(Forbes) SPDR Gold Shares (GLD) is an exchange-trade fund (ETF) that's turned in a pretty impressive summer this far, adding 11% in the last three months. There's reason to believe this hot streak is far from over, if this historical trend is any guide.

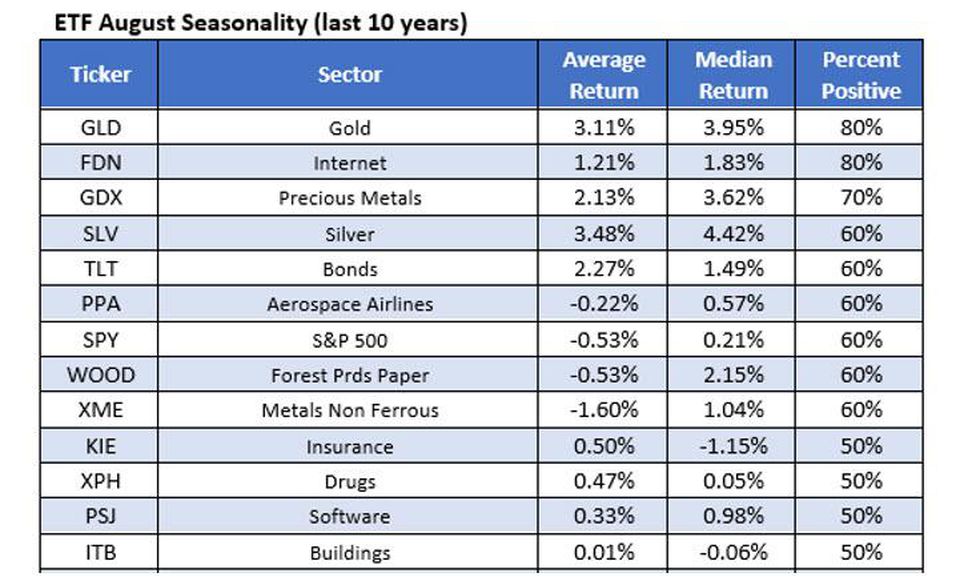

More specifically, the gold ETF landed on a list from Schaeffer's Senior Quantitative Analyst Rocky White showing the best ETFs in August from the past decade. During this time, GLD has ended the month in positive territory 80% of the time, and has averaged a gain of 3.1%. That's good enough for the second best return of the ETF's we looked at, trailing only iShares Silver Trust (SLV).

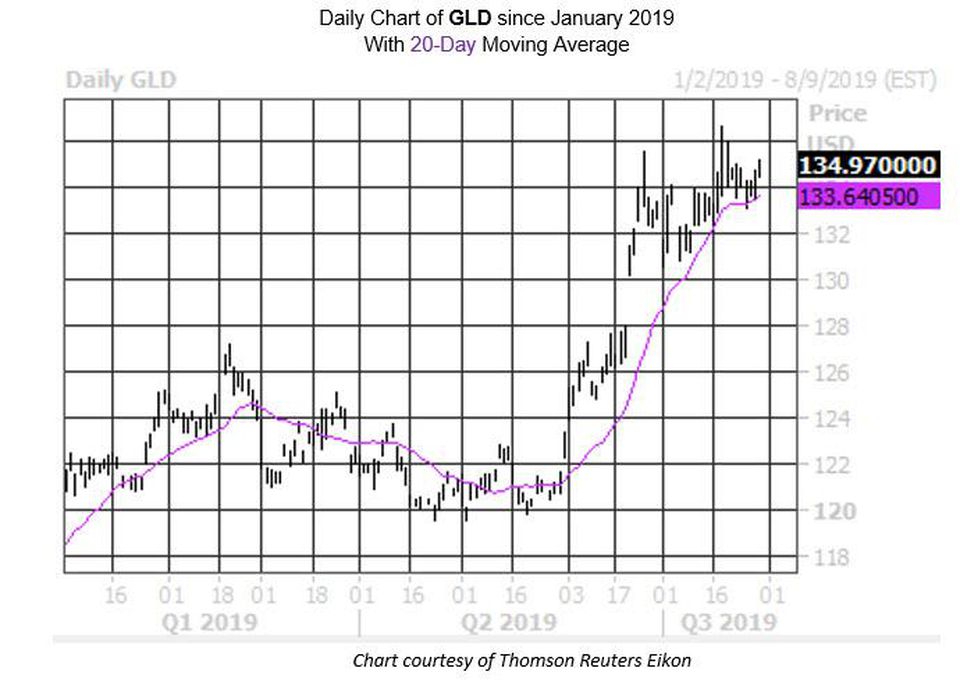

From its current perch, GLD is up 0.2% to trade at $134.97, so a move higher of similar magnitude a month out would send the ETF barreling past its July 19 high of $136.63 and just south of $139, territory not seen since 2013. GLD has relied on Fed news of rate cuts to move higher this summer, with pullbacks finding support at its ascending 20-day moving average.

In the options pits, calls have been in focus. GLD's 10-day call/put volume ratio of 2.21 on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks in the 86th percentile of its annual range, indicating not only that calls have doubled puts in the past two weeks, but also that the rate of call buying has been much faster than usual.

A note of caution though, as short-term options are pricing in extremely elevated volatility expectations, per GLD's 30-day at-the-money (ATM) implied volatility (IV) of 12.4% -- in the 90th annual percentile. Plus, the stock's IV skew of negative 28.3% registers in the 1st percentile of its 12-month range, meaning calls are near parity with their put counterparts.