(MarketWatch) It’s not a law that big banks have to be bullish, even though they usually find a way to look on the bright side of life.

BNP Paribas, however, has a bit of a bearish streak, and in the call of the day, the French bank expects the S&P 500 to drop to 2,730 by the end of the year—from 2,937.78 on Wednesday.

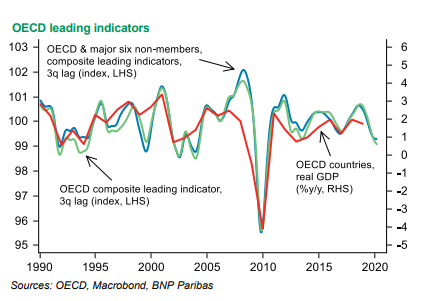

Why so glum? In its fourth-quarter outlook the bank cites the U.S.-China trade war (though the news today on that front was optimistic), as well as the possibility of auto tariffs, weighing on the global economy. Central banks seem ready to help, though fiscal support is more in talk than practice. And the risks to the global economy weigh to the downside.

“Especially if exacerbated by additional downside shocks, the downturn could become nonlinear and morph into a fully-fledged global recession.” BNP Paribas expects more negative revisions to earnings forecasts as the global economy slows further, which will shift the market focus to earnings from valuations.

Naturally with this perspective, they prefer defensive stocks over cyclicals. “We expect increased dispersion of stock returns, with companies that have pricing power and low labor costs as a percentage of earnings likely to be more resilient. We view companies with higher balance sheet leverage and already-low margins as most at risk in a late-cycle environment,” they said.

BNP Paribas are bond bulls and expect the yield on the 10-year Treasury to drop to 1% by the fourth quarter.