(AssetMark) Estate financial planning isn’t something that most want to think about, and for good reason. Because asking the question “What happens to my wealth after I’m gone?” is bound to cause some uncomfortable thoughts, many clients simply don’t ask it.

As a financial advisor, however, you know that making a plan for the responsible and organized dispensation of wealth is essential. Since making an orderly and well-executed estate financial plan is a sensitive and nuanced process — what do financial advisors need to know in order to do this well?

Why Estate Planning?

First, it’s simply the right thing to do. As a financial advisor, you have a responsibility to safeguard your clients’ financial future. Part of that future is their eventual passing on and the distribution of their wealth to family members and communities.

Estate financial planning is also smart business. If you want to retain assets under management (AUM), then you’ll want to start building a relationship with your clients’ family members. Estate financial planning is the perfect avenue to do so.

By walking everyone through the process of wealth transfer and ensuring that everything goes as smoothly as possible, you’ll have gone a long way towards earning the trust of your clients’ family. The odds are that once your client distributes their wealth to family members, they’ll be looking for a financial advisor to help manage those assets.

In addition to helping you acquire new clients in the future, estate financial planning can also help you keep the clients you already have. Often, individuals that are acquiring wealth will work with multiple financial experts for various purposes—one might be their investment manager, another might serve as their tax advisor, another may be their retirement planner, and so on.

But as individuals grow older and begin to think about distributing their wealth, they tend to narrow down to one trusted advisor that can see the whole picture to orchestrate and manage their estate. If you offer estate financial planning, you could be this person to your clients.

