A trio of exchange-traded funds that will benefit from President Joe Biden's tax plan could be about to break out.

These ETFs invest in alternative energy companies: First Trust Global Wind Energy ETF (FAN), the Invesco Solar ETF (TAN), and the iShares Global Clean Energy ETF (ICLN).

Increasing taxes will be a drag on many parts of the economy. Higher taxes mean fewer profits. However, some areas of the economy may do well under the Biden tax plan and the Green New Deal. These include alternative energy companies.

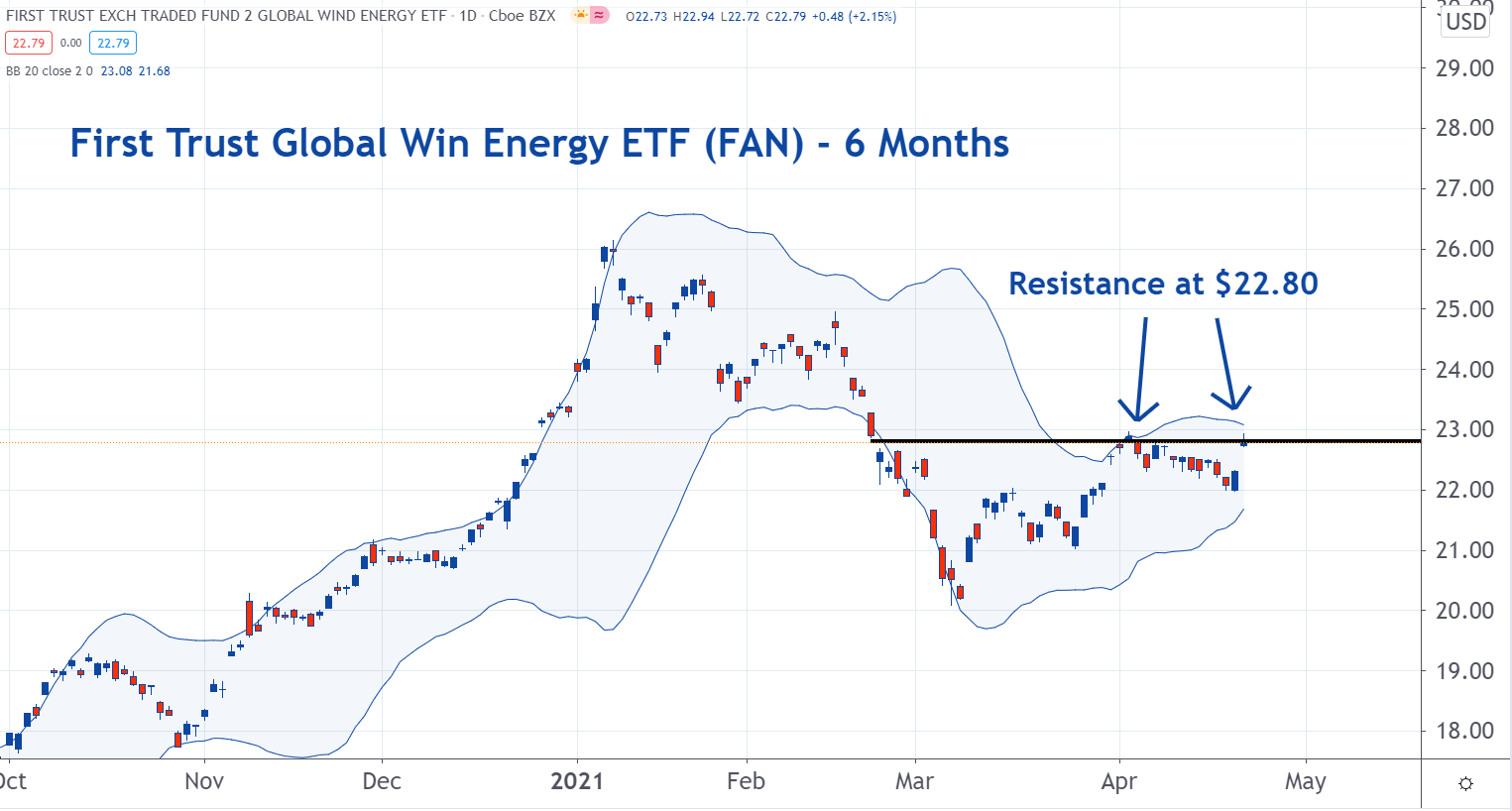

The First Trust Global Wind Energy ETF is testing resistance at the $22.80 level. If this resistance breaks, it could make a move higher.

