(FN) Mark Mobius has clear advice on what he’ll avoid as the market continues to waver between nervy investors undecided on tech stocks, virus vaccine trials and the upcoming US election.

The co-founder of Mobius Capital Partners is steering clear of “mining, banks and companies without an internet strategy”.

The candid thoughts from the emerging markets veteran come with markets in febrile mood.

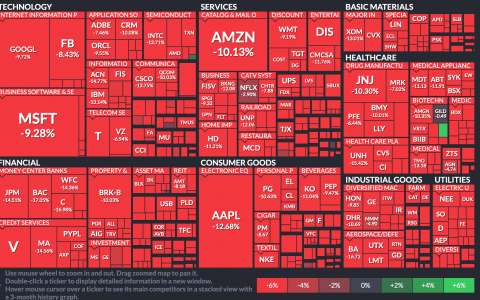

The S&P 500 has declined 7% since hitting an all-time high on 2 September, but stocks are still near the peak of a remarkable rally that has added almost 50% to the leading US index’s value since the Covid-19-inspired slump in March — despite no consistent good news on either economic recovery or the prospects for a vaccine.

Meanwhile, there are warning signs aplenty. Volatility has not been this high during a market peak since the turn of the millennium, according to a note from Goldman Sachs.

The global coronavirus pandemic has shifted consumers to online services for their basic needs, and triggered widescale failure of large bricks-and-mortar businesses that haven’t made the move to diversify their businesses to include internet-based sales and trading.

But while some fund managers are warning of a correction and tech bubble set to burst, Mobius still sees the positives in the sector.

“Tech is very important and increasingly important. But you must remember that it is a wide field. We are interested in tech components and services such as semiconductors and chip design and software.”

The race to find a vaccine is now also fueling market optimism, with investors sending pharma shares higher on positive-sounding news, only to sell off when setbacks are announced — amid high-pressure demands for quick fix from the Trump administration.

AstraZeneca saw its shares slide on 9 September when it announced a pause on its coronavirus vaccine trial due to evidence of an adverse reaction. A day later the firm’s CEO said a vaccine would still be possible by the end of the year.

President Donald Trump told US states to prepare, as a distributable vaccine would be available days before the vote on 3 November.

“If the promise is not met, I doubt it will have much impact on the election since by that time most people will already have voted,” Mobius said. “ But his [Trump’s] promise should now have a positive impact on him in the eyes of voters.”

As the US dollar declines, investors could still seek other opportunities.

“With the weakening USD the opportunities in emerging markets is particularly strong now since investors will want to diversify their holdings away from USD based assets,” said Mobius, adding that the “best opportunities” are in health care, consumer disposables and semi-conduction related firms.

The current retreat in stocks is also on Mobius’ mind; to an extent, he views it as a necessary correction, and possibly, not quite done yet. “A good 20% correction would set the stage for another surge in prices,” he said.