(AssetMark) What is a TAMP? Whether you've heard it as turnkey asset management "platform" or turnkey asset management "program," the answers vary.

Depending on who you ask, you might hear that a TAMP is:

- An access point for advisors to find investment managers and investment strategies

- An organization for outsourcing investment management

- A consultant for financial advisors

- A provider of technical solutions for financial advisory practices

- An invaluable resource that no financial advisor can go without

In this article, we’ll explore the history of TAMPs, their advantages and disadvantages, how advisors can decide whether TAMPs in general or a specific TAMP will be useful to them, and how advisory firms can make the most of their relationship with their TAMP.

Past and Present: What are TAMPs?

The Past:

Originally, TAMPs served as a sort of middleman between advisors and investment managers. Without a TAMP, advisors would have to identify investment managers, screen them, perform due diligence, and monitor ongoing performance on their own. TAMPs filled an unmet need in the financial industry, and it’s clear why they became a prominent tool for financial advisors.

An additional advantage of this original conception of TAMPs was that they could leverage economies of scale to make more investment managers accessible to advisors. An individual retail advisor might not be able to meet the investment minimums set forth by certain investment managers. By bundling advisors and investment managers together, TAMPs increased access for all parties. In this original conception, TAMPs were best summarized as an access point.

The Present:

Nowadays, TAMPs are much more than mere access points. The advent of the internet has meant that it’s no longer so challenging to find investment managers and to find opinions and assessments of their strategies.

Identifying the right investment managers for each client, conducting due diligence, and monitoring performance are still very much part of modern TAMPs’ service offering, however—just because the information is available doesn’t mean that there’s time to evaluate it, or bandwidth for an advisor to develop the expertise in evaluation to begin with.

Just like financial advising itself, TAMPs are evolving beyond simply providing information and access, and more on the holistic financial needs of advisors and their clients. For advisors, the most important factor at play in their practice is the client experience. For TAMPs, it’s enabling that client experience.

Modern TAMPS provide essential front- middle- and back-office services to enable a robust client experience. Two of the most important: digital technology and streamlined service.

Like every business, the use of digital technology is quickly becoming table stakes. Successful advisors are rapidly adopting dashboards, analytics tools, data visualization tools, and more to conduct business functions faster and to more clearly communicate with their clients both in-person and remotely. TAMPs curate and integrate these tools at advisors’ practices, giving them both the efficiency they need to gain more client time and the modern appeal that makes that time more valuable.

In terms of streamlined service, modern TAMPs facilitate both front-office and back-office aspects of financial advising, in addition to the back-office support of the traditional TAMP model. This involves acting as a middleman between the advisor and custodians and/or brokerage platforms, processing and digitizing paperwork, facilitating trades and investment changes, and conducting all of the billing and reporting

Evolving even more, leading TAMPs also provide support in the front office of a financial advisory practice. These valuable organizations help advisors be the trusted guide they’ve always wanted to be to their clients; not a distracted business owner. By facilitating the growth, marketing, process improvement, and other functions essential to running a business, these TAMPs help advisors keep their attention on their clients instead of on how to make their business grow.

What are the Advantages of TAMPs?

-

More Time for Client Engagement

TAMPs allow for more capacity when it comes to client engagement and relationship building. Rather than spending all of your time balancing back-office duties like portfolio management, you can spend your time enhancing client relationships. Building your own client portfolios, poring over investment research, and allocating clients' assets may seem like a noble aspiration for any advisor, but our data shows it’s a trap: doing it all in-house steals your time, so you’re unable focus on profitability.

Time saved on investment management can go directly into the client engagement bank.

Time saved on investment management can go directly into the client engagement bank.

-

Accountability

When you leverage a TAMP, you take a weight off the shoulders of you and your team. If a client feels that their portfolio is underperforming or desires a shift in strategy, you’ll be able to select another vetted investment strategy from your TAMP, rather than engage in the full due diligence process over again. With this shift in responsibility for due diligence and performance reporting also comes a shift in liability, making it easier to focus on truly meeting your clients’ goals rather than on protecting your practice through potentially unwarranted conservatism.

