(AssetMark) Financial advisor tech stacks save time and resources—so you can focus on serving clients. Lack of a developed tech stack can hinder client experience, marketing, and growth. But first comes the challenge of determining which platforms you, your firm, and your clients need to be efficient and effective.

In this article, we cut through the noise to help advisors navigate the increasingly complex tech solutions available for wealth management advisors. Here’s what you’ll find in this article:

- Individual Platforms vs. All-in-one Solutions

- Key Tools in Your Advisory Tech Stack

- Software for Every Stage of the Advisor-Investor Journey

What is a Financial Advisor Tech Stack?

A financial advisor tech stack is a set of software or apps a financial advisor uses for back-office operations or client-facing activities to manage investments, financial services, the business, or even client meetings. These digital solutions may be integrated working together or be used separately.

Individual Platforms vs All-in-one Solutions

The first decision that independent advisors often face is whether to select and purchase separate platforms or to outsource to an all-in-one provider. Let’s take a look at the potential benefits and challenges associated with both options.

Individual Platforms: Potential Benefits and Drawbacks

Assembling your own technology stack allows you to find the individual solutions you like most and integrate them yourself. Many tech companies today have created application program interfaces (APIs) to allow their products to connect with others. For example, an API-based approach might help users integrate a risk analysis tool with a financial planning tool with a relationship management tool much more easily than trying to integrate such tools if they were not API-based.

The potential downsides to this approach are that it requires significant tech savvy and can be time-consuming to both vet and set up various platforms.

- Research the various technology providers you can use and determine whether or not they have an API that works with your broader tech stack.

- Ensure your system is continually monitored and maintained from a security standpoint. Security is one of the largest potential risks of building out your own tech stack.

- Explore pricing including monthly or annual subscriptions for the various capabilities you want to access (it’s not uncommon for this to be more expensive in total than using an all-in-one platform).

Another important thing to note is if you lack the time or expertise to manage this system yourself, you’ll likely need to hire a full-time employee, contractor, or an external company to help build and maintain your system. Some firms use junior advisors to handle these duties, but it requires a sound working knowledge of technology and takes them away from focusing on other investment-related duties like building their own book of business, which may be a better use of their expertise.

All-in-One Solutions: Potential Benefits and Drawbacks

Outsourcing all-in-one platforms means you might not necessarily get all the niche features you want, but you’ll be able to rest easy in the knowledge your tech stack is being continually managed and upgraded in terms of both capabilities and security.

Additionally, outsourcing may offer some extra perks that might come in handy if you’re not a fintech wiz, including support whenever you need it or a digital training team that regularly hosts webinars and small group training sessions to ensure you’re getting the most out of your tech capabilities.

Some outsourcing providers like AssetMark also offer multiple platforms to serve the various needs of wealth managers. So, selecting an all-in-one provider does not mean you’re locked into one rigid digital solution. Here is a look at some of the platforms offered by AssetMark and the wide range of features and capabilities that advisors can access.

Key Tools in Your Financial Advisor Tech Stack

In terms of capabilities, your options run the gamut from fintech that supports your construction of portfolios, like risk tolerance and performance reporting to tools to help you manage your business, such as advisory fee billing and compliance software.

