(AssetMark) Smart investing is about finding opportunities in all market environments. As stocks and bonds continue to face the roughest terrain since 2008, widespread losses in portfolio value are a reality for both investors and advisors alike. But rather than dwelling on the drops, now is the ideal time to counter market volatility and macro uncertainty by optimizing the things that can be controlled—like taxes.

The combination of market performance, macroeconomic headwinds, policy shifts, and rule revisions has created a compelling opportunity to actively mitigate negative returns by pursuing tax-driven investment solutions that can help maintain well-rounded portfolios over the long-term.

Implementing tax strategies is not just for year-end, nor is it just for down markets, it is truly a year-round consideration. Wider tax brackets, higher standard deductions, and expanded retirement contributions are just some of the shifting aspects of tax policy that can impact investor portfolios as we move into 2023.

This 2023 Tax Tip and Investment Blog provides timely information to the new tax code revisions, while helping advisors navigate situations related to capital gains and losses, wash sale rules, and tax-loss harvesting to lower tax burden and minimize the impact of portfolio drops.

What’s New for Taxes in 2023?

A new year brings new changes to tax rules and policy—ones that can potentially have large effects on the bottom line of your clients’ investment portfolios. With sky-high cost-of-living increases and inflation running hot in 2022, the U.S. Internal Revenue Service made substantial Cost-Of-Living Adjustment (COLA) adjustments to Supplemental Security Income (“SSI") payments (+8.7%), in addition to inflation-adjusted revisions for retirement contributions, standard deductions, tax and capital gains brackets.

