Scott says: AssetMark seems energized and ready to face the future with its new executive team in place. They sent us this article exclusively. I think it sums up their partner proposition extremely well.

Advisors face a daily balancing act as they divide their time between serving existing clients, attracting new leads, and managing their businesses—all without significant resources and staff. Add to this a backdrop of clients increasingly expecting custom solutions and digital experiences to track and achieve their financial wellness goals as part of their advising experience, and the hurdle to meet and exceed all expectations becomes dangerously high.

As financial advisors are pushed to tailor solutions for individual client needs and time becomes an increasingly precious commodity, it’s crucial that advisors make deliberate decisions about how best to spend their time. Outsourcing is one solution that advisors can leverage in order to carve out more time with their clients and help them deliver a stronger, more holistic service. A recent industry study reveals that 86% of advisors who outsource investment management agree that it has made them more successful. Here are three tangible ways outsourcing is driving advisor success.

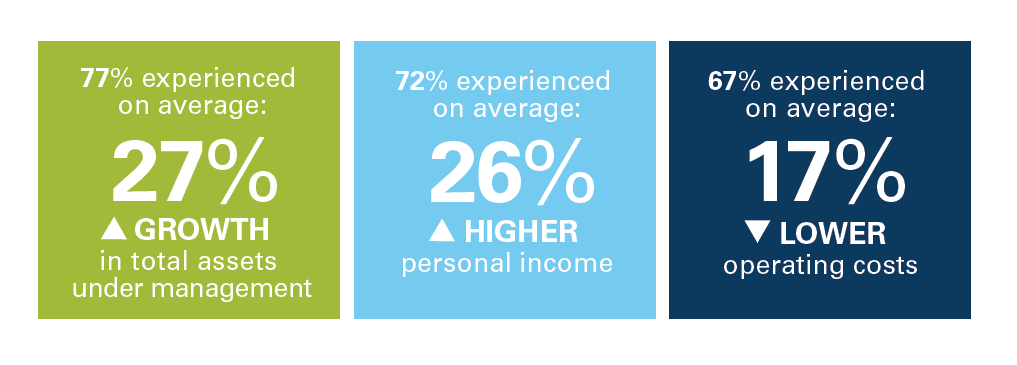

Advisors who outsource experience increased assets, lower costs

The pressures on financial advisors are changing and growing as investors seek individualized and transparent goals-based advice. With baby boomers retiring and market influencers becoming increasingly nuanced, there will likely be higher demand for advisors. Delivering a superior investment management experience is one way advisors can attract new clients and address rising demand. Outsourcing investment management gives advisors access to a broad range of investment solutions, portfolio management oversight, and sound due diligence processes, better positioning them to provide added value to their clients. In turn, this can contribute to stronger business performance. Study results show that as advisors outsourced more they experienced a growth in total assets and personal income, while also experiencing lower operating expenses. Further, as businesses become more profitable and margins increase, advisors can experience a range of personal benefits, from decreased stress to more capital to save or invest.

Advisors who outsource more, benefit more

Study results show that the more financial advisors outsource their investment management, the greater the benefits. Those who only tangentially embrace outsourcing fall short of the full potential of the scale and efficiency it can provide, and often struggle to manage the greater complexities that come with disparate solutions. A study looking at the value of outsourcing categorized advisors into different groups based on the percentage of their business that they outsource. Across all key performance indicators—operating costs, mean increase in total assets, business growth, and personal income—the advisors who outsourced more of their business experienced greater outcomes. Advisors who outsourced 90 -100% of assets under management also noted a times savings of over eight hours per week.

Advisors who align with a holistic outsourcing platform see better results

As investors increasingly demand personalized solutions tailored to their individual financial goals, advisors need to be able to provide holistic solutions focused on addressing specific client needs. Outsourcing to a third-party that has a curated platform, rather than a supermarket of solutions, has been shown to provide greater benefits to client deliverables and business impact, as well as advisors’ personal lives. By enabling advisors to build products and solutions that serve their clients’ individual needs, holistically curated platforms have been shown to deliver advisors the greatest returns.

Financial advisors today face mounting pressures to strike the right balance between managing their business and catering to clients. It’s crucial that they spend their time where delivers the greatest value. When considering the decision to outsource, advisors should focus on how it will enable them to scale their business and dedicate more time to client-facing activities. By offloading work from advisors and providing tailored solutions to meet investors’ needs, investment management outsourcing can allow advisors to be more impactful in their work and their clients’ lives.