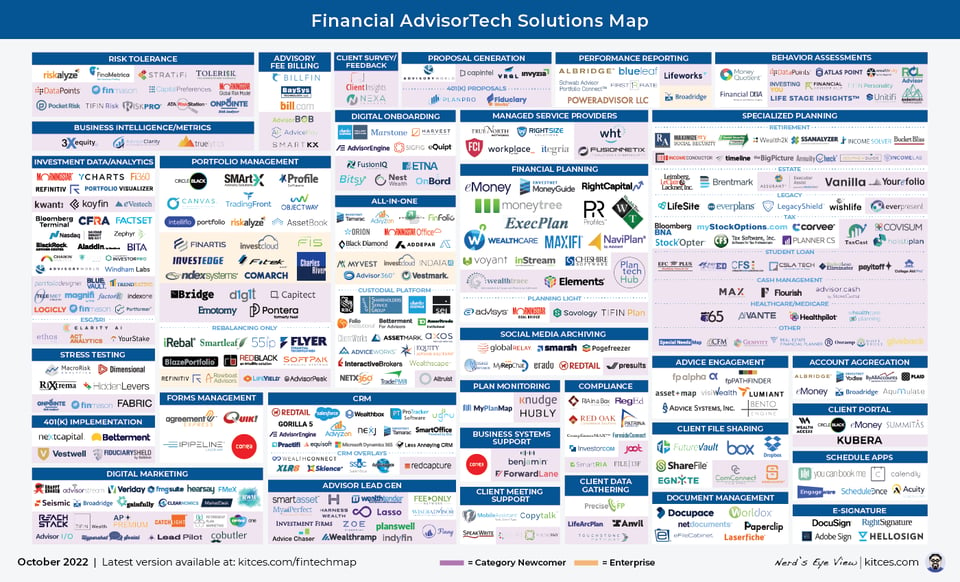

Michael Kitces maps out the fintech landscape with about 30 different capabilities and well over 100 platforms that advisors may wish to explore in his regularly updated Financial Advisor Tech Solutions Map.

Like any comprehensive listing, it can be exhausting to consider all the different options. Here are the essential capabilities every financial advisor should consider for both investment and practice management.

Investment Management Capabilities

- Portfolio Management System (PMS)

Portfolio management capabilities work in conjunction with financial planning, but provide greater emphasis on the analysis of different investments, portfolios, etc. Coupled with the analytics platform, below, it can help you construct portfolios optimized for specific risk/return characteristics. - Financial Planning

The cornerstone for wealth management advisors, financial planning software helps you assimilate a client’s objectives, risk tolerance, and constraints to create a plan to reach their goals. Very often, it allows for projections that help you and your clients sidestep potential pitfalls and incorporate changes that occur along the course of their journey. - Risk Tolerance

A strong risk tolerance platform helps you and your clients assess their comfort with exposure to risk in pursuit of their goals and helps set a baseline that can be carried through into other capabilities, below. - Proposal Generation

Proposal generation tools help you engage your clients and help them understand the strategies and tactics of their financial and investment plans. - Investment or Data Analytics

Really powerful investment or data analytics capabilities provide you and your clients with insights into their investments and portfolios rather than face a flood of data. Such insights can help guide your engagement and decision-making processes with clients. - Performance Reporting

Performance reporting automates streams of data and provides a cohesive, accessible structure to help you and your clients know where they’re at on their journey.

Practice Management Capabilities

- CRM

Customer Relationship Management (CRM) platforms help you track contact information and communications with clients, leads, and prospects. This allows you to streamline your processes and collect strategic information and data to help with marketing and sales efforts. - Compliance Software

Compliance management software or document software helps firms monitor and document all systems, processes, and documentation for compliance with required SEC standards and regulations. - Advisory Fee Billing

Advisory fee billing tools provide you and your clients with regular fee statements, so you and they can understand each part of the value chain they’re paying for. - Client Portal

A client portal is a secure web app that allows clients to access their private information and helps facilitate communications and business interactions. - Marketing Tools

Marketing tools are a collection of digital platforms, solutions, and resources that help firms not only promote their services to prospective clients but also engage and nurture client relationships for increased retention and referrals.

As you consider your options, you’ll want to start by covering the above capabilities. The next question that poses itself is when and how will you and your clients use each software. Do you have the tech to cover your needs at every step of your clients journey?

Software for the Advisor-Investor Journey

The advisor-investor relationship and journey may vary, but we’ve found there are certain stages along the path that nearly every advisor and client will go through together. To succeed, advisors need a platform that can smoothly carry them and their clients all the way through, including seamless workflows and a simple client experience.

.png?width=960&height=383&name=BlogAdvTechStckGuide_AMK-104947P_202210_opt2%20(3).png)

Quickly, here’s what the journey generally looks like: first prospecting for new leads, then onboarding newly acquired clients, followed by the ongoing cycle of delivering financial advice, constructing portfolios, monitoring, and servicing.

Via eWealthManager®—advisors’ gateway to access AssetMark tools and resources—advisors can access the latest resources and easily manage client portfolios for a smooth journey for the client and firm.

In the graphic below depicting the advisor-investor journey, you’ll see the names of several of AssetMark’s digital tools: AssetMark WealthBuilderSM, AssetMark PortfolioEngine®, Portfolio Review, and Investor Portal. One of these tools AssetMark WealthBuilder spans the entire journey, while the others cover different points along the path. Still, other digital solutions with AssetMark not listed below provide more niche capabilities.

