine.

Big deal, so what? U-6 and the stock bull market.

I say that as an avid U-6 tracker. Here is what I said in a piece I wrote way back in 2011, when the market and economic environment was the opposite of today:

I think this is THE decisive number that must come down in order for us to see a sustainable improvement in the U.S. economy and markets, and, by association, those of our major world trading partners.

Now, here we are, having just witnessed the kind of sudden jump in U-6 unemployment that has occurred shortly before the start of the last 2 recessions. Now, that’s not a ton of history. And, U-6 tends to rise in January most years.

But as I say all the time, I am neither a bull nor a bear, but a realist. So when we see bits of evidence like the true rate of unemployment starting to rise like this, we take note. Going forward, it makes sense to mark that, follow it very closely, and look for other signs that the stock market run is in the very late innings.

This article originally appeared on Forbes.