(Forbes) “Prepaid” 529 plans allow consumers to lock-in future tuition at current prices, but they have largely been overshadowed by the more popular 529 “Savings” plans. However, new research shows that the oft-overlooked Prepaid may be a better bet than originally thought, offering superior risk-adjusted returns, historically.

Prepaid Or Savings, Or Prepaid AND Savings?

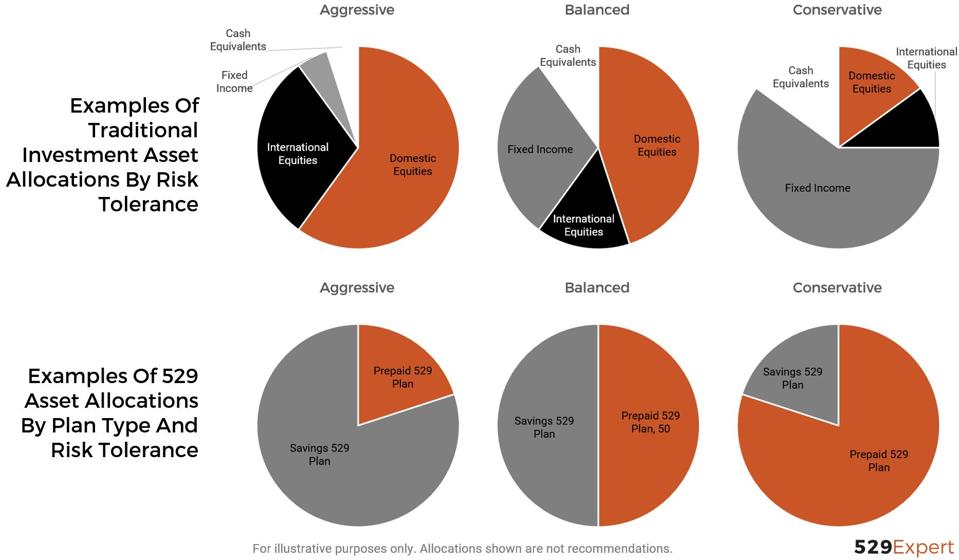

Savings plans are easier to understand for most investors since they share similarities to 401(k)s. In the plan, you select from a menu of mutual fund-like portfolios. Prepaid plans, by contrast, operate more like pensions. They provide a guaranteed return for investors tracking an index, such as national or state tuition inflation. As a result, the two types of 529s perform like different asset classes (e.g. stocks vs. bonds) over time, with a low to negative correlation.

The lower the correlation between different assets the better the diversification benefits, reducing overall risk. Research conducted by 529 Expert, LLCand sponsored by Private College 529 Plan found investing some college savings in a Prepaid and some in a Savings plan improved the overall “risk-adjusted return.”