-

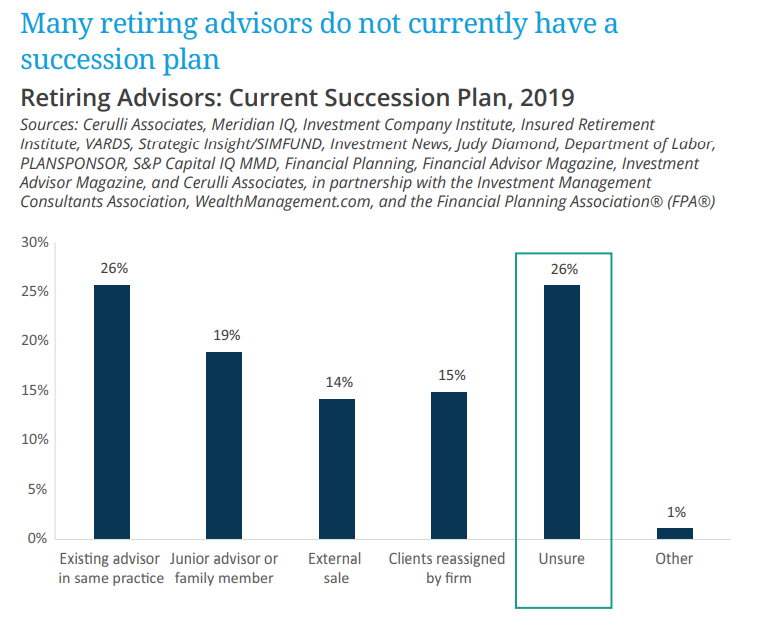

Succession Planning

While succession may not be something you often think about, it’s exactly the sort of thing successful advisors need to think about. Using a TAMP can help your practice grow, increase its valuation, and retain institutional knowledge as it passes from one owner to the next. This means you can rest easy knowing that your clients (and your clients' money) will have a consistent experience.

What’s more, advisors only get to execute on one succession plan during their careers (typically); TAMPs often act as succession consultants for many firms over their existence.

-

Access to Technology

A robust technology platform (or tech stack) is quickly becoming an expected feature in modern financial advisory practices. Advisors have the choice of evaluating, implementing, and maintaining their tech stack all themselves, hiring someone full time to manage their tech (often an IT professional without knowledge of the particular requirements in the financial services space), or outsourcing this work to a TAMP.

Typically, modern TAMPs provide a proprietary or third-party wealth management platform that advisors can use to streamline their financial planning processes and client communications (even during a pandemic). While not every TAMP does this, many will also offer other business support tools, or consult the advisor on how to select the tools that will work best for their practice.

-

Business Development

Although it’s rare right now, leading TAMPs support their advisors with robust business consultation services. At first blush, it might seem like it's outside of a TAMPs’ purview, especially if you’ve been used to thinking of TAMPs as traditional investment access points. But the most holistic TAMPs are all about maximizing the time that advisors spend with their clients—in that sense, attending to business growth is a huge distraction from that core service that advisors provide. More and more TAMPs are taking this perspective and assisting advisors with the challenges of business development so that they can return their focus to their clients, as well as onboarding new clients.

What are the Disadvantages of TAMPs?

-

Less Control

If you’re looking for support in investment management or business development or any of the other areas that TAMPs help with, you’re automatically ceding some measure of control.

This is especially true for the investment management side of things. Some advisors truly enjoy conducting due diligence and monitoring investment performance. Others find this work to be a distraction from what they truly enjoy—spending time with their clients and making financial plans.

The good news is that this disadvantage is typically a result of poor fit with a given TAMP. Conducting a thorough assessment of a potential TAMP can help you find the one that offers you the right amount of flexibility. Most investment advisors will want to find a middle ground between so much choice that you might as well be doing all the due diligence yourself and an overly restrictive offering that you have to accept and pass off to your clients.

-

Outsourcing Costs

Depending on the TAMP you're considering, you may wonder whether your practice can afford its fee. After all, no service is free—is working with a TAMP worth it?

Ultimately, the answer to this question depends on the individual advisor and the TAMP they’re evaluating.

Regarding the TAMP, it depends on what services they offer. Generally, those TAMPs that provide more holistic wealth management services (such as developing your practice as a business so that you can focus on your clients) will provide more value.

The advisor, too, plays a factor. If a given advisor is highly motivated by the non-revenue-generating functions of their business and doesn’t want to outsource those functions, they may see less value from working with a TAMP.

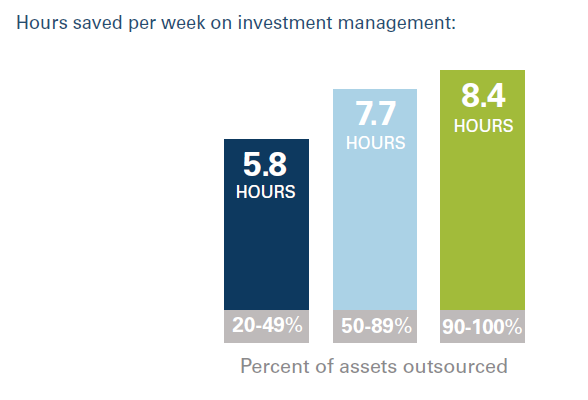

Ideally, you can find a TAMP that isn’t an all or nothing proposition. You might, for example, enjoy business development activities, but you could live without rigorous investment management. If you decided to outsource investment management, you could still realize an enormous benefit to your practice. In fact, one study found that advisors who did outsource investment management saved up to 8 hours per week.

