COVID-19 continues to impact the United States, the federal government is taking action to ease the burden on taxpayers. Most recently, the Senate passed a massive stimulus package (the House has yet to vote but is expected to follow suit). A key feature of the stimulus is individual checks.

As with anything tax-related, there’s a little bit of confusion. To help you sort it out, here are a few questions and answers:

When will I get my check? Checks are supposed to be produced “as rapidly as possible,” but it’s been suggested that could take up to two months. If you use direct deposit, it will be faster.

How big will my check be? Checks will be $1,200 per adult - or $2,400 for married couples filing jointly - and an additional $500 per child.

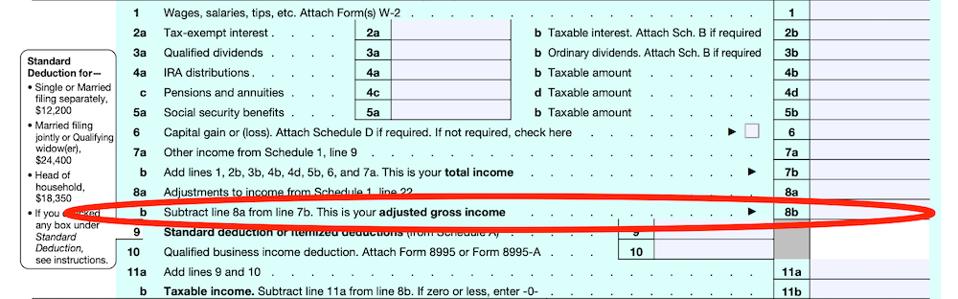

Are there income limits on checks? The amount of the checks would start to phaseout for those earning more than $75,000 ($150,000 for joint returns and $112,500 for heads of household). This is adjusted gross income (AGI), not taxable income - so before your standard or itemized deductions. You’ll see your number on line 8(b) of your form 1040:

Wait, how does a phaseout work? Phaseout means that the benefit goes down as income goes up. In this case, for every $100 of income above those thresholds, your check will drop by $5. So, if you are a single filer earning $75,100, your check will be $1,195 ($1,200-$5). If you are a single filer earning $85,000, your check will be $700 ($1,200-$500). If you do the quick math on that, it means that you’ll phaseout completely (meaning that you’ll get nothing) once you hit $99,000 as a single filer, $198,000 as a married couple filing jointly, or $146,500 for heads of household.

What about limits on kids? There are no limits on the number of children that qualify. The definition of child will be the same as for the child tax credit (you’ll find the age and other requirements at that link).

Will I need a Social Security Number to get a check? Yes. Or in the alternative, an adoption taxpayer identification number. Ditto for spouses and kids.

So how does this work? Do I need to file anything to get my check? Technically, the checks are advances of refundable credits. Treasury will advance your check based on your most recently filed tax return (2018 or 2019 tax return). If you haven’t filed a tax return, the bill allows Treasury touse the information on your 2019 Form SSA-1099, Social Security Benefit Statement, Form RRB-1099, Social Security Equivalent Benefit Statement.

Okay, I don’t understand. What is a refundable tax credit? The check acts like a refund you get in advance. When you file your 2020 tax return, the IRS will compare your income numbers. If you should have gotten more than you did, you’ll get a refund. If the numbers on your 2020 tax return are different from your 2019 tax return, I don’t expect that you’ll have to pay it back (as the bill is written now). Don’t worry: most taxpayers should get just the right amount.

Is my check taxable? No. This is not taxable income.

What if I am expecting a refund for the 2019 tax year? Your 2019 refund will not be affected by the stimulus check.

What if I’ve moved? Under the law, the Treasury must send notice of the payment by mail to your last known address. The notice will include how the payment was made and the amount of the payment. The notice will also include a phone number for the appropriate point of contact at the Internal Revenue Service (IRS) if you didn’t receive the payment. You can help make sure that it goes to the right place by updating your address after a move. Usually, you’d do that on your tax return, but you can also submit a federal form 8822, Change of Address (downloads as a PDF). It generally takes four to six weeks to process a change of address.

What about retired folks? Retired seniors are eligible.

What about those on government benefits? And those with no income? Yes, eligible folks include those with no income, as well as those whose income comes entirely from non-taxable means-tested benefit programs, such as SSI benefits.

Is my check subject to offset? No. If your refund would normally be seized to pay a debt, that shouldn’t happen here. Shouldn’t. Assuming it works as planned.

This is a done deal, right? Mostly. It cleared a hurdle in the Senate on Wednesday night and is expected to pass in the House. The President, through Treasury Secretary Mnuchin, has expressed a desire to sign a relief bill quickly.

So no changes? I didn’t say that. There could be additional guidance from the IRS. I’ll let you know by updating this page.

Not that I don’t trust you, but where can I find this in writing? I’ll post the official text as soon as it’s available.

This article originally appeared on Forbes.