Rumor has it that Apple (APPL) will release its cheapest ever top-tier phone this fall.

Influential tech magazine Tom’s Guide recently posted a leak claiming iPhone 12 will retail starting at $549. That’s almost half of what Apple charged for iPhone X a few years ago.

The leak came shortly after Apple released its second “budget” phone, iPhone SE, which sells for $399. That’s a hundred bucks less than the first iPhone.

This raises the question: Why is the most premium tech product maker all of a sudden selling itself short? As I’ll show in a moment, Apple’s business is entering a new era where iPhone profits won’t matter anymore.

Low price tags might seem like a desperate move to fend off competition. But like a chess master plotting several moves ahead, Apple is using cheap phones to seize what Apple’s CEO, Tim Cook, calls the “mother of all opportunities.”

The single most important number in Apple’s business

iPhone is hands-down the most successful product in history. Since its introduction, Apple sold more than a trillion dollars’ worth of iPhones. And for years, iPhone generated more than half of Apple’s total sales.

But iPhone was more than Apple’s biggest money maker. It was Apple’s gateway into the pockets of over a billion people.

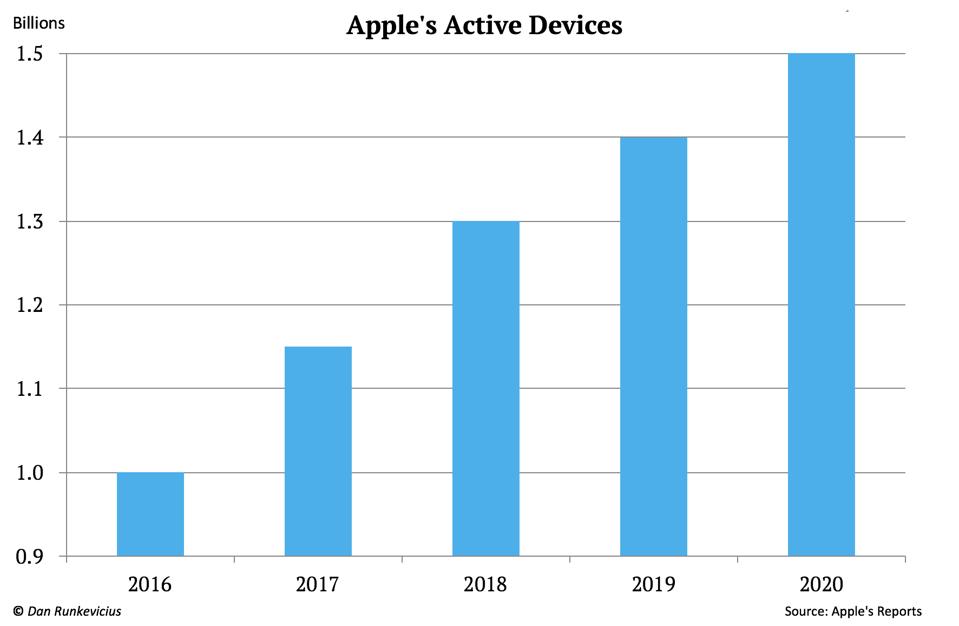

Take a look at this chart. It shows the growth of Apple’s active devices all across the world:

Apple's active devices (2016-2020)

DAN RUNKEVICIUSThanks to iPhone, Apple now has 1.5 billion active devices—phones, watches, etc.— used by over a billion people from all across the world. The company added a whopping half billion devices during the last few years alone.

Think about it, nearly one in seven people now carry around an Apple device every day.

Today, those 1.5 billion active devices are the single most important driver of Apple’s business. Even more important than phone sales alone. Because every day Apple earns more and more money from them.

Apple makes tons of money outside an Apple store

It does so through a myriad of services connected to Apple devices.

Take payments. Apple earns money every time anyone uses an iPhone to shop. When they pay at a local grocery store with Apple Pay, Apple gets a cut. When they buy an app from the App Store, Apple gets a cut.

Then there’s a suite of subscription services that Apple conveniently shoves into the faces of iPhone holders.

For starters, Apple sells a very steep warranty and insurance service—AppleCare—which amounts to about one-fifth of the phone price. Then there’s the iCloud cloud service and the magazine subscription service, Apple News.

In 2015, Apple also launched its music streaming service, Apple Music. In just four years, Apple Music grew to 68 million subscribers and became the world’s second biggest music streamer.