How to Choose the Right TAMP

Determine How Flexible You Want Your TAMP To Be

TAMPs differ when it comes to flexibility, guidance, due diligence, and variety. With so many options available, it’s important to assess what your needs are and how much you want a TAMP to address them.

Broadly, there are three kinds of TAMPs to consider: 1) the supermarket, 2) the specialist, 3) and the curator.

- Supermarket TAMPs are, as their name suggests, very hands-off and all about an abundance of choice. If you’re the type of advisor that really enjoys the due diligence process and providing a bespoke solution, this is the kind of TAMP for you. On the other hand, if you want to spend as much time focusing on revenue-generating activities as possible, this is likely a poor fit.

- Specialist TAMPs provide the opposite experience. Often, these TAMPs have a particular financial philosophy in mind when they offer their investment strategies. They may have just a handful of strategies to pick from. This can be great if their investment philosophy aligns with your own, or if you and your clients just really aren’t all that concerned about investment management.

- Curator TAMPs sit in the middle. These providers typically hold a high standard and measure investment strategies and managers against that standard on an on-going basis. As a result, investment managers with a broad range of approaches wind up on the platform so long as they maintain a certain level of excellence. With these providers, it’s less about meeting some certain investment philosophy or offering unlimited choice and more about providing only high-quality choices across a spectrum of investment philosophies.

Ensure the TAMP Provider Meets Your Standards

It’s key to think of working with a TAMP as an extension of your business—especially when it comes to the due diligence process. You don’t want misalignment when TAMPs work with such important information. Do your research to ensure that your TAMP’s due diligence process fits with your business’ values. This is especially important if you opt for a specialist TAMP, as described above.

Measure How Much Growth a TAMP Will Provide

When it comes to selecting a TAMP, you have to look at the bigger picture. This is more than just taking tasks off your plate and freeing up your time. Your TAMP selection should be based on the knowledge that it can take your business to new heights. This can mean establishing client account KPIs that you’ll be tracking ahead of time, monitoring growth and comparing it to historical benchmarks, or even just regularly checking in on your goals and how much a TAMP has contributed to your client's investment overview.

Make Sure a TAMP Is What You Want

Before making your final decision, you need to be sure you're comfortable with the TAMP you’ve chosen. You’ll be working with your TAMP intensively if you do it right, so you want to be sure you’re confident in what provisions you’ll be gaining. Ideally, this is a long-term relationship that you’re building, so it’s important to pick a TAMP you can see yourself working with in the future.

How to Get the Most out of your TAMP

Have a Passion for Spending Time in Front of Clients

By outsourcing investment portfolio and admin duties, you’ll be spending a lot more time in front of current and prospective clients. In order to make the most of this, ensure that client-facing work is what you’re passionate about. After all, the ability to spend more time with clients is one of the major benefits of a TAMP, and spending time with clients has the highest ROI when compared to all the activities on a typical advisor’s calendar.

Be Ready and Willing to Delegate Non-Revenue-Generating Functions to Others

Regardless of which provider you settle on, you’ll need to be comfortable passing off non-revenue-generating tasks. As fiduciary, you’ll be spending a lot of time with client-facing work, and you should be ready to go full-steam ahead when it comes to revenue generation. If you ensure that your values align with the TAMP ahead of selection, you’ll allow for peace of mind and ease of integration.

Plan For the Future With Long-Term Goals

TAMPs enable long-term planning capabilities by providing actionable data insights and freeing up more time to look ahead. You’ll be able to take a step back and develop big-picture strategies. Take advantage of this by strategizing far in advance.

Growing your Business with AssetMark’s TAMP

What sets AssetMark apart from other TAMPs? Our approach is truly focused on enabling financial advisors in a holistic way. We don’t force advisors to take a one-size-fits-all approach, and we don’t leave them to do all the work on their own. Instead, we provide a curated experience strategically adjusted to the individual financial advisor’s practice.

Our approach is centered around service—the financial advisors we work with are dedicated to serving their clients, and we believe that their TAMP should provide an equal level of service. That’s why we serve our clients with a curated range of investment strategies, compelling digital technology, and business consulting that streamlines the front office so you can grow your practice and deliver an unparalleled experience to your clients.

As part of our advisor-first attitude, we focus on providing a sense of community as well. Financial advising can be an isolating experience. If you’re the expert, who do you go to for advice? The professionals at AssetMark are always available to talk, but we also host numerous networking events to ensure that our advisors are talking to and learning from one another. That way, your clients will always enjoy the best practices that are currently available in the industry.

Lastly, we’re growth-oriented. When we work with an advisor, our goal is to grow their practice. Some TAMPs simply slot into a practice’s existing business structure and keep the status quo going. We become a true consultative guide and identify the best opportunities for growth.

These are impactful benefits, but the only way to truly know whether AssetMark is a good fit for your financial advisory practice is to talk with one of our professional consultants. Reach out and request a consultation today.