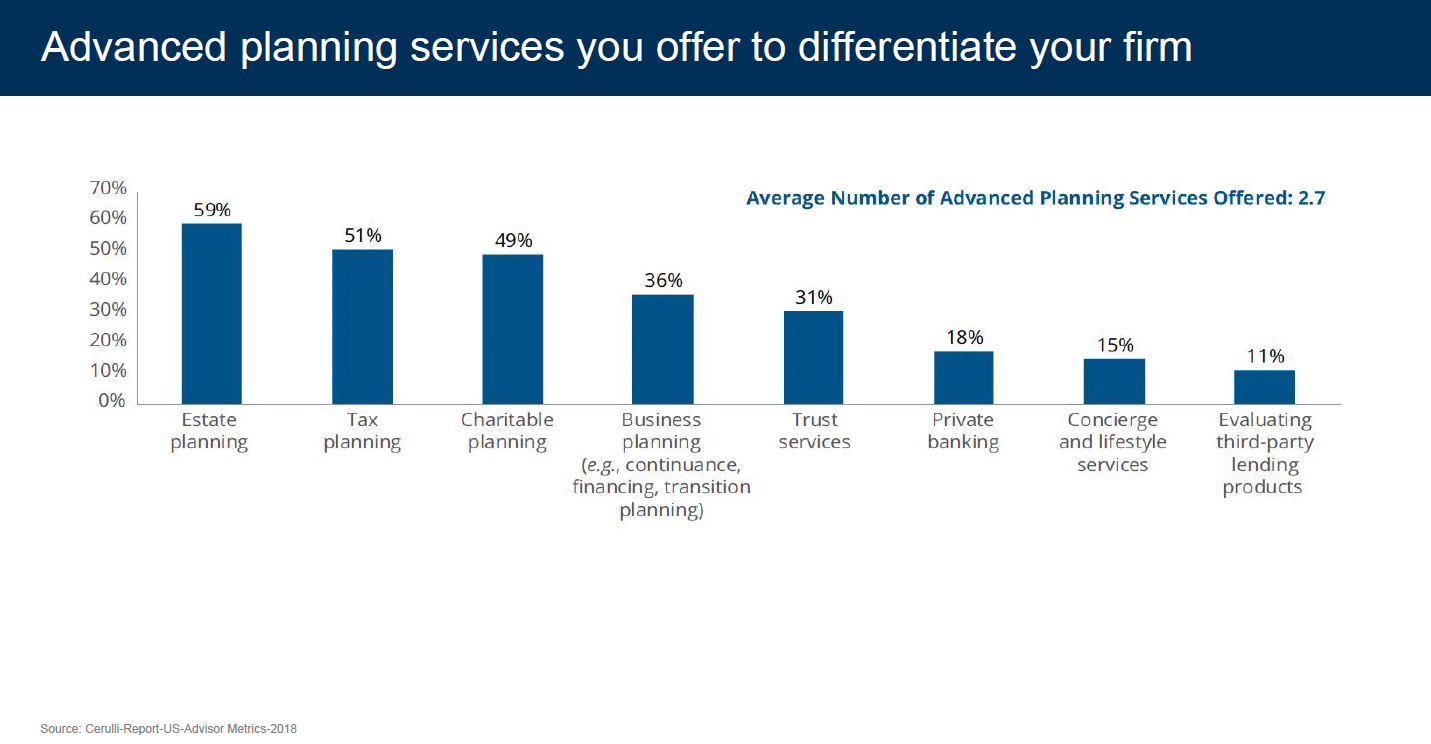

Lastly, the demand for estate financial planning exceeds its supply. According to the Cerulli US Advisor Metrics study, only 59 percent of financial advisors offer estate services. From the client's perspective, that means it’s almost a coin toss whether their advisor offers this service.

What Role Does a Financial Advisor Play?

As a financial advisor, your role is primarily to be an accountability partner.

Because estate financial planning is such a sensitive topic, one that many people would rather not think about in the first place, you’ll need to be the first to broach the subject with your clients. Once you’ve done that, build a plan with your client (or refer them to an estate planner) and schedule regular check-ins to make sure that they’re sticking to it.

Why Accountability?

You can make as detailed a plan for your client’s estate as you like—but ultimately, implementation is in the client’s hands.

Think about the tasks involved in estate planning. Your client might promise to:

- Write a will

- Make strategic charitable donations

- Identify an executor

- Name beneficiaries

- Make funeral arrangements

- Set up a durable power of attorney

But if they don’t actually carry these tasks out, there’s little you can do about it. Your involvement in these tasks beyond identifying them and advising your client on their execution is limited. Thus, you must keep track of your client’s progress to hold them accountable to the plan you’ve built together. Unlike other financial planning services, estate financial planning involves a point of no return. Once it’s too late, it’s too late.

How to Raise the Subject

We’ve talked about why estate financial planning is so vital. It’s:

- The responsible thing to do for your clients and their families

- An attractive service offering that not enough advisors provide

- A way to make you stickier to your clients.

- An opportunity to onboard the new generation of clients when the time is right

There’s no guarantee that a client will raise the subject to you first. Instead, financial advisors should make the first move, especially if they want to realize all of the benefits listed above.

But the best approach is going to differ from advisor to advisor. Larger, more established financial advisors, for instance, might make estate financial planning a mandatory part of their service offering. Sure, they’ll lose some clients this way, but it ensures that the clients they onboard will be more valuable over time and set up for success in the long-term.

Less established advisors will want to make estate financial planning a regular part of their client communication. Clients are going to differ in their readiness to discuss their estate; some will just need one nudge, while others will need repeated communications before they decide it’s time to act.

One Approach: Themed Client Review

An effective way to raise the topic of estate financial planning with your clients is to center client meetings around different themes.

Say you meet once a quarter with your clients.

For the first quarter, for example, maybe you talk about their taxes in addition to the regular housekeeping topics. In the second quarter, you might focus on their investments. In the third, you could discuss financial goals like education accounts for children or grandchildren. Finally, in the fourth quarter, you’ll talk about estate planning.

Crucially, you would communicate these themes to clients beforehand—that way, they won’t feel ambushed. And by regularly making this a part of your meeting plans for clients, they’ll eventually have to dedicate some time towards thinking about what they want to be done with their wealth when they pass away.

The Most Important Thing to Remember?

Ultimately, estate financial planning isn’t about your client—it’s about the people they’ll leave behind. Your client’s family members are going to feel the biggest impact from whatever plan you and your client put into action. It’s not only fair to involve them in the process; it’s necessary.

Once you and your client begin crafting a plan, schedule a meeting with all of their major family members to walk through the plan together. It’s essential to do this now when your client can answer questions, listen to feedback, and change their plan as a result.

There’s nothing more dangerous to your relationship with the next generation than for them to hear unexpected and unpleasant news about their deceased loved one’s estate plan. Even if a family member dislikes an element of the plan, discussing it ahead of time and explaining the reasons can go a long way toward preserving your relationship.

One way to get started toward involving your client’s family members in the estate financial planning process is to use our free Family Preparedness Workbook. This workbook can serve as a place to centralize important documents and information for your clients’ loved ones. It’s not a comprehensive solution for involving the family in your clients’ estate plan, but it can get the conversation started.

If you want to learn more about how you can best serve your clients’ family members after they’ve passed away, we recommend watching our on-demand webinar on the subject, Family Preparedness: Working with Clients Across Generations.

With these resources, you’ll set yourself up for success when it comes time to talk about the future of your clients’ estates.