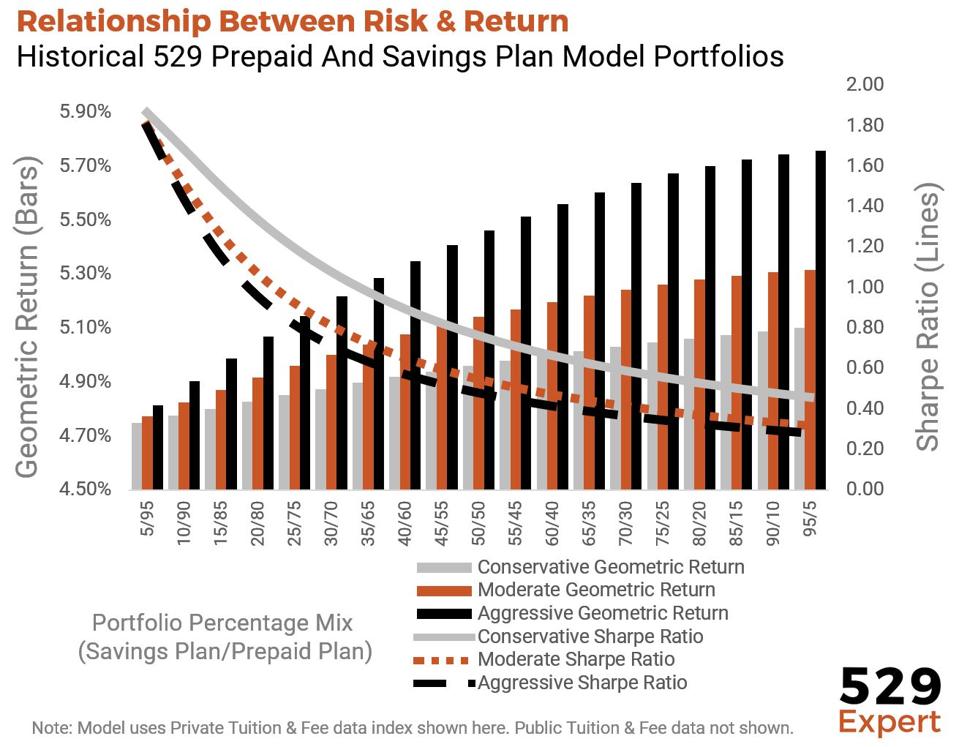

Think about risk-adjusted returns in terms of portfolio fuel efficiency. The faster you drive the quicker you reach your destination, but the more gas you burn and the higher probability of an accident. There is an optimal speed at which safety is reduced and fuel-efficiency improves. This risk-adjusted return efficiency is measured by the “Sharpe ratio,” but instead of miles per gallon you are measuring return per unit of risk (as measured by standard deviation). The higher the ratio, the more return you are getting for a specific level of risk.

Optimizing Risk-Adjusted Return

In 114 combinations of model portfolios the research showed that the Sharpe ratio improved dramatically when adding Prepaid assets to a traditional Savings portfolio over a 22-year period. In fact, data would suggest an optimal college-savings investment portfolio include 50% or more of assets in Prepaids to optimize overall risk-return characteristics.

The goal of the research was to find which combination of Prepaid and Savings portfolios produced the highest Sharpe ratio. Surprisingly, risk-adjusted performance continues to increase the more you hold assets in Prepaid plans. There is a tradeoff in potential returns when reducing your Savings plan allocation, but there is a greater benefit in overall portfolio efficiency – in terms of the Sharpe ratio – the more that was held in Prepaid plans.

This held true for Savings plan model portfolios that were conservative, moderate, and aggressive in their respective investments. However, the benefits of owning Prepaid plans alongside a Savings plan were highest with the aggressive portfolio and lowest with the conservative portfolio. This is likely due to the higher correlation between Prepaid plans and the model conservative portfolio.

Having Both Plans Reduces Their Risks

Prepaid and Savings plans types both offer all the standard federal benefits: Tax-deferred growth and tax-free withdrawals for qualified higher education expenses, for example. Prepaid plans lock in today’s tuition rates and Savings plans offer higher return potential, but each has their own drawbacks, as well.

- Savings plans offer investors market participation. It’s possible, therefore, to outpace tuition inflation and then some, but it also means that there is the potential loss of principal. Many 529 investors were shocked during the 2008 bear market to see their portfolio drop 20% or more, leaving some with a net loss. As a result, savings plans make sense for investors that want more flexibility and return potential, but who have a higher risk threshold for their college savings.

- Prepaid plans, typically have restrictions that savings plans do not. Most Prepaids limit participants to schools in their network or state, meaning if your beneficiary attends an out-of-network or state school, you may not see the returns you anticipated. More than half of all prepaid plans have either closed to new participants or liquidated, as well, making the future of Prepaids less certain than Savings. To this end, investors who are reasonably certain of the school their child will attend or who are more risk averse may find Prepaids more attractive.

Individual states may offer unique benefits for either type of plan, such as tax deductions or matching grant programs to participants. It is important to review your in-state plan before considering other 529 programs, as a result.

So What Does This All Mean For Investors?

College savers could reduce their overall risk without sacrificing significant return potential by investing in both a Prepaid and Savings 529 plan. In particular, aggressive investors, those with a longer investment time horizon such as young parents, stand to benefit most from the addition of Prepaid plans to their college savings strategy. Regardless of plan type, investors should use caution and understand the benefits and drawbacks of 529 plans before investing.