(Forbes) Since early 2018 it seems like whenever the markets tumbled, especially in relation to worries about the negative impacts from the tariffs President Trump has placed on China, he either tweets or says something to try and soothe investors. Or he will send out someone from the Administration to try and calm the markets. However, the positive effects have been short-lived as can be seen in the markets either pulling back soon afterwards, or the lack of return since January 2018.

Many investors may not realize it but since January 2018, or for the past 19 months, the Dow Jones 30 Industrials (down 2.2%), Dow Jones Transports (down 12.9%) and the Russell 2000 (down 8.6%) indexes are all lower; the S&P 500 is up less than 1% and the Nasdaq is the only one that has shown much upside at up 4.7%. The markets are all up very nicely since President Trump was elected, but the increases looks like it was in anticipation of tax cuts being passed. It appears to have been a buy the rumor, sell the news event.

Dow Jones 30 IndustrialsSTOCKCHARTS.COM

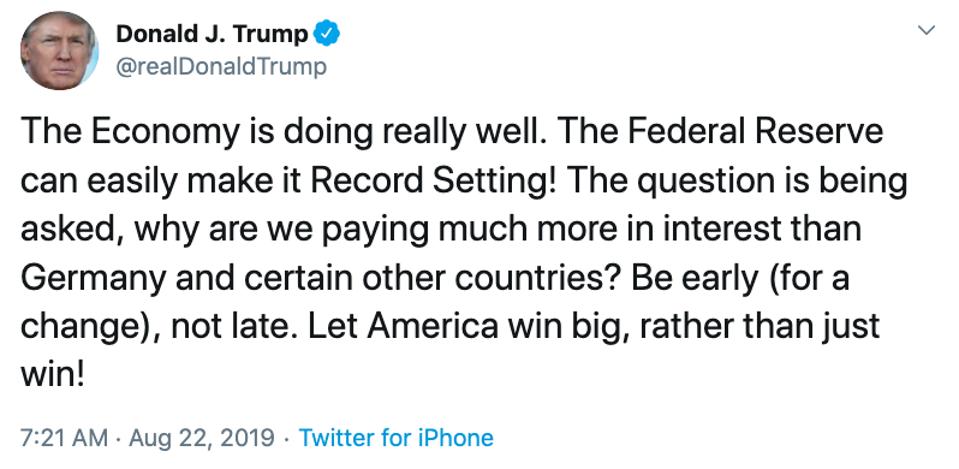

The past week saw a flurry of tweets and statements

On Thursday, August 22, Trump tweeted that the economy is doing very well but if the Federal Reserve would lower interest rates the economy would be “Record Setting.” He also questioned why the U.S. interest rates are higher than Germany’s and other countries where their rates are negative. Trump either doesn’t understand that better performing countries will tend to have higher interest rates or ignores the contradiction in his tweet. On August 22 the Dow increased 50 points and closed at 26,252.

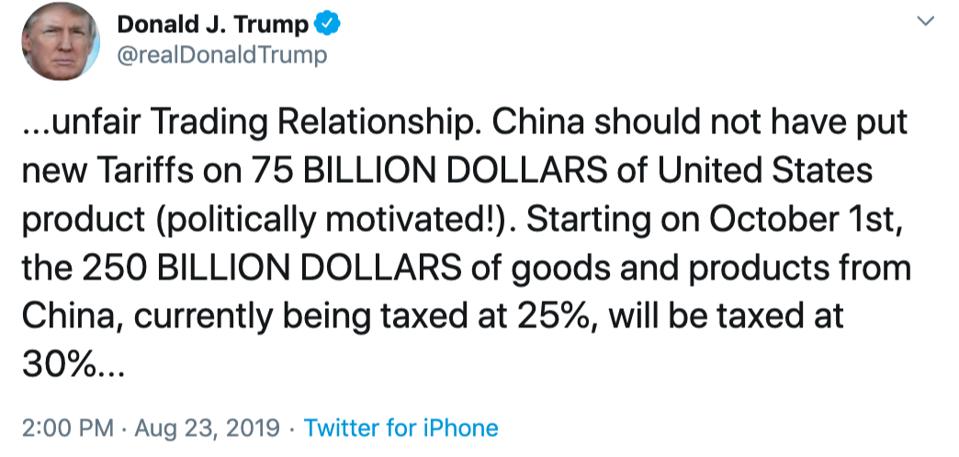

On Friday, August 23, Trump sent out a series of tweets increasing tariffs on China, ordering U.S. companies to leave China and saying that Fed Chairman Powell is an enemy of the U.S. The Dow closed down 623 points to 25,629 or 2.4%.

On Sunday at the G7 summit in France Trump was asked if he had any “second thoughts” about the trade war with China. The question and answers below are from the official White House readout.

Q Mr. President, any second thoughts on escalating the trade war with China?

PRESIDENT TRUMP: Yeah, sure. Why not?

Q Second thoughts? Yes?

PRESIDENT TRUMP: Might as well. Might as well.

Q You have second thoughts about escalating the war with China?

PRESIDENT TRUMP: I have second thoughts about everything.

A few hour later White House Press Secretary Stephanie Grisham issued a statement attempting to explain the remark, writing: "His answer has been greatly misinterpreted. President Trump responded in the affirmative—because he regrets not raising the tariffs higher."

On Monday, August 26, Trump said that Chinese officials had called twice over the weekend to discuss trade. Even though a Chinese official denied any phone calls the S&P 500 opened up 1% and closed up 1.1% for the day. The next day the markets gave back between 0.3% and 0.5% of the prior days gain.

On Wednesday, August 28, the Dow gained 258 points on lackluster trading. There were various reasons for the increase including the energy and financial sectors performing well and no major announcements about China.

While it is a short timeframe, over the course of a week when Trump sent multiple tweets and made various statements from Wednesday, August 21, when the Dow 30 closed at 26,203, to yesterday, August 28, it lost 167 points or 0.6%. However, over the five trading days it changed by up 50, down 623, up 270, down 121 and up 258, respectively. Overall Trump’s actions of increasing tariffs outweighed the positive tweets he wrote or the comments he made.