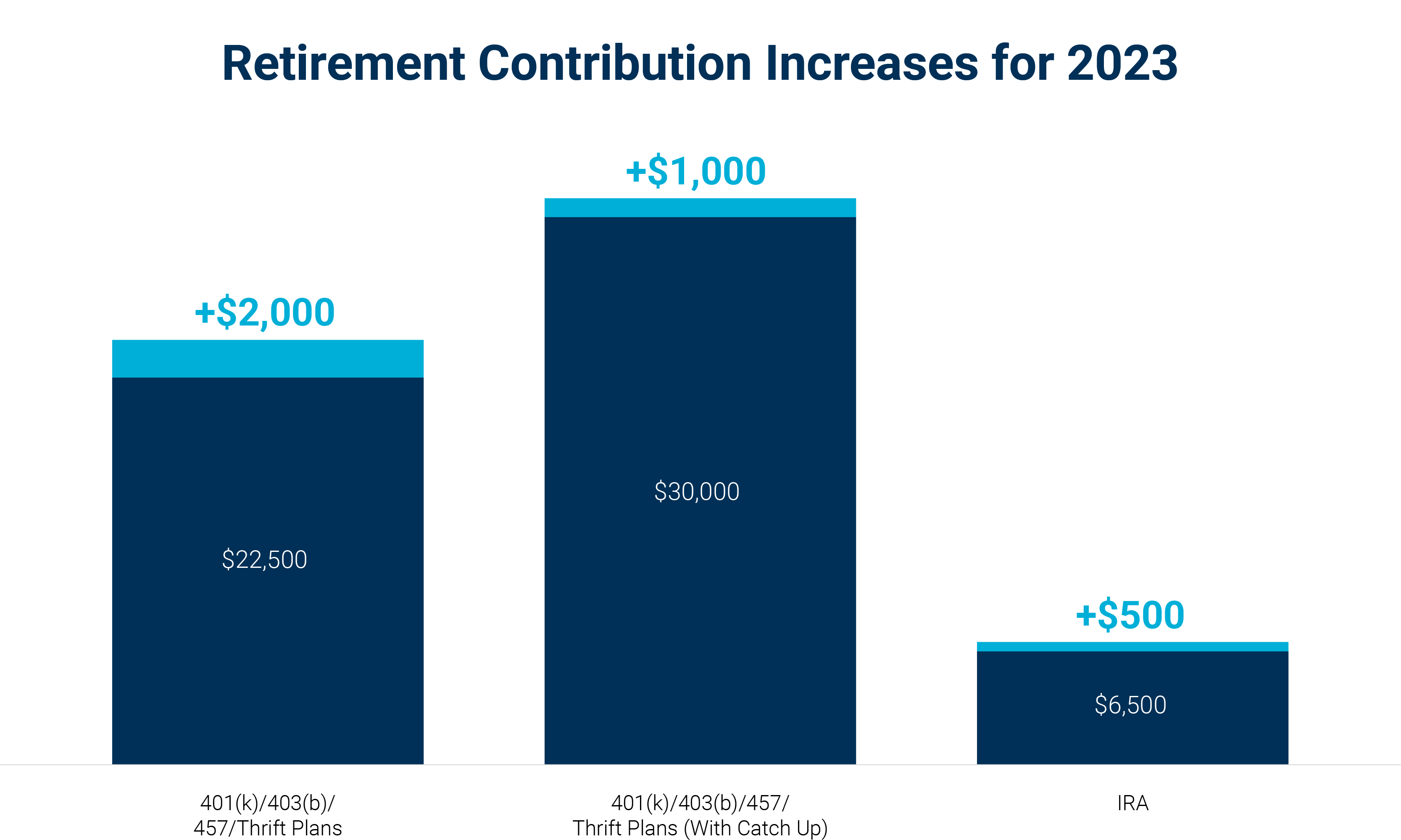

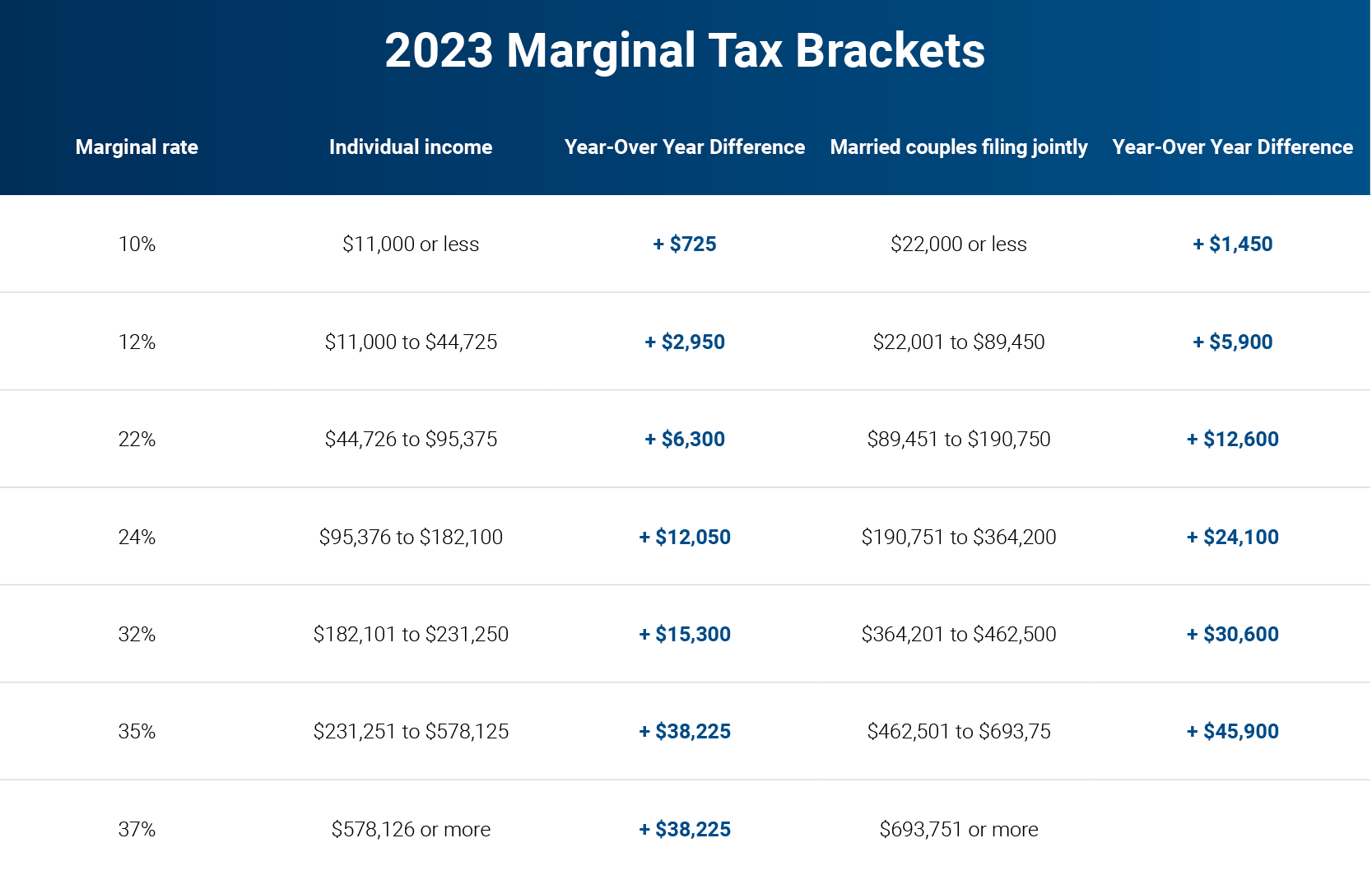

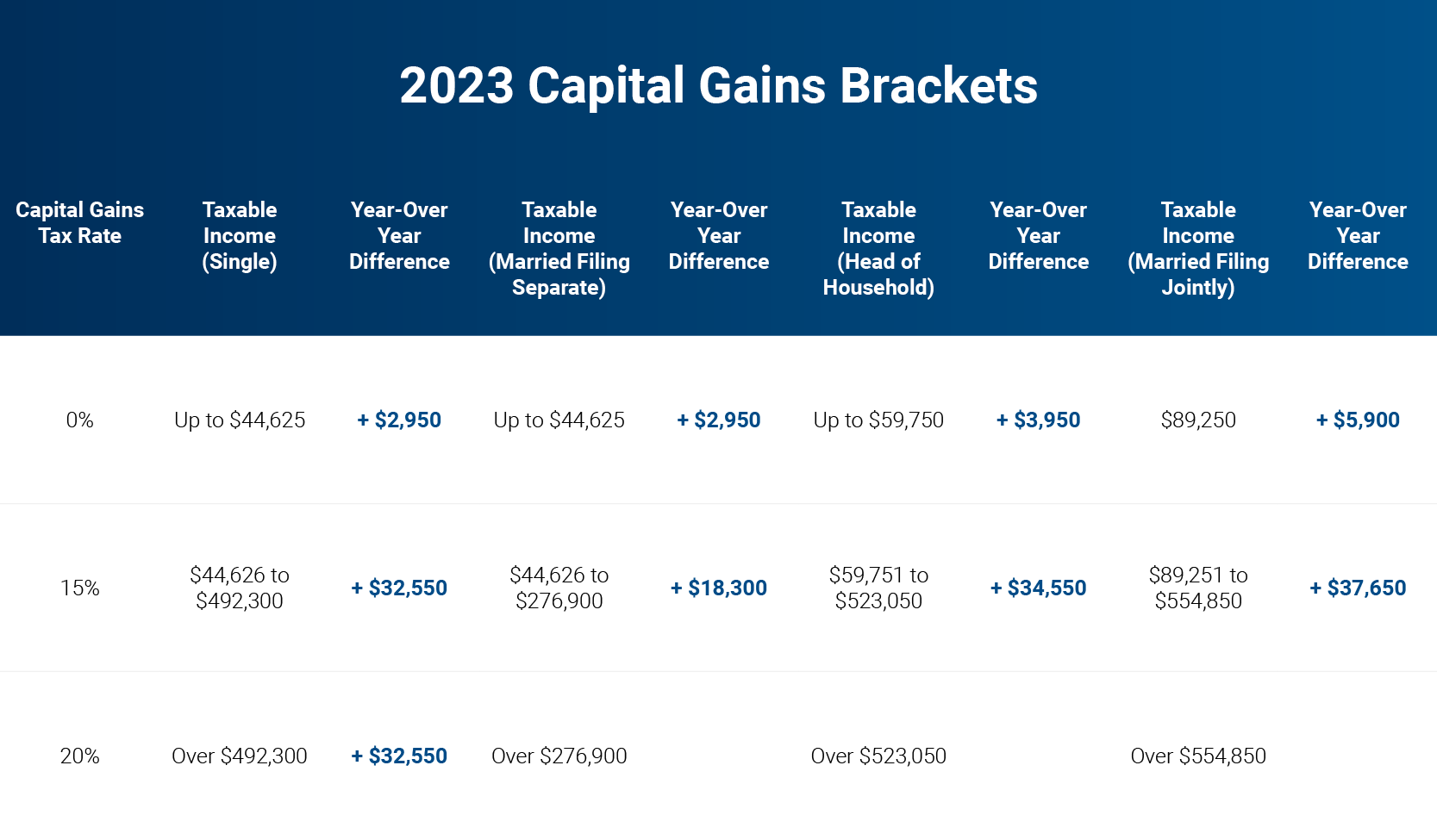

These annual adjustments are quite expansive, with large year-over-year increases across brackets, in addition to the largest increase ever in terms of dollars and percentage related to retirement contributions. Here are the most relevant 2023 changes:

Source: IRS

Standard Deductions for 2023

| Single Taxpayers $13,850 +$900 |

Married Taxpayers $27,700 +$1,800 |

Source: IRS

Tax Tip: Analyze client itemized deductions closely this year. And note the 401k Catch-Up (where those 50+ can contribute a larger amount to close the retirement gap) will increase in 2023 to $7,500 and the catch-up for IRAs will be adjusted for inflation in 2024.

Source: IRS

Source: What Are the Capital Gains Tax Rates for 2022 vs. 2023? (Kiplinger)

Tax Tip: Those in the highest income bracket need to keep an eye on Net Investment Income Tax (“NIIT”) (currently 3.8%), as the resulting effective rate can be as high as 40.8%. And when state and local income taxes are added in, the rates can be even higher for high-net-worth clients.

Bracket thresholds are going up by around ~7% from 2022 due to inflation adjustments.

Finding the Balance: Capital Gains & Losses

For much of the past decade, capital gains tax considerations have been the focus of many investors. But as the market moved lower in 2022, the tax conversation is shifting to include capital losses as well.

While this conversation can be difficult, a down market presents other tax opportunities – capital losses can offset previous capital gains, be carried forward, and offset a limited amount of ordinary income, like wages.

Offset Gains

Taxable capital gain – investment gain – realized in a tax year can be offset with a capital loss from that year or one carried forward from a prior year. If losses exceed gains, it is considered a net loss.

Carry Forward

If the $3,000 threshold is exceeded for a given year, investors can claim the loss in future years or use it to offset future gains.

Offset Income

If there are no capital gains for the year, claimed losses can reduce taxable income, lowering the overall tax bill.

Tax Tip: Consider charitable giving itemized deductions this year. Investors can donate appreciated assets held longer than one year to a qualified public charity, and by doing so, are able to deduct the fair market value of the asset without paying capital gains (subject to a 30% adjusted gross income limitation, with any excess deductible carried over for up to 5 years).

Learn more about charitable giving in our blog: Charitable Giving for High-Net-Worth Individuals in 2023

Keeping Portfolios Clean: 2023 Wash Sale Rules

When losses add up, many investors may want to wipe their hands clean and dump their losers as a way to capture tax benefits without substantially changing their portfolio allocation or strategy. This creates the urge to buy something similar in place of the underperforming stock. But such actions must be undertaken with caution, as you need to be aware of the IRS wash sale rule.

The wash sale rule prohibits the selling of an investment for a loss and replacing it with the same or substantially identical investment 30 days before or after a sale.

This essentially means that investors have a 60-day window in which they won’t be able to take a loss for a security on their current-year tax return. The wash sale rule is a way in which the IRS keeps taxpayers from gaming the system by claiming deductions for positions that are sold, but then quickly repurchased.

Tax Tip: If you have a wash sale, your clients won't be allowed to claim the loss on their taxes. Also keep in mind that the rule applies across the entire portfolio, so if clients sell individual holdings, they cannot buy another stock for their IRA, for example, without invoking the wash sale rule.

The Crypto Exception

For those speculating on cryptocurrencies, wash sale rules are still a grey area. Being a relatively new (and difficult to define) asset, cryptocurrencies have yet to be placed under the official regulatory eye of the IRS. Clients should check with their tax advisor to see if they can take advantage of the 60-day window.

Reap What the Market Sowed: Tax-Loss Harvesting

Knowing the parameters of tax rates and rules allows investors and advisors to utilize the power of tax-loss harvesting, a tax management strategy that can be utilized on an ongoing basis throughout the year. Implementing harvesting techniques can leverage normally burdensome market volatility, while adding value to portfolios by managing capital gains and losses, avoiding wash sales, and managing holding periods.

Investors “harvest” investments to sell at a loss, then use that loss to lower (or even eliminate) the taxes they must pay on gains made during the year. This process is generally three-tiered:

- Sell an underperforming investment that is losing money.

- Use that loss to reduce taxable capital gains and possibly offset up to $3,000 of ordinary income

- Reinvest the money from the sale in a different security that similarly meets investment needs and asset-allocation strategies.