Last year, Apple joined the video streaming race with Apple TV+. Apple hasn’t reported on its subscriptions, but several sources pegged the number at 10-30 million.

The least visible, yet very lucrative, side of Apple’s services business is licensing. Apple charges companies billions of dollars to get their services or apps on Apple devices. For example, Google GOOGL +1.2% pays Apple a whopping $7 billion a year to be the default search engine on iPhones.

There are many more smaller Apple services I haven’t mentioned. And every one of them pulls in more money than you might think.

Apple now earns more from its services than it does from iPhone

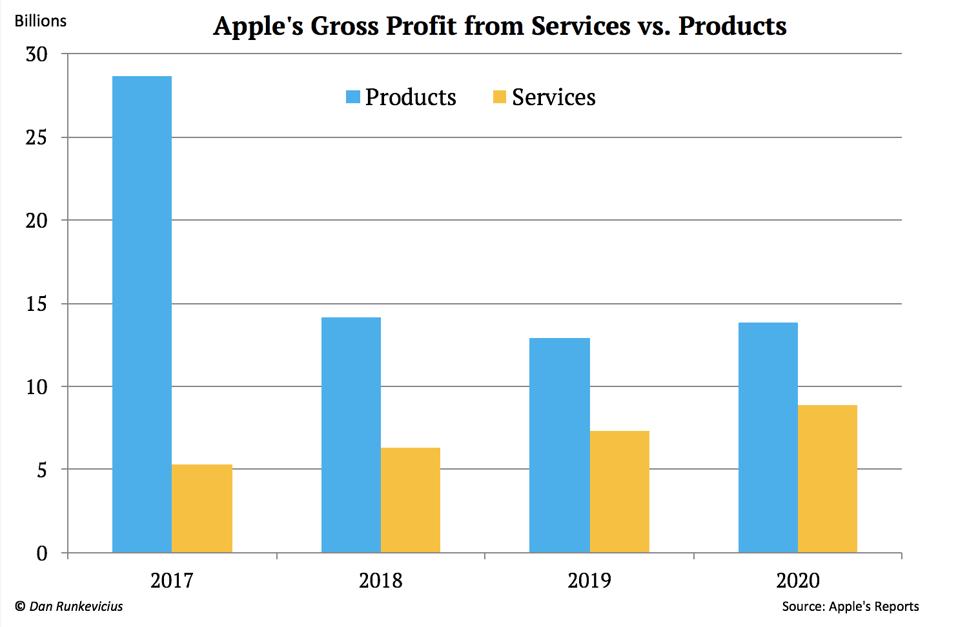

Let me show you the most important chart about Apple right now. It shows how much of its profits Apple earned from services vs. products in recent years:

Apple's gross profit from services vs. products

DAN RUNKEVICIUSIn 2017, Apple products earned the lion’s share of their profits while services made up just 15%. Today, services bring in more than half of Apple’s total gross profits—and Apple has just barely dipped its toes in this industry.

The “mother of all opportunities” lies in enterprise services

Now Apple has set its sights on a much larger bite of the apple: enterprise services. It’s such a lucrative industry that Apple’s CEO, Tim Cook, calls it the “mother of all opportunities.”

You probably haven’t noticed it, but Apple is already making moves to get its foot in there. Behind the headlines, it has started gobbling up companies with technologies aimed at businesses.

Last month, Apple bought Fleetsmith, a software company that helps businesses deploy and track Apple devices across workplaces. This is part of Apple’s plan to get businesses to use Apple devices, and in turn, its enterprise services.

A few weeks ago, Apple bought Mobeewave, a company with technology that could turn iPhones into mobile payment terminals. This technology will get Apple’s hands on a massive $69 billion point-of-sale terminal industry.

I expect more and more similar acquisitions down the line that could soon morph into the most lucrative suite of Apple’s services.

The end of Apple as we know it—but in a good way

iPhone is no longer Apple’s biggest money maker. It’s services.

That’s why Apple doesn’t care about iPhone prices anymore. It’s goal is simply to put more and more of its phones in people’s hands—at any cost. Because the more people carry iPhones, the more people will buy Apple services.

And it’s working.

Last quarter, Apple’s sales from services roared to an all-time record. But with its push into money-spinning enterprise services, I’m convinced Apple’s growth story is just starting. For this reason, Apple stock sits at the top of my watch list.

This article originally appeared on Forbes.