Resistance is a concentration of sellers. In this case, they have gathered at the $22.80 level, which has kept a ceiling on shares.

If FAN trades above $22.80, it will mean the sellers have left the market. Buyers will need to pay higher prices, which will force FAN to rally.

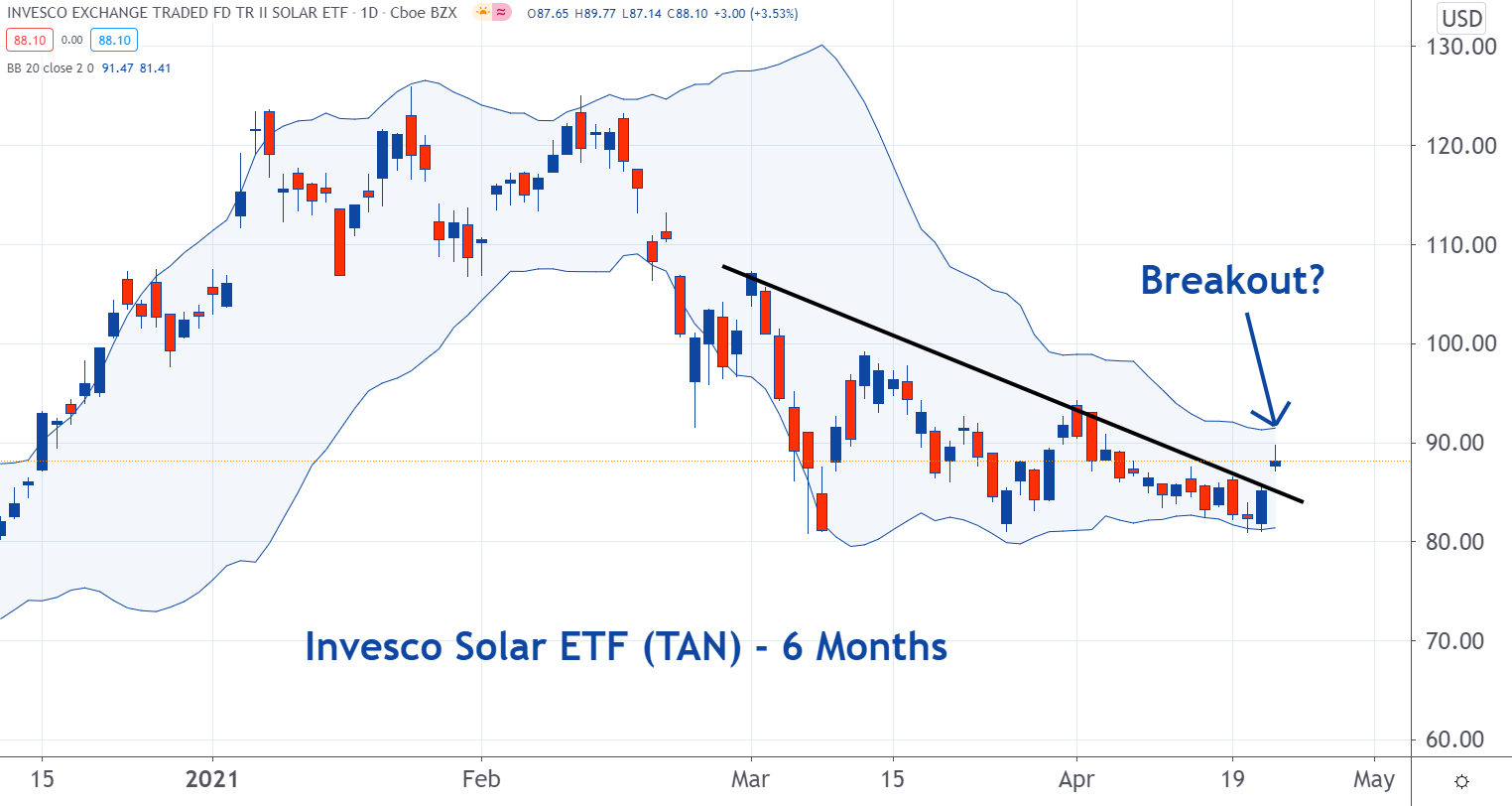

The Invesco Solar ETF has broken its recent downtrend. This means it may be about to move higher.

When markets are rallying, the bulls are in control. When they're moving lower, the bears are in charge. The break of a downtrend line shows the leadership may be changing.

TAN has broken the downtrend that began in February. The bulls may be about to take over and drive the price higher.

The iShares Global Clean Energy ETF has also broken its recent downtrend. Shares could be setting up for another move higher here as well.

This article originally appeared on Benzinga.