Advisor Tech for the Whole Journey: WealthBuilder

AssetMark WealthBuilder is a comprehensive solution that makes it easy for new advisors or those advisors whose primary business is in something else, like insurance, to quickly get up to speed, prospect, and fund accounts. It’s been described as “advisory in a box,” and makes it easy to help clients get on track and stay on track when it comes to their investments.

WealthBuilder can also help advisors with a more established practice who have clients with more complex needs by providing an efficient way to manage clients who are exceptions to your account minimums. The platform makes it easy to help these clients pursue their investment objectives without requiring you to spend extra time on their servicing needs.

Here are some of the ways that WealthBuilder can help you and your clients.

|

WEALTHBUILDER |

WEALTHBUILDER |

|

|

A Few Words about Prospecting

One specific capability that deserves calling out is WealthBuilder’s prospecting capabilities. After spending about twenty minutes with WealthBuilder, advisors can set up a branded client discovery process with a unique link.

By including this link in emails, interested prospects can click through to an online discovery experience and enter information about their objectives and their risk tolerance—they even can reach out to you directly. The WealthBuilder platform alerts you when prospects complete the discovery process so you can engage them at the right moment. This process can help you both screen your leads and boost your chances of winning business because you’ll be connecting with a warm lead whose investment needs you already understand.

Capabilities for Complex Client Needs: PortfolioEngine and Portfolio Review

For advisors with a little more experience under their belt or those looking to provide more robust planning to their clients, AssetMark PortfolioEngine and Portfolio Review are a favorite. Advisors can conduct more sophisticated analyses of a client’s portfolio and investments or provide more complex portfolios that may better serve a client’s needs.

Many advisors who turn to AssetMark have clients with more complex investment needs or clients who need to make use of multiple strategies to construct portfolios to pursue their objectives. AssetMark has digital solutions to help advisors in both scenarios.

AssetMark PortfolioEngine empowers advisors to create and compare portfolios to help clients choose a plan to pursue their objectives. Let’s take a closer look at these elements.

|

PORTFOLIO ENGINE |

|

|

CREATE |

Build multi-strategy portfolios and view advanced analytics on the overall portfolio and the role each strategy plays in providing diversification. |

|

INTEGRATE |

Use the Holistic Portfolios feature of PortfolioEngine to help investors understand their complete investment picture and how their decisions regarding these separate investments might impact their overall portfolio—including not only AssetMark products and portfolios, but also stock options, 401(k) accounts, or even portfolios managed by another advisor. |

|

COMPARE |

Engage clients and view how different portfolios stack up against one another to illustrate how risk or return characteristics can be better aligned to an investor’s situation. |

|

PLAN |

Use the platform’s Monte Carlo simulations to project thousands of possible outcomes and show clients how different portfolios might play out over time. |

This can be a great tool for helping clients get on track with their investing and that different pools of money managed in different ways aren’t conflicting with one another. It also can create opportunities for you to bring those assets “into the fold,” should the opportunity arise (e.g., a retiring client wants to shift their 401(k) holdings into an IRA with their advisor or transfer a portfolio being managed by another advisor).

Another favorite feature of PortfolioEngine is its full integration with Account Wizard, making it easy to generate a branded, professional proposal to share with prospects in face-to-face or virtual meetings.

Full-Service Platform for Registered Investment Advisors (RIAs): AssetMark Advisor Managed Portfolios (AMP)

Designed with the complex needs of RIAs in mind, AssetMark Institutional’s Advisor Managed Portfolios® is a digital portfolio management and trading system designed to streamline and scale your practice. Integrated with leading custodians, AMP’s advanced technology gives you more time to focus on what matters most.

|

ADVISOR MANAGED PORTFOLIOS for RIAs |

|

|

CENTRALIZED PORTFOLIO MANAGEMENT |

Advanced modeling capabilities that make it easy to create custom portfolios across households and clients |

|

ROBUST TRADING AND REBALANCING TECHNOLOGY |

Efficient trading and rebalancing allow seamless trading across multiple accounts or models |

|

POWERFUL ACCOUNT MONITORING |

Actively monitor accounts using AMP’s drift parameters, alerts, and visual heat maps that can identify items requiring immediate attention |

|

DYNAMIC TAX HARVESTING AND TAX MANAGEMENT |

Easily implement custom tax management strategies at the model or account level |

Ready to Learn More?

Request a consultation to learn more about how AssetMark can deliver you the breadth and depth of investment-related and investment-adjacent technology to meet your and your clients’ needs.