There is no limit on the losses investors can harvest, however, only $3,000 can be applied against ordinary income, with the rest of the balance carried forward.

Tax Tip: Consider the actual-cost method for certain investors because it allows certain individuals to sell specific, higher-cost shares, potentially increasing the amount of the realized loss.

Harvesting Situations

While the tax timeline has several deadlines around December 31 each year, tax-loss harvesting is an ongoing process that can be taken advantage of throughout the year in order to optimize investment portfolios.

There are many situations where tax-loss harvesting can be deployed strategically:

- You have investments subject to capital gains

- You have the ability to defer until retirement

- You moved up/down in tax brackets

- You invest in individual stocks

- You had negative returns

Tax Tip: Factor in Tax Drag when assessing the value of tax-loss harvesting. Tax drag is the long-term cumulative reduction in portfolio returns due to taxation. By taking the opportunity to fine-tune your portfolio over the year, investors can further mitigate the costs of tax drag and enhance their portfolio by minimizing unnecessary taxation.

Additional Tax Tips, Changes & Tactics

Beyond the core pillars of intelligent tax strategy, there are other targeted considerations and insights both advisors and investors can take into account when designing a tax-optimized portfolio for 2023 and 2024:

Form 1099-K Changes

One of the more obscure updates, 1099-K changes are for those who engage in third-party payment network transactions. With the passage of the American Rescue Plan Act of 2021, the reporting threshold for third-party networks that process payments for those doing business has been lowered.

Tax Tip: Cash received through third-party payment networks from friends and relatives as personal gifts or reimbursement for personal expenses is not taxable.

Post-Pandemic Normalization: COVID-era Tax Credits Reduced

A particular aspect of the tax code that has not been communicated well is the changes to pandemic-era tax credits. The credits implemented during the pandemic are rapidly reducing or expiring completely. Many taxpayers may receive a significantly smaller refund compared with the previous tax year. Impacted credits include:

| Child Tax Credit (CTC) was $3,600/dependent now $2,000/dependent |

Earned Income Tax Credit was $1,500 now $500 |

Child and Dependent Care Credit |

Source: IRS

See more credits & deductions here.

Before Sunset: Estate Planning Provisions

Another time-sensitive consideration is related to the estate planning provisions included in the 2017 Tax Cuts and Jobs Act that will be sunsetting at the end of 2025. Although doubled in the Act itself, the estate and gift tax exclusions will revert to pre-2017 levels in 2 years.

Tax Tip: Consider accelerating or donating appreciated assets. Individuals can also gift up to $17,000 per family member of other persons. For a married couple, each person can gift this amount without it being considered taxable. Talk to your clients and their tax advisor about opportunities to optimize their investments, expenses, and taxes.

Read more about Estate Planning here.

Clean Credits: Electric Vehicle Tax Benefits

The Inflation Reduction Act of 2022 (IRA) focused heavily on updating and detailing EV tax credit qualifications with the Department of Energy listed somewhat stringent requirements on whom and what models are eligible for the updated credits. The most notable is the primary requirement that to be eligible, the EV must have final assembly in North America.

Tax Tip: Review the details of the requirements. Due to supply chains issues, EVs can be assembled in places outside of the North American region.

General Tax Changes: The Importance of Communication & Information

Knowing the details of tax policy (and then communicating those details in a timely fashion) goes a long way. Industry polling shows that some key concerns amongst financial professionals are late tax filing and unprepared clients. This is particularly important in times of substantial tax code changes, both in terms of preparing the right plans and building strong relationships between advisors and investors.

Tax Tip: Working closely with clients’ tax advisors and communicating minor changes like 1099-K can mitigate “late-filing anxiety”, while giving them peace of mind knowing they have a financial advocate in uncertain environments. Now is the time for more communication, guidance, and reassurance. A prepared and informed investor is a confident one.

Navigating Uncertainty in 2023

As we march into 2023, taxes can be a major headwind for investors, yet the impact of these taxes on investment portfolios can be managed intentionally, reaping benefits for investors and advisors alike. Seizing these opportunities during periods of uncertainty and volatility can help create investor confidence and peace of mind; knowing that they are positioned well to manage their after-tax wealth despite the macro environment.

This is where AssetMark can make a difference. Equipped with the infrastructure needed to help advisors manage clients’ tax situations, our investment management services provide support for advisors seeking optimized solutions for their clients and their practice.